GHMC : e-Registration for Self Assessment of Property Tax Hyderabad

Organization : Greater Hyderabad Municipal Corporation

Facility : e-Registration for Self Assessment of Property Tax

Applicable State/UT: Telangana

Register here : http://eghmc.ghmc.gov.in/Survey/SelfAssessmentt.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

GHMC Property Tax Self-Assessment Registration

In Case of New Assessment In Case of Additional Construction/ Change of Usage.Go to the above link Registration form will be opened enter the following details.

Related / Similar Facility :

GHMC Check Property Tax Dues Online

Owner Details :

1. Enter Owner First Name

2. Enter Owner Last Name

3. Enter Mobile Number

4. Enter Email Id

5. Select Circle

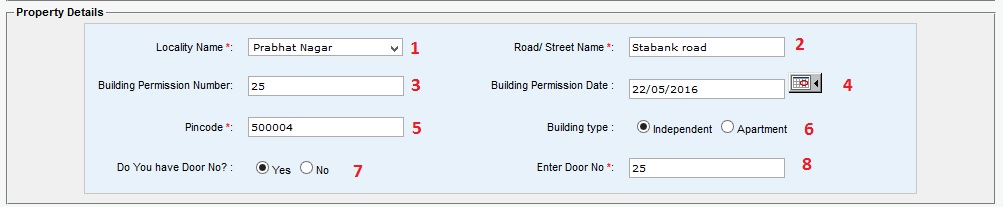

Property Details :

1. Select Locality Name

2. Enter Road/ Street Name

3. Enter Building Permission Number

4. Enter Building Permission Date

5. Enter Pincode

6. Select Building type – Independent / Apartment

7. Do You have Door No- Yes No

8. Enter Door No

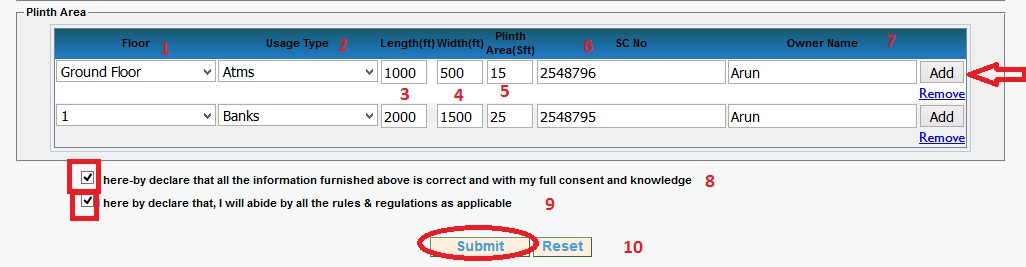

Plinth Area :

1. Select Plinth Area Floor

2. Select Usage Type

3. Enter Length(ft)

4. Enter Width(ft)

5. Enter Plinth Area(Sft)

6. Enter SC Number

7. Enter Owner Name

8. Select Check Box I here-by declare that all the information furnished above is correct and with my full consent and knowledge

9. Select Check Box I here by declare that, I will abide by all the rules & regulations as applicable

10. Click on Submit Button for Property Tax Self-Assessment Registration.

GHMC Payment of Property Tax Dues

** GHMC offers the following modes of payments in collecting Property Tax from the Citizens.

** Debit/Credit Card Payment from our website ghmc.gov.in

** mee-Seva Counters

** AP Online Service Delivery

** Citizen Service Centers

** Bill Collectors

** State Bank of Hyderabad Branches

** heque/DD should be in the favor of “COMMISSIONER, GHMC”

** Hyderabad Municipal Corporation. Property Tax Identification Number (PTIN) is given to each taxpayer for each property. This number is unique in itself and is of Fourteen digits for old PTINs and Ten digits for new PTINs. You can enter this number in the website and make the payment online.

** Site Best viewed in 1024*768 / IE7 (Designed,Developed & Maintained by IT Department, GHMC.)

No manual transactions in Tax assessment, issue of special notice, issue of annual demand notices and receipts 100% computerization of assessments – notices – collection GHMC offers the following modes

** Handheld machines of Bill Collectors are integrated with central server

** 72 Mee-Seva Centres in GHMC limits

** Citizen Service Centres in all 19 Circles and GHMC Head Office

** Online, NEFT and RTGS modes of payment and 537 branches of 8 Banks

FAQ On GHMC Property Tax

Frequently Asked Questions (FAQs) on GHMC Property Tax

1. How is my PTIN No. generated?

PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

2. How to pay my Property tax online?

** You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad.

** You can also pay your Property tax at GHMC Citizen service centres.

3. How do I calculate my Property Tax?

Annual Tax is Calculated as 3.5 X Total Plinth Area in Sft X Monthly Rental Value per Sft in Rs. You can calculate your Property Tax

About Us:

In 1937 Banjara Hills, Jublee Hills etc are merged into Jublee Hills Municipality. In 1942, the Corporation status has been removed due to certain issues. In 1945 Secunderabad Municipality was formed. In 1951 it became Corporation.

1869 the Kotwal-e-Baldia, the City Police Commissioner, begins to look after the Municipal Administration. 1869 Sir Salar Jung-I, the then Nizam, constitutes the Department of Municipal and Road Maintenance and a Municipal Commissioner appointed for Hyderabad Board and Chadarghat Boa.

Some Important Information From Comments

Comments:

1. I want to pay my house property tax and it is not assessed till now. The reason is, I am not having good terms with my brother who is occupied my property as of now, but he has different municipal number I have different. So Please advice me, how to go forward.

2. Recently, I bought the Independent newly constructed house at Attapur, in link document it is mentioned, as Plot Number. Now to get new electricity meter and water connection, I need to get Municipal Door number. Can you tell me how and from, where can I apply for Municipal Door number?

Features of GHMC Property Tax

Here are some of the features of GHMC Property Tax:

** Self-Assessment: Property owners can self-assess their property tax liability and pay online through the GHMC website.

** Online Payment: Property owners can pay their property tax online through the GHMC website or through a variety of online payment gateways.

** Discounts: Property owners who pay their property tax in full and on time are eligible for a discount.

** Exemptions: Certain categories of property owners, such as senior citizens and persons with disabilities, are exempt from paying property tax.

** Penalty: Property owners who fail to pay their property tax on time are liable to pay a penalty.

The GHMC Property Tax is a major source of revenue for the Greater Hyderabad Municipal Corporation (GHMC). The tax is used to fund a variety of civic services, such as road maintenance, garbage collection, and water supply.

Additional Simplified Procedure

Here are the steps on how to do GHMC Property Tax Self-Assessment Registration:

1) Go to the GHMC website: https://www.ghmc.gov.in/

2) Click on the “Property Tax” tab.

3) Select the “Self Assessment” option.

4) You will be taken to a new page where you will need to enter the following details:

5) Click on the “Submit” button.

6) You will receive a confirmation email with a link to complete your registration.

You will need to upload the following documents:

** A copy of your property tax assessment order

** A copy of your title deed or other proof of ownership

** A copy of your recent electricity bill

** A copy of your recent water bill

Once you have uploaded the required documents, you will need to pay the registration fee of Rs. 100. You can pay the fee online using a credit card or debit card.

** Your Property Tax Identification Number (PTIN)

** Your name

** Your address

** Your mobile number

** Your email address

OTP is not coming on GHMC site, instead of easing the system they just know how to trouble the citizens and later fine for their follies.

Self assessment OTP NOT RECEIVED last four days

Procedure to get house number for new construction.

How many days will be taken to consider my e-Registration of self assessment of new construction?

If monthly rental value per SFT is less than Rupees 50 then the property tax is exempted as per your table for residential property tax?

What does SC Number in self-assessment form means and from where I can get that?

I am planning to apply, did you get any answer for SC Number? if so, please share.

The term SC number means Sold Conditionally number.

Hi..Did you get SC number and where we have to find ?

What does SC No. means in self-assessment form and from where I can get that?

I have already applied for the assessment of my house. I need to know the status. What can I do?

From where you get the SC number?

Recently I bought the house. The old owners having two assessment taxes in wife and husband names. So, now how to cancel husband assessment tax in MCH?

How to register apartment on my name? Where to approach?

I have submitted all the documents needed for Assessment-ITS been more than month.

CSCNO-65266/27/02/2016/C04– But there is no communication/update so far. Can you help to get PTIN created for me?

I have house in Saleh Magar Kancha. I have notary. I want Assessment for house. What documents are required? Please help me.

Self assessment registration can be done using the above link online.

Recently I came to know from the staff of GHMC that new assessment of property taxes will be online very shortly. I have checked in Net but seems such facility is not organized by the GHMC authorities so far.

I want to know the assessment value of my house in hafezbabanagar hyderabad

I want to pay my house property tax and it is not assessed till now. The reason is I am not having good terms with my brother who is occupied my property as of now, but he has different municipal number I have different. So Please advice me how to go forward.

Thanks in Advance

Recently I bought the Independent newly constructed house at Attapur, in link document it is mentioned as Plot No. Now to get new electricity meter, water connection I need to get Municipal Door number. Can you tell me how and from where can I apply for Muncipal Door number?

Thanks in Advance.