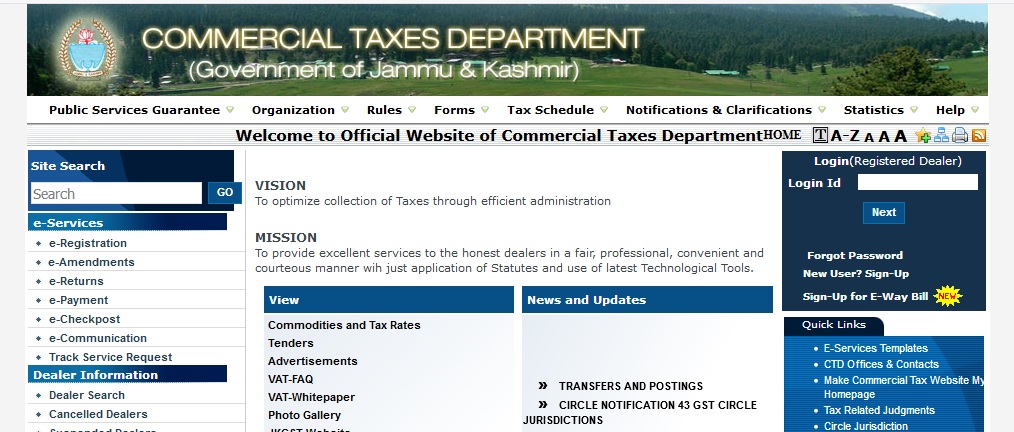

jkcomtax.gov.in GST Registration Jammu & Kashmir : Commercial Taxes Department

Organisation : Commercial Taxes Department

Facility : GST Registration

Applicable For : Jammu & Kashmir

Website : https://www.jkcomtax.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

GST Registration

Please enter the following details for GST Registration,

1. Enter Applicant First Name*

Related : Commercial Taxes Department Jammu & Kashmir Search Dealer Status : www.statusin.in/25829.html

2. Enter Applicant Surname*

3. Select Form Type

4. Select Division*

5. Select Circle*

6. Enter Email Id*

7. Upload File*

FAQs :

1. What does the word ‘enrolment’ under GST system portal mean?

Enrolment under GST means validating the data of existing taxpayers and filling up the remaining key fields.

2. Do I need to enroll for GST?

All existing taxpayers registered under any of the Acts as specified in Q1 will be transitioned to GST. Enrolment for GST will ensure smooth transition to GST regime.

The data available with various tax authorities is incomplete and thus fresh enrolment has been planned. Also, this will ensure latest data is available in GST Database without any recourse to amendment process, which is the norm to update the data under tax statutes today.

3. Why do I need to enroll myself as a user on the GST System Portal?

GST System portal has been created for this purpose as no paper based enrolment will be allowed. You need to enroll as a user on the GST system portal, so that you may be enabled as a registrant for GST Compliance requirement viz. return filling, tax payment, etc.

4. When do I need to enroll with the GST Systems Portal?

The taxpayers registered under any Acts as specified under Q1 are required to enroll at GST System Portal. State VAT and Central Excise can start enrolling from October, 2016 on GST System Portal as per plan indicated on GST System portal.

The taxpayers registered under Service Tax will be enrolled on a later date for which separate intimation will be sent.

5. Is there any concept of deemed enrolment on GST System Portal?

No. There is no deemed enrolment on GST system portal. All the taxpayers registered under any of the Acts as specified in Q1, are expected to visit the GST System Portal and enroll themselves.

6. Is there any fee/charge levied for the enrolment on GST System Portal?

No. There is no fee/charge levied for the enrolment of a taxpayer with GST System Portal.

7. Is the enrolment process different for taxpayers registered under Centre /State/UT tax Acts as specified in Q1?

No. The enrolment process is common for all taxpayers registered under Centre /State/UT tax Acts as specified in Q1.

8. Are taxpayers required to enroll separately with Central and State authorities under GST?

No, any person who wants to seek enrolment under the GST Act has to apply on the GST System Portal. Enrolment under the GST is common for both Central GST and the State GST. There will be common registration, common return and common Challan for Central and State GST.