Ponmagan Podhuvaippu Nidhi Scheme Account Opening Procedure Tamil Nadu : Department of Post indiapost.gov.in

Organization : Department of Post

Scheme Name : Ponmagan Podhuvaippu Nidhi Scheme 2015 Account Opening Procedure

Applicable For : Male Child

Applicable State : Tamil Nadu

Application Last Date : No Last Date

Website : https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx:

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is India Post Ponmagan Podhuvaippu Nidhi Scheme?

As per the India Post Ponmagan Podhuvaippu Nidhi Scheme, an account for children below 10 years can be opened through a guardian while children above 10 years can open the account individually. An individual can open account with INR 100/- but has to deposit minimum of INR 500/- in a financial year and maximum INR 1,50,000/

Related / Similar Service :

Selva Magal Semippu Thittam Account Opening Procedure

Interest Rates Are As Follows:

** 8.70% per annum (compounded yearly).

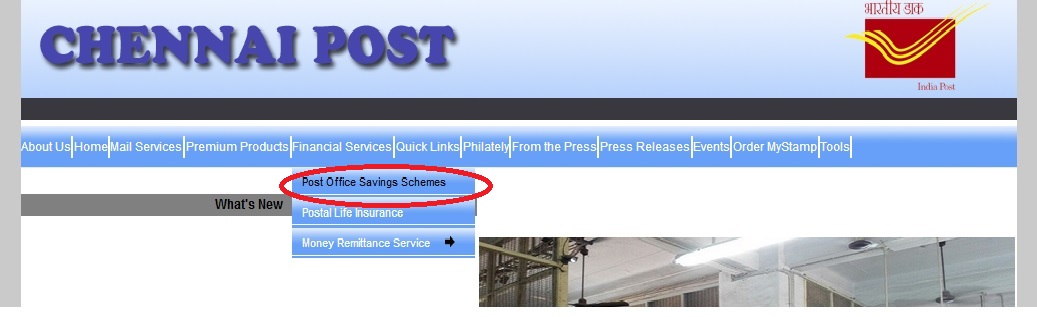

How To Open Ponmagan Podhuvaippu Nidhi Scheme Account?

** Deposits can be made in lump-sum or in 12 installments.

** An individual can open account with INR 100/- but has to deposit minimum of INR 500/- in a financial year and maximum INR 1,50,000/-

** Joint account cannot be opened.

** Ponmagan Podhuvaippu Nidhi Scheme Account can be opened by cash/cheque and In case of cheque, the date of realization of cheque in Govt. account shall be date of opening of account.

** Nomination facility is available at the time of opening and also after opening of account. Account can be transferred from one post office to another.

** The subscriber can open another account in the name of minors but subject to maximum investment limit by adding balance in all accounts.

** Maturity period is 15 years but the same can be extended within one year of maturity for further 5 years and so on.

** Maturity value can be retained without extension and without further deposits also.

** Premature closure is not allowed before 15 years.

** Deposits qualify for deduction from income under Sec. 80C of IT Act.

** Interest is completely tax-free.

** Withdrawal is permissible every year from 7th financial year from the year of opening account..

** Loan facility available from 3rd financial year.

** No attachment under court decree order.

** The PPF account can be opened in a Post Office which is Double handed and above.

FAQ On India Post Ponmagan Podhuvaippu Nidhi Scheme

Frequently Asked Questions (FAQ) on India Post Ponmagan Podhuvaippu Nidhi Scheme

1. How do I login to the portal?

For log-in to the portal, follow the steps given below :

** Click the Sign In link on the homepage of IndiaPost Site.

** Click the Appropriate Category.Click Registered User category in case you have register yourself in any categories mentioned here

i. Retail

ii. Corporate

iii. OSA/Franchise

iv. GCIF

** Provide valid User ID and password on the Login Screen.

** Click Sign In to log-in to your account.

2. I have forgotten my password. How do I log-in now?

To create a new password for log-in, follow the steps mentioned below :

** Click Sign In button on the homepage of IndiaPost Site and then click the ‘Forgot Password’ link.

** Enter your User ID and click the submit button.

** Enter the answer of the hint question, provided by you while registration and click on Submit button.

** One Time Password(OTP) will also sent to your registered email ID.

** Login with OTP and User ID and change your password.

3. How do I change my password?

Log in to your Account on IndiaPost Site, Select the ‘Change Password’ link at the top of your page. Enter your new password and submit the details.

4. How do I change my personal details?

Log in to your Account on IndiaPost Site, click on ‘My Profile’ link at the top of your page. Modify the details and submit to update the details.

Some Important Information From Comments

Comments:

1. I have tried to open Ponmagan Semippu Thittam for my son. So, I went directly to my native Post Office at Veerapandi (Theni). But, they said there is no such schemes. I do wonder why even the employees are not aware of it. So, I doubt that this scheme is not implemented yet across TN.

2. In Ponmagan deposit scheme, there is any insurance linked. If anything happen to the parent, there is any special benefits to the child like, children education plan in some of the insurance policy. Kindly reply.

Benefits of India Post Ponmagan Podhuvaippu Nidhi Scheme

India Post Ponmagan Podhuvaippu Nidhi Scheme is a savings scheme that is specifically designed for the girl child. Here are some of the benefits of this scheme:

Encourages Savings:

The scheme encourages parents and guardians to start saving money for the girl child’s future. It instills the habit of saving from an early age, which can be useful for the girl child’s financial planning in the future.

Financial Security:

The scheme ensures that the girl child has a secure financial future. It provides a lump sum amount after the maturity period, which can be useful for higher education or marriage expenses.

Tax Benefits:

The scheme offers tax benefits under section 80C of the Income Tax Act, which allows individuals to claim tax deductions on the amount invested in the scheme.

PPF and PPNS are same or different saving plans, Moreover, I have PPF plan on my name, shall I open a PPNS plan under my son’s name.

Hi Sir,

If Father and Mother had separate PPF accounts and both deposited 1.5 lac each per annum. Can they open the Ponmagan Saving scheme and deposit an upper limit of 1.5 lac?.

How to apply in online process i am account older

dono

In ponmagan scheme fixed amount for can be deposited for 10 years ah..

I have tried to open Ponmagan Semippu thittam for my son. So I went directly to my native Post Office at Veerapandi (Theni). But they said there is no such schemes. I do wonder why even the employees are not aware of it.

So I doubt that this scheme is not implemented yet across TN.

Hai.. My native is chennai but got married and my husband native is Bangalore. I have one boy baby so can I able to apply for ponmagan scheme in chennai..Kindly clarify my doubts.

Yes u can but it should be in Chennai only not Bangalore

Please let me know the forms I need to submit for the Selvamagal Semipu Thittam.

Please give the authorized branches.

I HAVE ONE QUESTION. CAN YOU PLEASE TELL ME?

MONTHLY 2000 I WILL PAY. HOW MUCH AMOUNT WILL YOU GIVE? ALREADY FINISHED 14 YEARS .

This scheme announced in Chennai or all over Tamil Nadu?

All over TN

I have deposited Rs 500 after 15 years. How much I can get?

Now Ponnagan planning account opening in Chennai only or other district?

You can open your account wherever you want in Tamilnadu.

Why branch post offices are not allowed to open Ponmagan a/c?

After 20 years how much I will get?

I have two kids male

Minimum planning for 500 rs after 20 years. How much I can get?

Please let me know the proof details

I am already having PPF from Post office. Is it possible to open the Ponmagan Podhuvaippu Nidhi policy too/

In Ponmagan deposit scheme there is any insurance linked if any thing happen to the parent there is any special benefits to the child like children education plan in some of the insurance policy. Kindly replay

Can a married male person apply for this scheme?

Is it only for boy child?

Yes it is only for Male child

No, Married Male can’t apply but he can apply for his son who is under 10 years.

Documents needed to open the acc