hdfcbank.com Education Loan Application Procedure : HDFC Bank

Organization : HDFC Bank

Service Name : Education Loan Application Procedure

Applicable State/UT: All India

Website : http://www.hdfcbank.com/personal/products/loans/educational-loan/education-loan-for-indian-education

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

HDFC Bank Education Loan Application

Pursue your dream education course in India and abroad with Education Loan

Related / Similar Facility :

1. HDFC Bank Pay Loan Overdue Online

Features of Education Loans for education in India:

** Service at your doorstep

** Preferential rates for top ranked universities / institutes

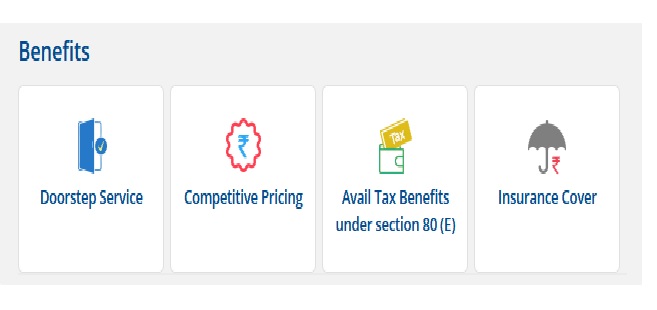

Benefits of Educational Loan In India:

** Avail tax benefits under section 80(E) of income tax Act 1961

** Flexible repayment options

** Option to avail insurance cover for your loan

Why take an Education Loan from HDFC Bank?:

Whatever be your need we have a loan for you. Over the years we have won the trust of our customers and have become market leader in loan products.

Enjoy triple benefits when you take an Education Loan from HDFC Bank:

** Faster loan – Our loan sanction and disbursal is one of the quickest with easy documentation and doorstep service.

** Competitive pricing – Our loan rates and charges are very attractive

** Transparency – All charges are communicated up front in writing along with the loan quotation

Features & Benefits of HDFC Bank Education Loan

Focus on pursuing the course of your choice and securing a great education. Leave the hassles of documentation and finances of your Education Loan for Indian education to us.

Here are a few features of the loan:

** Amount limits: Get Education Loan upto Rs. 10 lakh and unsecured lending upto Rs. 7.5 lakh. No collateral will be required for loans upto Rs. 7.5 lakh

** Wider collateral options: Are you securing a loan of a higher amount than Rs. 7.5 lakh? We offer a wide range of bank approved collateral securities like Residential Property, HDFC Bank Fixed Deposit, LIC, NSC or a KVP policy.

** Loan Tenure: The maximum repayment tenure is upto 15 years post moratorium period.

** Tax Rebate: Did you know that you are eligible for a tax rebate for the interest you pay on an education loan under Section 80-E of the Income Tax Act 1961*? See the Income Tax Circular for more details here. Write to us by visiting www.hdfcbank.com/services to receive interest certificate for the last financial year.

If this wasn’t enough for you, check out some more special privileges that you will get as a HDFC customer for an Education Loan for Indian Education:

** We will provide services at your doorstep.

** Loans will be directly disbursed to the educational institution as per the fee structure.

** Avail access to some other great products and services that we offer. Get a Savings Account with us right away!

** Thinking about insurance? As our customer for a student loan, you can also get a special privilege of choosing the Insurance Protection – Credit Protect from HDFC LIFE.

What are the eligibility criteria for securing Education Loan for Indian Education?:

** You need to be a Indian resident

** You should be aged between 16 – 35 years.

** If you are taking a loan of more than Rs. 7.5 Lakh, a collateral security will be required.

** Co-applicant: A co-applicant is mandatory for all full time programs. Co-applicant could be Parent/ Guardian or Spouse (if married) / Parent-in-law (if married).

Rates & Fees of HDFC Bank Education Loan

| Description of Charges | Education Loan |

| Loan Processing Charges* | Maximum up to 1% of the loan amount as applicable. or Minimum Rs. 1000/- whichever is higher |

| Pre-payment charges* | Upto 4% of the Outstanding Balance prepaid, if loan is foreclosed/ part perpaid during Moratorium (along with and in addition to due/accrued interest, if any, and other amounts due and/or payable by the Borrower to the Bank). No prepayment charges will be charged if loan is foreclosed / part prepaid any time after expiry of the Moratorium. |

| No Due Certificate / No Objection Certificate (NOC) | Nil |

| Duplicate of No Dues Certificate/NOC | Nil |

| Solvency Certificate | Not applicable |

| Charges for late payment of EMI | @ 24 % p.a. on overdue/unpaid EMI amount outstanding from EMI due date |

| Credit assessment charges | Not applicable |

| Non standard repayment charges | Not applicable |

| Cheque / ACH swapping charges | Rs. 500/- per instance |

| Duplicate Repayment Schedule Charges | Rs. 200/- |

| Loan Re-Booking / Re-Scheduling Charges | Upto Rs. 1000/- |

| EMI Return Charges* | Rs.550/- per instance |

| Legal / incidental charges | At actual |

| Stamp Duty & other statutory charges | As per applicable laws of the state |

| Loan Cancellation Charges | Nil cancellation charges. However, interest for the interim period (date of disbursement to date of cancellation), CBC/LPP charges as applicable would be charged and Stamp duty will be retained |

FAQ On HDFC Bank Education Loan

Do I need a co-applicant for the loan (Education Loans For Indian Education)?

Yes a co applicant is required for all full time courses. Co-applicant could be Parent/ Guardian or Spouse/ Parent-in-law (if married)

Is there moratorium/repayment holiday available (Education Loans For Indian Education)?

Yes. A moratorium/repayment holiday is available for select courses.

Do I have to make any repayment during the moratorium period (Education Loans For Indian Education)?

You have the option of servicing simple interest during moratorium period. Simple interest will be calculated on the loan amount disbursed payable monthly.

What is the mode of repayment for student loan in India?

You have the option of repaying the loan through a Standing instruction, ACH or post-dated cheques.

Loan Offered By HDFC Bank

HDFC Bank offers a wide range of loans to individuals and businesses. Some of the most popular loans offered by HDFC Bank include:

Personal Loans:

Personal loans are unsecured loans that can be used for any purpose, such as consolidating debt, making home improvements, or paying for a wedding.

Home Loans:

Home loans are secured loans that can be used to purchase a home.

Car Loans:

Car loans are secured loans that can be used to purchase a car.

Education Loans:

Education loans are unsecured loans that can be used to pay for college or other educational expenses.

Business Loans:

Business loans are secured loans that can be used to start or expand a business.

Please update my personal loan status. Reference number is 46042997.

Please tell me my personal loan status. My application no is 44823353.

Please update my personal application No 43919923. Please inform me early to know my status.

Please update the status of my personal loan number 43628265.

Please update my personal loan status.

Ref no : 42920535

PLEASE UPDATE STATUS OF MY PERSONAL LOAN.

MY A/C NUMBER IS 42166570.

Please update my personal loan application is now accepted ref No 41385731. How many working days it will take to process loan?

Please update the status on Personal loan with reference No 41274585.

Please update the status on personal loan with reference No 41274585.

I am unable to check my PL status.

How to check the status?

Please update my personal loan status. Reference no is 40892428..

Please update my car loan status.

Ref.NO.40982261

Please update my personal loan ref no 40836280.

Please update my personal loan ref no 40814727.

I am HDFC account Holder. I want education loan for my brother Pursuing his Higher education. Is there any Salary range required for this?

Please update my car loan status

39580413

I HAVE APPLIED FOR MY PERSONAL LOAN.

From the Website :

PLEASE UPDATE STATUS OF MY PERSONAL LOAN REF NO 39654858.

Please update my personal application No 38411552. How many working days it will take to process loan?