ghmc.gov.in Pay Property Tax Online : Greater Hyderabad Municipal Corporation

Organization : Greater Hyderabad Municipal Corporation

Service Name : Pay Property Tax Online

State : Telangana

Website : http://www.ghmc.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay GHMC Property Tax Online?

You can follow the below guidelines to check Property Tax Dues & pay property tax online.

Related / Similar Facility :

GHMC TIN Trade License & PTIN Search

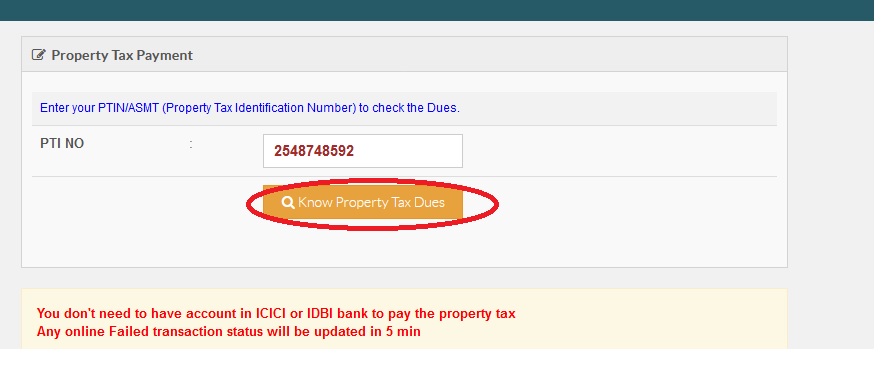

Go to Online Payment of Property Tax available in the GHMC home page as shown below

Enter your PTIN/ASMT (Property Tax Identification Number) to check the Dues. If you do not know the PTIN/ASMT, Search for PTIN/ASMT by Owner Name , Door No and Old PTIN

Help:

“A unique PTIN” (Property Tax Identification Number) is alloted for each Tax Assessee. The PTIN/ASMT is Fourteen digits for old PTINs and Ten digits for new PTINs.

How is my PTIN No. generated?

** PTIN is a 10 digit number

** First number is common for all circles

** 2,3 digits circle number

** 4,5 digits Revenue wards

** the last 5 digits is the serial No.

How to pay my Property tax online?:

You can pay your Property tax in any of the eSeva centers located in Hyderabad and Secunderabad.

You can also pay your Property tax at GHMC Citizen service centres.

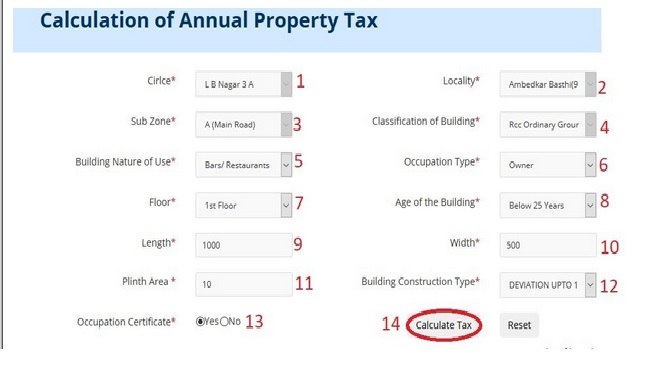

How do I calculate my Property Tax?:

Annual Tax is Calculated as 3.5 X Total Plinth Area in Sft X Monthly Rental Value per Sft in Rs.

Follow the below steps to proceed for annual calculation of property tax.

Step 1 : Select Circle*

Step 2 : Select Locality*

Step 3 : Select Sub Zone*

Step 4 : Select Classification of Building*

Step 5 : Select Building Nature of Use*

Step 6 : Select Occupation Type*

Step 7 : Select Floor*

Step 8 : Select Age of the Building*

Step 9 : Enter Length* (Ft)

Step 10 : Enter Width* (Ft)

Step 11 : Enter Plinth Area * (Sq.fts)

Step 12 : Select Building Construction Type*

Step 13 : Select Occupation Type *

Step 14 : Click Calculate Tax Button

Payment of Tax Dues

No manual transactions in Tax assessment, issue of special notice, issue of annual demand notices and receipts 100% computerization of assessments – notices – collection GHMC offers the following modes

** Handheld machines of Bill Collectors are integrated with central server

** 72 Mee-Seva Centres in GHMC limits

** Citizen Service Centres in all 19 Circles and GHMC Head Office

** Online, NEFT and RTGS modes of payment and 537 branches of 8 Banks

What are the online services provided by GHMC ?

GHMC is the official portal of Greater Hyderabad Municipal Corporation. It is a one stop place to avail the online services provided by the Corporation.

The online services provided are :

Search facility on Birth Verification, Death Verification, Trade License Payments, Engineering Work Status, Registered Contractors, New House Numbers, Building Permission Status

A unique Grievance Redressal System called Parishkruthi to increase the transparency and efficiency in the system.

Information about the Corporation, Budget, Citizens’ Charter, Building Permission Procedure, Building Fee Details, new FSI Policy, Rationalisation of House Numbers, Properties on Lease and such other information.

Application forms for Birth Certificate, Death Certificate, Self Assessment, License for Advertisement, Building Application Form, Building Construction Permission, Balika Samriddhi Yojana, Thrift & Credit Application Form, Transfer of Property etc. can be downloaded from the net.

About Us:

In 1937 Banjara Hills, Jublee Hills etc are merged into Jublee Hills Municipality. In 1942, the Corporation status has been removed due to certain issues. In 1945 Secunderabad Municipality was formed. In 1951 it became Corporation.

1869 the Kotwal-e-Baldia, the City Police Commissioner, begins to look after the Municipal Administration. 1869 Sir Salar Jung-I, the then Nizam, constitutes the Department of Municipal and Road Maintenance and a Municipal Commissioner appointed for Hyderabad Board and Chadarghat Boa

Contact

Greater Hyderabad Municipal Corporation

CC Complex Tank Bund Road,

Lower Tank Bund

Hyderabad: 500029

Helpline : 155304, Phone No.040-23225397.

FAQ On GHMC Property Tax

Here are some frequently asked questions (FAQ) about GHMC Property Tax:

What is GHMC Property Tax?

GHMC Property Tax is a tax that is levied by the Greater Hyderabad Municipal Corporation (GHMC) on all properties located within its jurisdiction. The tax is used to fund the development and maintenance of civic amenities, such as roads, parks, and schools.

Who is liable to pay GHMC Property Tax?

The owner of any property located within the jurisdiction of GHMC is liable to pay property tax. The owner is also liable to pay property tax if they are a tenant or sub-tenant of the property.

What is the basis for assessment of GHMC Property Tax?

The basis for assessment of GHMC Property Tax is the annual rental value of the property. The annual rental value is determined by the GHMC based on the location, size, and type of the property.

What is the rate of GHMC Property Tax?

The rate of GHMC Property Tax varies depending on the annual rental value of the property. The rate is also affected by the type of property, such as residential, commercial, or industrial.

What does SC no. in plinth area tab, of self assessment registration form mean?

How can I check my property tax?

My house number is 1-9-211 and I am getting property tax receipt on house number 1-9-209/4/c. How to change my door number?

Let me know my property tax. My house address is in 3-3-343. Lb nagar Masjid Lane Lingogiguda division Saroornagar Mandel rr dist Telengana.

How to check home tax?

HOW TO SEE 2012 PROPERTY TAX PAYMENT RECEIPT?

I could not find any option to print the receipt individually. I guess while paying tax itself you will be able to download the receipt.

I need my property tax 2012-13 receipt. My address is1-1-573/ 605 Archana apartment Golconda Cross Roads Musheerabad.

Please let me know the dues of my flat Putin no 01810209803841 under circle no 9 Bagh Amberpet