Pune Corporation : Pay Property Tax & Get Bill Online

Organization : Pune Municipal Corporation

Type of Facility : Pay Property Tax & Get Bill Online

Location : Pune

Applicable State : Maharashtra

Website : https://pmc.gov.in/en

Online Payment User Manual : https://www.statusin.in/uploads/1435-tax_manual.pdf

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Pune Corporation Property Tax?

This online service is for paying property tax & get bill online. Please follow the below procedure to pay your tax.

Related / Similar Service : PMC Mobile App

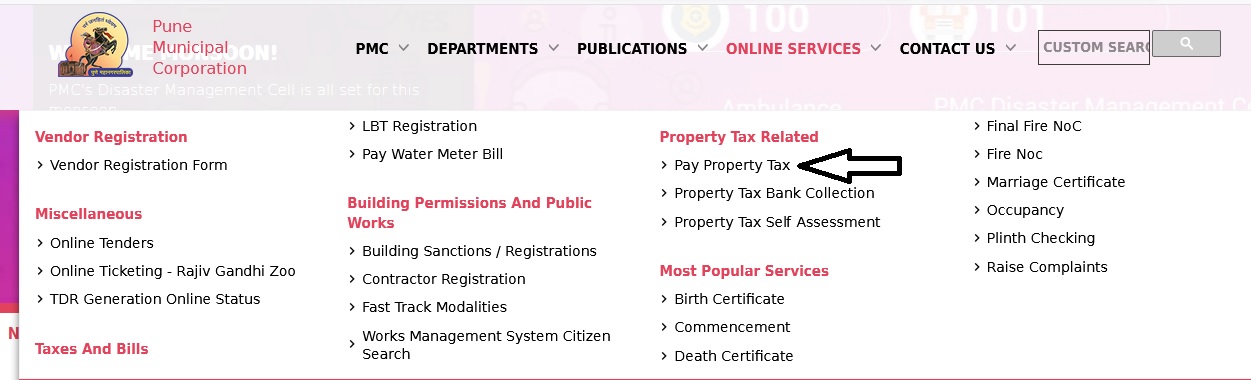

Go to the link of Pune Corporation official website. Click on the link Pay Property Tax which is under Online Services tab.

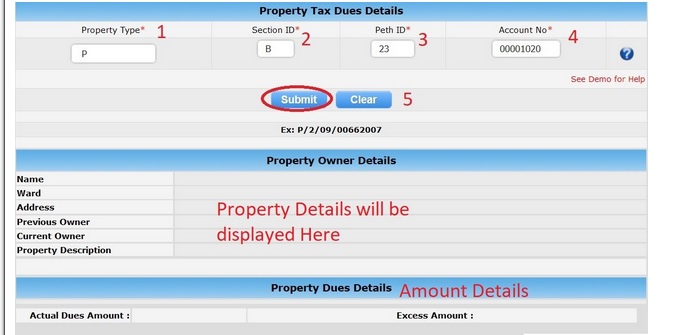

Step 1 : Select Your Property Type (Eg : P, O, F)

Step 2 : Enter Your Section ID

Step 3 : Enter Your Peth ID

Step 4 : Enter Your Account No (Eg : 00662007)

Step 5 : Click Submit Button

There are no additional charges to amount due for payments made through Internet Banking

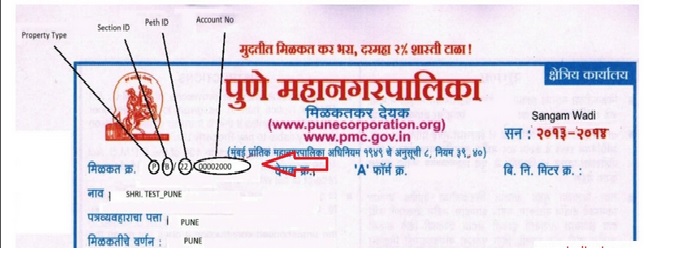

Sample format for property id is given below.

Once you click submit button, you will receive Property Owner details & Property Dues Details. If there are no dues you will receive message as “No Dues Against This Property.”

Need Help?

Note :

1. Prefer the NET-BANKING option rather than CARD PAYMENT option to save your money and avoid extra charges to pay.

2. For online Payments through Credit Cards, Debit Cards and Cash Cards the additional charges to amount due are Visa/ Master Credit/Debit Cards: 1% of Transaction Amount + Service Tax Maestro Cards: 1.8% of Transaction Amount + Service Tax Diners/American Express Cards: 4% of Transaction Amount + Service Tax Prepaid Cash Cards: 4% of Transaction Amount + Service Tax

3. If you find any difficulties during online payment then please contact our helpdesk.

Contact Time: 10 A.M. to 5:30 P.M.

Contact No. : 020-25501164

Email-ID : propertytax AT punecorporation.org

4. For any refund issues please contact to Pune Municipal Corporation.

5.Do not attempt your transaction second time if you have already attempted, please check your amount is debited from your bank account, if amount is debited and not updated in PMC website, then please mail us all the details on our mail ID propertytax@punecorporation.org Check your receipt entry on Get Property Tax Details For Citizen link on our website

Pune Corporation Property Tax Bill Details

Following details are required for Pune Corporation Property Tax Bill Details

** Property Type

** Section ID

** Peth ID

** Account Number

FAQ On Pune Corporation Property Tax

Frequently Asked Questions (FAQs) on Pune Corporation Property Tax

1. How can I get Property Tax Bill?

1) The Annual bill are distributed through Indian Post.

2) Alternatively, you can get it from concerned Ward Office wherein your property is situated.

You may also visit Property tax website :

i) propertytax.punecorporation.org then

ii) Click on Property Tax Web Portal link.

iii) Click on My Property Tax Bill link.

iv) Enter Your Property ID.

v) Click on Submit button.

2. What is the last date of payment of Property Tax?

A. For first half year i.e. from 1st April to 30th September – last date of payment 30th June for getting 5% or 10% Discount.

B. For second half year i.e. from 1st October to 31st March – last date for payment is 31st December.

3. How much penalty or fine is payable in case of no-payment of Tax on due dates?

1) In case of non-payment of property tax for first half year 2% fine per month is Payable from 1st July. In case of second half year 2% fine (per month) is charged starting 1st January.

2) If Property has arrears, it is applicable for per month 2% Penalty on Arrears Amount per month.

3) In case of non-payment of government taxes like Education Cess, Employment Guarantee Tax on due dates, notice fee at 1% is charged.

4. In whose favor Cheque / D.D. will be drawn?

In case of amount being paid by Cheque / D.D. money order the same should be drawn in favor of The Assessor & Collector of Tax, P.M.C. Pune.

5. How can one avail online property tax payment facility?

1) Visit propertytax.punecorporation.org then.

2) Click on Pay Your Property Tax Online link.

3) Enter Your Property ID.

4) Click on Pay Online button

Pune Municipal Corporation :

Pune, the Oxford of the East is a historical city in India with a glorious past, an innovative present and a promising future. Since 1950, the Pune Municipal Corporation is administrating the city and serving citizens. Pune Municipal Corporation has taken an initiative for implementing e-Governance. Success of e-governance depends on use of Information Technology in mobilization of Government resources and utilization of these scarce resources with an aim of providing a better service.

Contact us:

Pune Municipal Corporation

Pune Municipal Corporation

Shivaji Nagar,

Pune – 411 005.

Some Important Information From Comments

Comments:

1. It is ridiculous that, we can’t log on to the web site for tax payment. Every time you try, it goes blank and says cannot get the server connection. Is it a method to avoid paying discounts on PMC tax before June as per their advertisement? I wonder. PMC for your reputation. Please fix the problem ASAP.

2. All details are appearing on Online payment of Property Tax, but in Mode of payment only one option i.e. Credit Card,Debit Card, Net banking, Cash card is appearing. When clicked on the only said option, it does not go further. I would like to pay by Canara Bank debit Card. How to do it? How can I get further option to pay by Debit card? Please reply.

Features of PMC Property Tax

PMC (Pune Municipal Corporation) property tax is a tax that is levied by the Pune Municipal Corporation on properties within its jurisdiction. Some of the features of PMC property tax are:

Calculation of tax:

The PMC property tax is calculated based on the type of property, its location, and the annual rental value of the property.

Due date:

The property tax is due on the 31st of March every year. However, taxpayers can also pay the tax in two installments – the first installment is due on the 30th of September, and the second installment is due on the 31st of December.

Discounts:

Taxpayers who pay their property tax before the due date are eligible for a discount. The discount amount varies from year to year and is announced by the PMC.

I have to know the steps to get the property ID for online payment.

How can I collect receipt to pay online?

Is there any mobile app for payment of property tax?

How can I get online bill?

MY PROPERTY ADDRESS IS FLAT NO.402, 4TH FLOOR, ‘ BLDG.-D6 ‘ , WING-B, S. NO. 79/B+116/6/1, RAHUL PARK, WARJE, PUNE-411058

O/B/3/

I WANT TO KNOW MY ACCOUNT NUMBER FOR THE ABOVE PROPERTY.

I want to know about how can we find that who did the complaints to corporation their name and phone number?

Whether property tax bill is sent on home address regularly?

Not able to open Pune tax payment site.

Can anyone help?

I have paid the property tax online from my home PC but I have no printer in my house & I want the payment receipt. Please guide me how can I get the receipt?

First time we are paying the property tax ,we are representing housing society please guide us. We don’t have any details of property tax.

Online PMC property tax payment through net banking. Web page is not getting opened.

I have filled up wrong email Id, while paying property tax online ,want to update the correct one. What is the procedure?

How to get bill payment confirmation?

How to get tax bill online?

As in previous year 2015-16 we have paid tax in the month of April. Still this year they have charged Rs. 69/- as penalty.

It is ridiculous that we cant log on to the web site for tax payment.

Every time you try it goes blank and says cannot get the server connection.

Is it a method to avoid paying discounts on PMC tax before June as per their advertisement? I wonder.

PMC for your reputation. Please fix the problem ASAP.

The Bank having largest network in India and biggest Banking Group the State Bank Group is not optioned for making payment by using Debit Card and ATM Pin.

After paying the Bill, by mistake i closed the screen before taking the receipt. Now I want to Print my Receipt. How do I? Please guide.

Get your Property Tax Bill Here : https://propertytax.punecorporation.org/

Is there any way to download the property tax bill online? If yes, please provide the details.

Can I get property tax bill by name & address online?

Can I know the amount of my property tax? Can the PMC send on my mail ID my bill? I want to know my property tax amount.

How to change the name of property tax receipt?

Can I know the amount of my property tax? Will the PMC send on my mail id?

I want to know my property tax amount.

My Address :

Bhalchandra Dixit & Mrs Medha B Dixit

Flat No.103, Royal avenue Apartment,

Near Bavdhan Police Station, Pashan Road,

Ram Nagar West, Pune

What all documents are required for new property tax registration?

How do I get the water bill? I have not received the print copy.

Online PMC property tax payment through net banking. Web page is not getting opened.

How to search a property tax receipt by name or address of property holder?

From the Website :

I have not received Property Tax yet. Please give me details about my tax dues.

My address is as follows:

Mrs. Sulbha Nikhal Prayeja City C-1

Flat No. 203 Servey No.71

Vadgaon Bruduk

I am staying in Marvella the wonder. D.P. road, survey no 211/12A-13-15, behind PMT Gadital Depot.,Hadapsar, PUNE 28. I have not got any bill of property tax since 2011. I want to know how you calculate property tax whether on salable area or carpet area or built up area. Please furnish computation details that you made against my flat since 2011. And when bills are being prepared and posted on your official web site? Thanking you

I want to know my property tax amount.

Address-flat a/15,

s no-33/22,man bag,

Sundaran residency,

Wadgaon bk, Pune-411041

I wish to pay the property tax online but there is a major problem with the site.. None of the site seems to be working

Use this link to pay your property tax online.

https://propertytax.punecorporation.org/

All details are appearing on Online payment of Property Tax, but in Mode of payment only one option i.e. Credit Card,Debit Card, Net banking , Cash card is appearing. When clicked on the only said option it does not go further. I would like to pay by Canara Bank debit Card. How to do it? How can I get further option to pay by Debit card? Please reply

Regards,

Deepak Madan

Dear Sir,

My payment of tax bill gone 2 times. Kindly reverse the amount to my account.I am not able to open the receipt.

Regards,

Vivek Patwardhan

MY PROPER IN DHAYARY OPPOSITE PARI COMPANY. VENTEKASH SHARVIL,APPT.C 1005

PLEASE INFORM ME MY SECTION ID, PETH ID AND ACCOUNT NO.

REGARDS

VIVEK JAIN

Online PMC property tax payment through net banking web page is not getting opened