HP Tax e-Track Status Himachal Pradesh : Excise & Taxation Department

Organization : Excise and Taxation Department

Service Name : e-Track Status

Applicable State :Himachal Pradesh

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Track Status : https://www.hptax.gov.in/

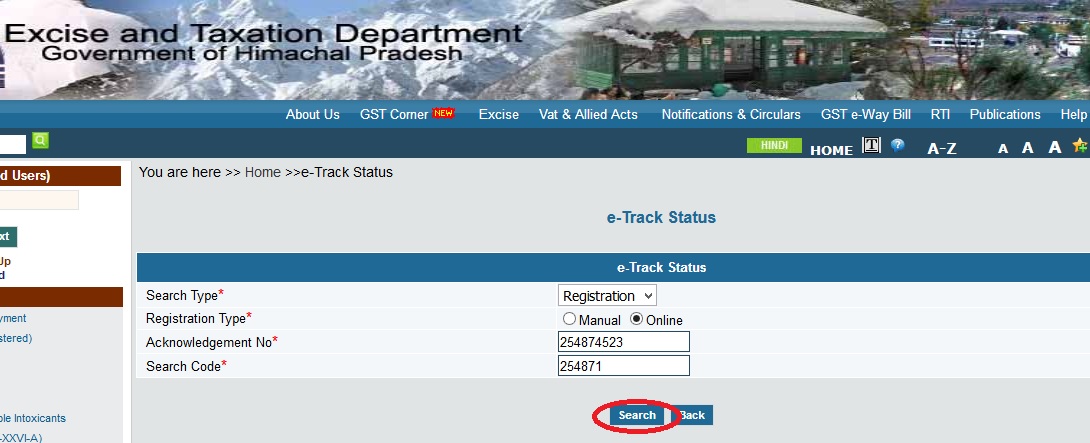

e-Track Status

Enter (or) Select the following details & submit to track status.

Related : HP Tax e- Declaration Submission Process for Dealer : www.statusin.in/7779.html

Required Details:

** Search Type

** Registration Type

** Acknowledgement No.

** Search Code

Know About VAT:

What is VAT ?:

VAT or Value Added Tax is a multi-point taxation system under which taxes are levied only on the value addition done at each stage of the commodities, production and sale. With a facility of set off for in-put tax i.e. the tax paid by the purchasing registered dealer to a selling registered dealer.

What goods are covered under VAT ?:

Schedules A,C & D of the HP VAT Act include the goods which are liable to tax and Schedule-B includes the tax-free goods. Only few goods will be outside the purview of VAT. For example, Liquor and Motor spirit.

Are farmers liable to pay VAT ?:

No. Agriculture and Horticulture produce is exempted from VAT.

What are the advantages of VAT ?:

The advantages are: It is simple,Shares the burden of all levels of supply chain,Taxes only the value addition,Fewer rates,Uniform floor rate throughout the country,Uniform classification of goods throughout the country,Lesser procedure helps better compliance and audit trail, Larger tax base ,No tax on tax already paid.

Can dealer file normal return and can make payment online?:

Yes, dealer can make payment online.

How to claim Input Tax Credit ?:

Input Tax Credit is available on the basis of tax invoice which is to be kept by the dealer.

What will be the tax element on Exports made out of the Country?:

For all exports made out of the country, tax paid within the State will be refunded in full, and this refund will be made within three months. Units located in SEZ and EOU will be granted either exemption from payment of input tax or refund of the input tax paid within three months.

How will the Opening Stock on 1-4-2005 be treated ?:

** All tax-paid goods purchased on or after April1,2004 and still in stock as on April 1,2005 will be eligible to receive input tax credit, subject to submission of requisite documents. Resellers holding tax-paid goods on April,2005 will also be eligible.

** VAT will be levied on the goods when sold on and after April 1, 2005 and input tax credit will be given for the sales tax already paid in the previous year. This tax credit will be available over a period 6 months after an interval of 3 months needed for verification.

What is the difference between tax invoices and cash memos ?:

The tax invoice is the document issued by the registered dealers to another registered dealer on the basis of which a purchasing dealer can claim input tax credit. Tax invoice is not issued by the dealer who has opted for lump-sum tax or composition scheme. However, only VAT dealers are authorized to issue tax invoices; all other dealers will issue cash memos. ITC will be given only on tax invoice.

What is the difference between exempted and zero rated sales:

Exempted sales are listed in Schedule-B of HP VAT Act and both zero rated and exempt sales do not charge VAT. For zero rated sales you are eligible to claim input tax credit on your purchases whereas for exempt sales you are not eligible to claim ITC paid on your purchases.