AGUP Employees Online Pay Slip : Accountants General Uttar Pradesh

Organisation : Accountants General Uttar Pradesh

Facility : Employees Online Pay Slip

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Website : http://agup.nic.in/payslipo.asp

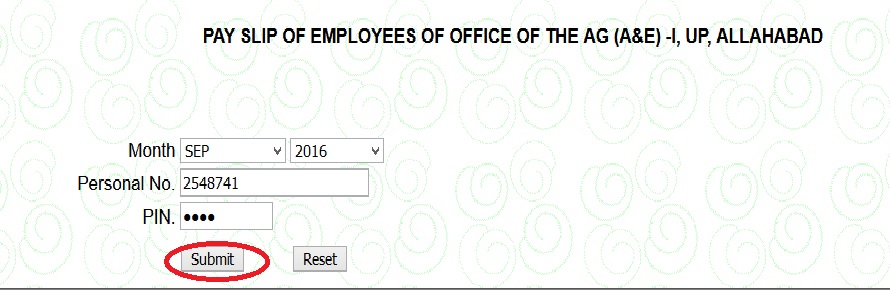

How To Download AGUP Payslip of Employees?

i) Select Month / Year

ii) Enter Personal No.

iii) Enter PIN.

iv) Click on Submit Button

Related : Annual GPF Statement For Officers Uttar Pradesh Accountants General : www.statusin.in/1187.html

AGUP Contact

Office of Accountant General,

20 S.N. Marg, Allahabad,

Uttar Pradesh, India

This site can be best viewed in IE5.0+ with a screen resolution 1024×768 pixels

FAQ On AGUP

How GPF account number can be allotted.

Send your application in prescribed proforma through your D.D.O. to A.G.U.P. well before you complete one year of service.

What is the amount of subscription.

The amount should not be less than 10 percent of basic pay and not more than the amount of basic pay.

How to deposit subscription if posted in Foreign Service.

If posted in U.P., the amount should be deposited in State Bank of India through Treasury Challan with complete details like GPF Account No., Name of subscriber etc.

If posted outside U.P., the amount should be forwarded to Accounts Officer, A.G.U.P. through a Bank Draft of the State Bank of India accompanied by complete details in schedule as well as in the back of the Bank Draft itself.

How to ensure that recovery is made against correct account number.

Verify frequently that only correct account number is given in the G.P.F. schedule prepared by your D.D.O.

How to ensure correct maintenance of G.P.F. Pass Book.

Your Pass book is maintained by your D.D.O. and in case of your transfer it will be forwarded to that Office along with your L.P.C.

1 Verify your Pass Book annually.

2 Ensure that all the subscription, Recovery of advance, Temporary advances and Withdrawal taken by you is correctly entered.

3 All the columns of Pass Book are correctly filled in and certified by your relevant D.D.O. of that posting (separately for debit and credit both) and closing is done properly.

4 There is no cutting, erasing, overwriting in the Pass Book and any correction is properly attested by D.D.O.

5 Only then you sign your Pass Book in token of its annual verification.

How to get a copy of G.P.F. Pass Book.

You are entitled to get a copy of our Pass Book from your DD.O. by depositing prescribed fees.

How to rectify error.

Your Pass Book is primary document. If it is reconciled annualy than the rectification matter will not arise at all, at the time of your 10% payment after retirement. Hence all efferts for correct maintenance should be done between a subscriber and DDO. You should point out any error or omission in the Pass Book to your D.D.O. before signing the Pass Book and get it rectified.

How to get up to date interest in Final Payment of G.P.F. after retirement.

Submit your final payment application to your D.D.O. within six months of the date of your retirement/resignation etc. from Govt. Service.

How to avoid penal interest in case of minus balance (i.e. recovery of over payment) during service and after your retirement.

– The recovery of amount drawn in excess of the amount at your credit will be recovered alongwith 2.5% up to date interest over and above the normal rate of interest.

– This recovery should be deposited by you in one lump-sum otherwise will be realized from your pay, arrears and land revenue.

Functions of AG Uttar Pradesh

The Accountants General (AG) of Uttar Pradesh are responsible for auditing the accounts of the state government and its agencies.

They also have a number of other functions, including:

** Issuing audit reports: The AGs issue audit reports on the accounts of the state government and its agencies. These reports are submitted to the state legislature and the government.

** Ensuring compliance with financial regulations: The AGs ensure that the state government and its agencies comply with financial regulations. This includes ensuring that the government’s accounts are properly maintained and that all financial transactions are authorized.

** Providing advice to the government: The AGs provide advice to the government on financial matters. This includes advising the government on how to improve its financial management practices and how to ensure that it complies with financial regulations.

** Investigating financial irregularities: The AGs investigate financial irregularities in the state government and its agencies. This includes investigating allegations of fraud, corruption, and misuse of public funds.