OFRIS Factory Returns Himachal Pradesh

Organization : Department of Labour & Employment

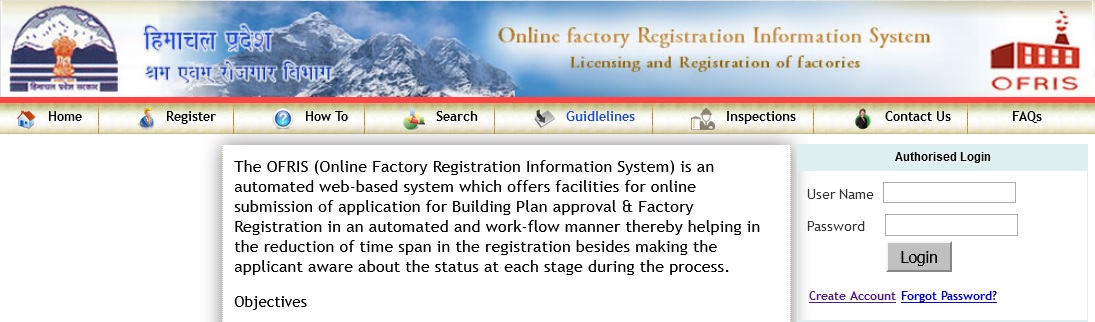

System Name : OFRIS Online Factory Registration Information System

Service Name : Factory Returns

Applicable State : Himachal Pradesh

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Website : https://ofris.hp.nic.in/

Factory Returns

Checks For Annual Returns Submitted By Factories / States:

Annual Return Submitted By Factories To State Authorities:

** Ensure that the information furnished is as accurate as possible

Related : OFRIS Factory Renewal Applications Himachal Pradesh : www.statusin.in/18335.html

** Information supplied in each return is complete in every respect

** Check the list of establishment covered and ensure that returns have been received from all registered factories.

** Ensure that the number of days worked is<=365 (366 in leap year). it should be exactly 365 or 366 in case of factories which work for all the days of the year but generally it should be less due to various holidays observed

** Please ensure that number of mandays worked has been reported separately from men, women and children. it should should be checked as Number of mandays worked = Number of Days worked X Average Daily Employment

** Ensure that correct method has ben followed in calculating the Average Daily Employment and sex-wise figures have been furnished separately for Adults, Adolescents and Children (i.e. Number of Mandays worked / Number of Days Worked)

** Figure of Average Daily Employment should also be checked with hte figures reported is the Directory of Industrial Establishments

** Ensure that total number of mandhours worked reported separately for men, women and children is the aggregate number of actual manhours worked in all the shifts on all the working days in the factory including overtime hours but excluding rest intervals

** The Average number of hours worked per week reported separately for men, women and children should be correctly worked out, i.e. total actual hours worked by all workers during the year / [Average number of workers employed daily in the factory during the year x Number of weeks worked by the factory during the year]

** If it has been stated that the factory is covered under Section 87, the fact may be checked from the administrative records of the Chief Inspector of Factories

** Please ensure that all persons, who have been on roll even for a single day during the year, have been taken into account and reported against item 14 of Form No. 34 i.e. Leave with wages. A particular parsons is to be counted once only

** For ‘Safety Officers’, ‘Ambulance Rooms’, ‘Canteens’, ‘Shelters or Rest rooms and Lunch rooms’, ‘Creches’, and ‘Welfare Officers’, if nil information has been furnished please ensure its conformity with the provisions of the Act.

** Every person killed or injured in an occurance should be treated as one separate accident, e.g. if in one occurance 10 persons are injured or killed, it should be counted as 10 accidents

** Please ensure that figures furnished against item 24(a) in Form no. 34 relates to such Non-fatal injuries only in which the workers affected were prevented from working for a period of 48 hours or more immediately following the accidents

** The figures of mandays lost due to accidents should be double or more than double the number of persons who returned to work. This is because only such injuries are to be reported in which the person injured was prevennted from working for a period of 48 hours or more

** Please check the figures of Mandays lost reported against item 24(b)(ii) are inclusive of figures of mandays lost during previous year as well as current year.

** Please ensure that the non-fatal accidents reported against item 24(a)(ii) are accounted for against item 24(b)(i)(aa) and 24(c)(i) in a Form No. 34

** The information relating to accidents reported in Annual Return (Form no. 34) should also be checked with the Notices of Accidents

** Please get all discrepancies clarified befre the consolidating work is taken up at the Headquarters

** Please ensure that details about Suggestions Scheme have been furnished correctly

** If Visiting a factirt abd examining the Return on spot please also check all registers and records prescribed under the State Rules and mainainted properly

The Payment Of Wages Act, 1936:

Methods of Scrutiny at the Primary Stage and Cross – Checks, etc.:

** The primary unit is required to submit information in Form IV annually to the appropriate Government. Before submission, it is to be seen that the inforamtion in respect of all the items in Form IV has been given in the return

** The figures of average daily employment for adults and children should be got verified by dividing the respective figures of mandays worked by the number of days worked during the year

** The total wages when divided by the figures of average daily employment give the per capita annual earnings. It should be checked that the per capita annual earnings as obtained by dividing the figure of total wages furnished in item 4 of Form -IV, excluding figures of arrears of pay, by the corresponding figures of average daily number of persons employed’ is less than Rs. 19200.

** The figures of per capita earnings should also not be too low taking into account the number of days worked by the factories / establishment. This is very important check and should always be kept in view

** It should be seen that total of basic wages, dearness allowance and arrears of pay is equal to the figure of total wages paid

** Total of profit – sharing bonus, money value of concessions and total wages paid, should be equal to gross amount paid as remuneration

** The per capita annual earnings, as obtained by dividing the total gross wages amount paid minus arrears divided by the figures of average daily employment, should be compared with the corresponding figure for the previous year. Normally, there should not be wide flactuations.

** In case there is a wide divergence that cause should be investigated and invariable reported in the form of footnotes etc. Unless there is some error in reporting, such difference may in the rates of wages or due to major shift in the employment pattern such as employment of much larger proportion of employees on higher / lower rates of wages