TSU TRP SMS Based Service To Customer : Tripura Transport

Organization : Tripura Transport Department

Service Name : SMS Based Service To Customer

Applicable State: Tripura

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

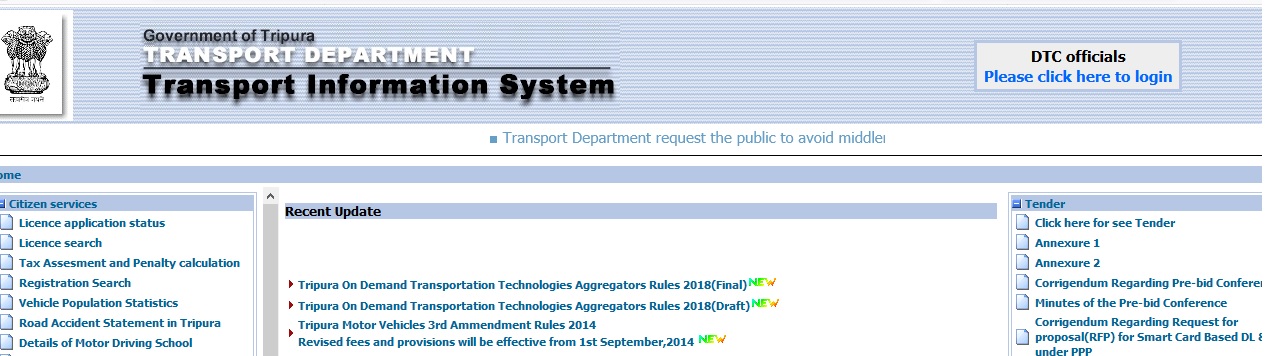

Website : https://transport.tripura.gov.in/

SMS Based Service

A) Service to be provided to the customer:

(1) For Tax Related Information:

TYPE MESSAGE AS transtrp <space> tax <space> vehicle no & send it to 9212357123

Related : Tripura Transport License & Registration Search : www.statusin.in/6096.html

Eg- (transtrp tax tr01r 5678)

(2) For Fitness Related Information :

TYPE MESSAGE AS transtrp <space> fit <space> vehicle no & send it to 9212357123

Eg- (transtrp fit tr01r 5678)

(3) For National Permit related information :

TYPE MESSAGE AS vahan <space> np <space> vehicle no & send it to 9212357123

Eg-(vahan np TR01R 1515).

B) Service from Transport Department:

There are two types of services from the Transport Department.

i) Daily Services—Intimation SMS shall be sent to the customer on completion of a process on a daily basis.

ii) Monthly Service—SMS will be sent to the customer on monthly basis.

i) Daily Services:

** Ownership Change

** New Registration

** Tax Intimation

** Hypothecation Cancellations Intimation

ii) Monthly Service:

** Tax Defaulter (Monthly Service)

Amendment of Rule 35 of the Principal Rules :

After sub-rule (d) of Rule 35 of the Principal Rules, the following new sub-rules (e)’, ‘(f) and (g) shall be inserted, as follows “

(e) * Fees for Fancy Registration mark / choice numbers thereof shall be levied at the following rates

(i) If the fancy number chosen by the applicant is within 1000 of running number the fees for such fancy number will be Rs.2,000/- for each fancy number.

(ii) Fees for every 1000 above the 1000 running registration number will be Rs. 1,000/- extra.

(iii). The above provision shall not apply in respect of State Government vehicles.

(f) * Fees for Licence of Dealership :

(i) Fees for new License – Rs.10,000/- (for three years);

(ii) Fees for renewal of Licence – Rs.5,000/- (for three years);

(iii) Late fee for Renewal of Licence – Rs.500/- extra after every 30 days.

(g)” Licence fees for Sub-dealership :

Fees for Sub-dealers Licence for

i) Two wheelers : Rs.1,500/-

ii) Three wheeler : Rs.2,600/-

iii) LMV : Rs.6,500/-(with validity of 3(three) years).

(iv) Medium, heavy and above : Rs.10,000/- (with validity of 3(three) years).

(v) Renewal fees of Licence for all categories with validity of 3(three) years after expiry of the validity of original Sub-dealers licence:-Rs.1,500/-

vi) Late fee : Rs.250/- extra after every 30 days expiry of validity period of licence.

(h) Fees for issue & withdrawal of NOC for registration in other districts / states.

(i) For all class of private vehicles: Rs1,500/- per vehicle

(ii) For commercial vehicles :

a) LMV Rs.300/-

b) MMV Rs.500/-

c) HMV Rs. 600/-

Note :

(i) For the purpose of this rule, “Dealership’ means and includes a trader or reseller who deals in vehicles for sale to individuals directly or through Sub-dealers or by any other means.

(ii)For the purpose of this rule, ‘Sub-dealership’ means and includes a trader or reseller who deals in vehicles for sale to individuals directly or through his authorized agent or by any other means.”