mahavat.gov.in Know Your TIN : Maharashtra Sales Tax

Organisation : Department of Sales Tax , Govt. of Maharashtra

Facility : Know Your MAHAVAT TIN

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Website : http://www.mahavat.gov.in/Mahavat/index.jsp

What is MAHAVAT “Know Your TIN” Service?

“Know Your TIN” service is offered by Maharashtra Department of Sales Tax (MAHAVAT)

Related / Similar Service : Mahavat PTRC Online Enrolment & E-Return

How To Know Your MAHAVAT TIN?

Just follow the simple procedure mentioned below to Know Your MAHAVAT TIN online.

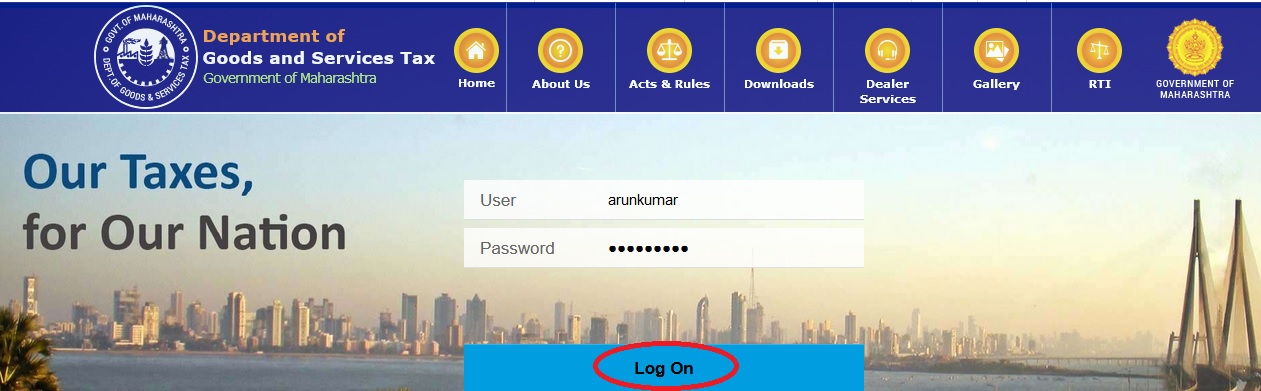

Step-1 : Go to the official website of MAHAVAT and click on the login button then enter the user name & password.

Step-2 : Enter the following details

Step-2 : Enter the following details

i) Enter TIN

ii) Enter PAN

iii) Enter OLD RC NO.UNDER BST/CST/PTRC.

iv) Enter OLD PTEC NO.

(Enter the Starting Two digit sof your PTEC Number without slash)

(Enter the number after last slash of your PTEC Number)

v) Enter DEALER NAME

Step-3 : Click on “Search” Button to know your MAHAVAT TIN

MAHAVAT TIN Amendment Procedure

The application for amendment of the MAHAVAT TIN certificate or for the updation of the TIN details shall be normally made to the registration officer, under whose jurisdiction the principal POB of the dealer is located.

In places like Mumbai, where there are more than one registration officers, the applications shall be accepted centrally and equally distributed amongst the registration officers on a rotation basis. As in the case of new registrations, the applications for amendments shall be entered by the Counter clerk/Tax Assistants in Reg. Counter 01 and in Reg. Counter 02.

In case of the Large Tax payers, the amendment applications shall be received by the LTU branch.

Processing of Applications

The applications for amendment due to shifting of Principal POB shall be accepted by the STO (Regn),under whose jurisdiction, the new POB falls.

The RC record shall be sent to the STO(Regn) of the new POB. In case any assessments are required to be done for the pre-VAT period or if any proceedings are pending, the same shall be completed by the old officer in charge. Of course, if the dealer applies for the Transfer of Proceedings, the same can be processed by the appropriate authority.

Effective date of registration/MAHAVAT TIN Certificate :

Except in the case of voluntary registration, the application for MAHAVAT TIN registration is required to be made within the time limit prescribed.

What are the Time limits of MVAT RC Application?

Time limits for MAHAVAT MVAT RC applications :

Sr | Reason for registration | Time limit

1 Voluntary Not applicable

2 Change in constitution 30 days

3 Transfer of business due to death of the dealer 60 days

4 Part/full transfer of business, not covered by serial no 3, above. 30 days

5 Exceeded the TO limits 30 days

About Us:

Sales tax was first introduced in India in the province of Bombay, where a tax was imposed on sales of tobacco within certain very limited urban and suburban areas by the Bombay Tobacco (Amendment) Act, 1938, which came into force on the 24th March, 1938.

In the Central provinces & levy, again a selective one, on motor spirit and lubricants alone was introduced in January, 1939. In the province of Bombay, Government took powers by the Bombay Sales Tax Act, 1939 to levy sales tax on motor spirit and manufactured cloth, at rates not exceeding six and a quarter per cent. Eventually, however, only motor spirit was notified for taxation under that Act.

FAQ On MAHAVAT TIN

Mahavat TIN, or the Maharashtra Value Added Tax and Taxpayer Identification Number, is a system for registering and tracking businesses in the state of Maharashtra, India. Here are some frequently asked questions (FAQ) about Mahavat TIN:

What is Mahavat TIN?

Mahavat TIN is a registration number issued by the Maharashtra government to businesses operating in the state. It is used for tracking sales tax payments and filing tax returns.

Who needs to register for Mahavat TIN?

Any business operating in Maharashtra that is involved in the sale or purchase of goods and has an annual turnover of more than Rs. 10 lakh is required to register for Mahavat TIN.

How can I register for Mahavat TIN?

You can register for Mahavat TIN online by visiting the official website of the Maharashtra Sales Tax Department and filling out the registration form.

What are the documents required for Mahavat TIN registration?

The documents required for Mahavat TIN registration include PAN card, address proof, bank account details, and business registration certificate.