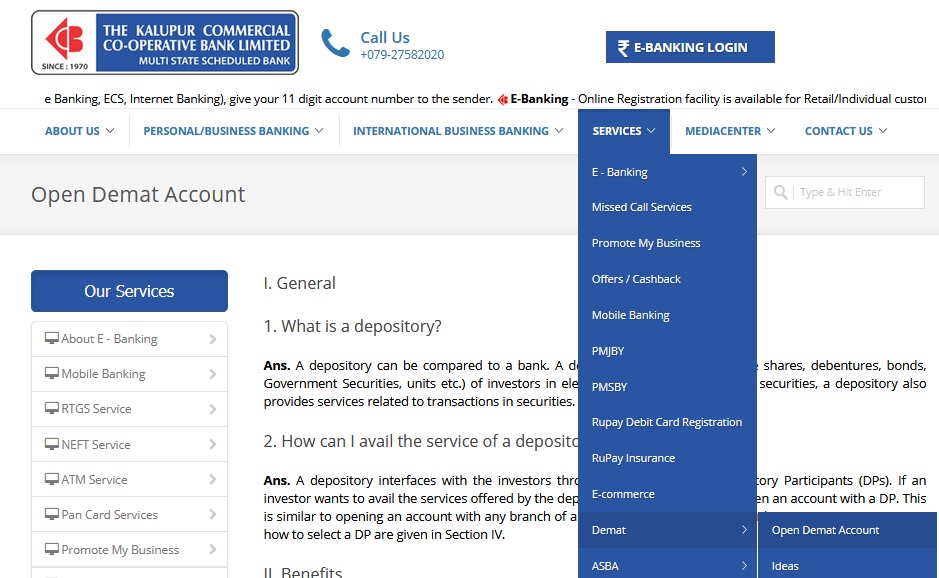

Open Demat Account : Kalupur Bank

Organisation : The Kalupur Commercial Co-Operative Bank Limited

Facility : Open Demat Account

Website : https://www.kalupurbank.com/open-demat-account.html

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Open Demat Account

I. General :

1. What is a depository?

Related : Kalupur Bank Rupay Debit Card Registration : www.statusin.in/23642.html

A depository can be compared to a bank. A depository holds securities (like shares, debentures, bonds, Government Securities, units etc.) of investors in electronic form. Besides holding securities, a depository also provides services related to transactions in securities.

2. How can I avail the service of a depository?

A depository interfaces with the investors through its agents called Depository Participants (DPs). If an investor wants to avail the services offered by the depository, the investor has to open an account with a DP.

This is similar to opening an account with any branch of a bank in order to utilize the bank’s services. Suggestions on how to select a DP are given in Section IV.

II. Benefits :

1. What are the benefits of participation in a depository?

The benefits of participation in a depository are :

** Immediate transfer of securities;

** No stamp duty on transfer of securities;

** Elimination of risks associated with physical certificates such as bad delivery , fake securities , etc.;

** Reduction in paperwork involved in transfer of securities;

** Reduction in transaction cost;

** Nomination facility;

** Change in address recorded with DP gets registered electronically with all companies in which investor holds securities eliminating the need to correspond with each of them separately;

** Transmission of securities is done by DP eliminating correspondence with companies;

** Convenient method of consolidation of folios/accounts ;

** Holding investments in equity, debt instruments and Government securities in a single account;

** Automatic credit into Demat account, of shares, arising out of split/consolidation/merger etc.

III. Services :

1. What are the facilities offered by NSDL?

NSDL offers following facilities :

** Dematerialization i.e., converting physical certificates to electronic form;

** Rematerialisation i.e., conversion of securities in Demat form into physical certificates;

** Facilitating repurchase / redemption of units of mutual funds;

** Electronic settlement of trades in stock exchanges connected to NSDL;

** Pledging/hypothecation of dematerialized securities against loan;

** Electronic credit of securities allotted in public issues, rights issue;

** Receipt of non-cash corporate benefits such as bonus, in electronic form;

** Freezing of Demat accounts, so that the debits from the account are not permitted;

** Nomination facility for Demat accounts;

** Services related to change of address;

** Effecting transmission of securities;

** Instructions to your DP over Internet through SPEED-e facility. (Please check with your DP for availing the facility);

** Account monitoring facility over Internet for clearing members through SPEED facility;

** Other facilities viz. holding debt instruments in the same account, availing stock lending/borrowing facility, etc.

IV. Account Opening :

1. What should I do when I want to open an account with a DP?

You can approach any DP of your choice and fill up an account. opening form. At the time of opening an account, you have to sign an agreement with the DP in a NSDL prescribed standard agreement, which details you r and your DP ’s rights and duties.

You have to submit the following with the prescribed account opening form. In case you want to open account jointly with other person(s), following should be submitted for all the account holders.

I. Proof of Identity (POI) (copy of any one proof) :

Passport Voter ID Card Driving license PAN card with photograph Identity card/document with applicant’s Photo, issued b y

** Central/State Government and its Departments

** Statutory/Regulatory Authorities

** Public Sector Undertakings

** Scheduled Commercial Banks

** Public Financial Institutions

** Colleges affiliated to Universities (this can be treated as valid only till the time the applicant is a student)

** Professional Bodies such as ICAI, ICWAI, ICSI, Bar Council etc., to their Members; and h) Credit cards/Debit cards issued by Banks.