andssw1.and.nic.in Track Status Andaman & Nicobar : Single Window Clearance

Organisation : Single Window Clearance

Facility : Track Status

Applicable For : Andaman & Nicobar

Website : http://andssw1.and.nic.in/swc/track-status.php

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

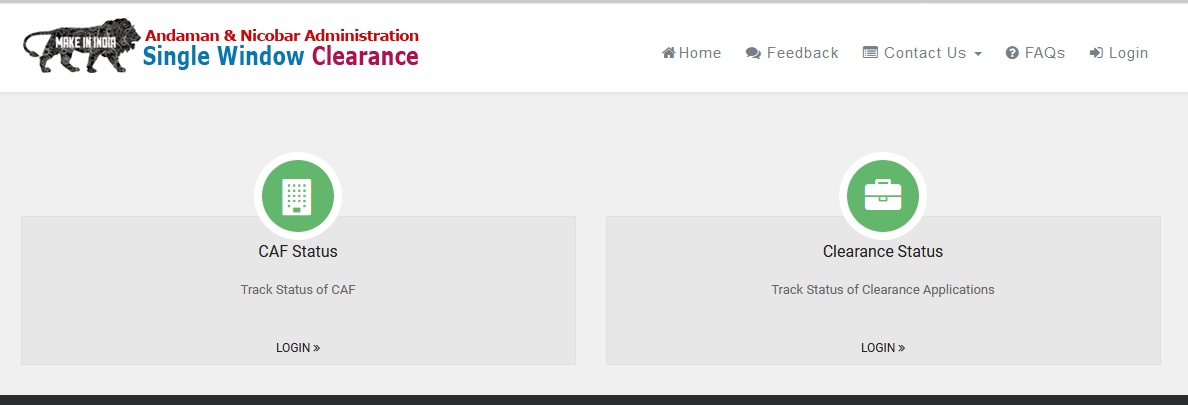

SSW Track Status

1. You can track the CAF, Clearance Status

2. For that you have to Login into your account first

Related : Apply for Clearance Service Andaman & Nicobar : www.statusin.in/24180.html

3. Please enter your Username or Email id

4. Enter the Password

5. Click on the Sign In button

Sign-in for Extended Features :

** Featured Rich Dashboard

** Apply for Online Clearances

** Track Status of Clearances Applied

About Us :

The GoI has undertaken the “Ease of Doing Business (EoDB)” project all over the country to facilitate a “Business friendly environment”, so that Entrepreneurs can Establish and Operate Business enterprises in the various States, easily and quickly.

One major component of EoDB project is the establishment of “Single Window Clearance (SWC) portal” by states so that all clearances provided by States to business enterprises are brought under a Single System, which will reduce the hardships faced by business community in the country.

FAQs :

1. What is Single Window Clearance Portal?

Single Window Clearance System in a single point contacts for the enterpreneur to get various Clearance, Applications etc for the proposed enterprise.

This online portal will bring transparency to the system thereby facilitating investors with expeditious and time-bound clearances and approvals

2. What does Ease of Doing Business(EoDB) project mean?

Ease of Doing Business (EoDB)” project all over the India to facilitate a “Business friendly environment”, so that Entrepreneurs can Establish and Operate Business enterprises in the various States, easily and quickly.

3. Is SWC applicable for entire A & N Islands?

Yes.However setting up of enterprises is not allowed in –

a. Nicobar district being a tribal area.

b. Reserved forests of A & N Islands notified by Government of India.

4. What is the ” Nodal department of A & N Admin” for implementing SWC?

DIC (District Industries Centre).

5. What are the “Offices of A & N Islands” covered under SWC Portal?

1. Fire

2. Electricity

3. APWD

4. PBMC

5. Labour

6. DC Office

7. PCC

6. Is there a “Help Desk” facility set up for SWC portal?If so ,the contact details.

This portal is a simple and easy system providing information like how to setup an industry and the incentives provided by A & N Administration, where to apply , the various approvals and clearances required from different Govt.Departments etc.

7. Do we have “Chamber of Commerce and Industries” in A & N Islands, If so the contact details?

Yes we have ”Chamber of commerce and Industries” in A & N

8. What are the “challenges” that will be faced by me ,as an Enterpreneur, in establishing Business Enterprises in A & N Islands?

Challenges that will be faced in setting up enterprises in A & N Island :

** land allocation, land availability major portion of A & N Island is comes under reserved forest. So industries are not allowed in reserved forest area. The most of the Nicobar district is not allowed. Please contact A & N administrator for the availability of lands.

** Skill Man Power- A & N Island popular tourist destinations for both Indian & foreigner, Tourism Industries offers immense scope. Skill man power is available for Tourism industry who can be further trained into well class service provider.

** Distance from A & N is around 1200 km away from Mainland. So moment of goods for setting up and operating enterprises have to be shift Mainland. However A & N administrator is gives subsides of transportation of goods from Mainland to A & N Island. Click here for contact details

** A & N is in fragile ecological and disaster porn area and reserved forest, approval from Govt. of India will be require for “Polluting industries “ so it is recommended to start enterprises in A & N which are ecofriendly for food processing, fishing click here for investing

9. What is the “Tax Regime” functioning in A & N Islands?

** The Entrepreneur should apply to Office of Deputy Commissioner, seeking Clearance for “Registration under Central Sales Tax” of Business units / Shops proposed to be established by him/her in A & N Islands.

** The entrepreneur should submit the Application form in given format of “Form ‘A'”, with required supporting documents to the office of Deputy Commissioner, A & N Admin.

** The Application will be processed by the concerned offices for correctness and completeness of the filled in details and the supporting documents enclosed with the application.

** Based on above and inspection if needed, the Office of Deputy Commissioner will issue the “Registration Under Central Sales Tax” clearance to the entrepreneur.