payment.gst.gov.in Create Challan & Track Payment Status : Goods & Services Tax

Organisation : Goods and Services Tax

Facility : Create Challan & Track Payment Status

Applicable For : All India

Website : https://payment.gst.gov.in/payment/

Check Status Here : https://payment.gst.gov.in/payment/trackpayment

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

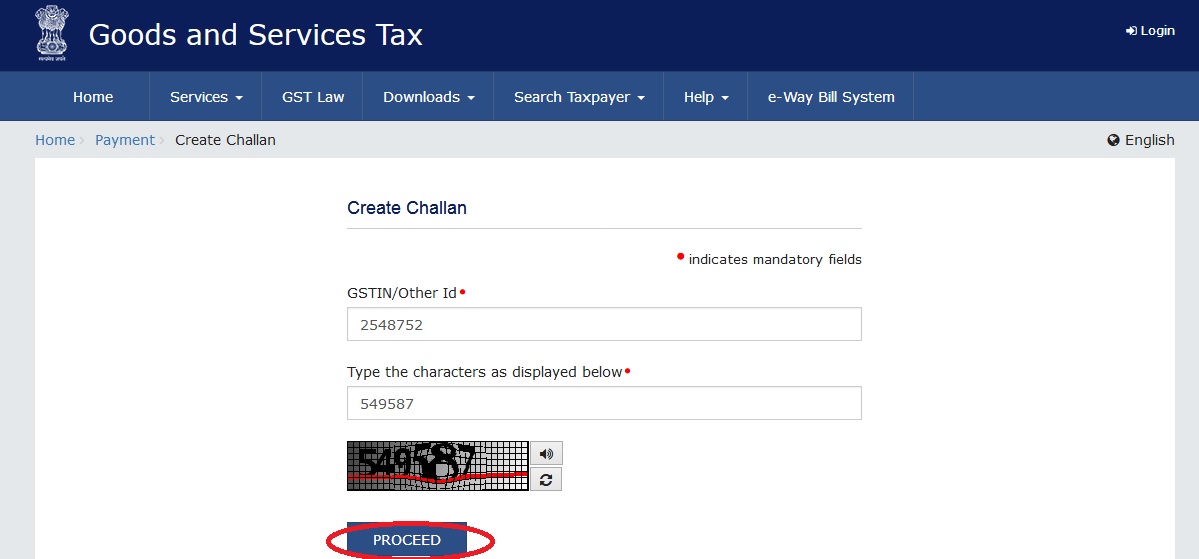

Create Challan

1. Enter GSTIN / UIN / TRPID / TMPID

2. Click on the Proceed button

Related : GST Digital Payment Procedure PDS Portal of India : www.statusin.in/25552.html

Track Payment Status :

Please enter the below details,

1. Enter GSTIN

2. Enter CPIN

3. Click on the Track Status button

FAQs :

1. Who is an existing taxpayer?

An existing taxpayer is an entity currently registered under any State or Central laws, like Value Added Tax Act, Central Excise Act and Service Tax Act.

Existing taxpayers include taxpayers already registered under :

** Central Excise

** Service Tax

** State Sales Tax or VAT (except exclusive liquor dealers if registered under VAT)

** Entry Tax

** Luxury Tax

** Entertainment Tax (except levied by the local bodies)

2. What does the word ‘enrolment’ under the GST Common Portal mean?

Enrolment under GST means validating the data of existing taxpayers and filling up the remaining key fields by the taxpayer in the Enrolment Application at the GST Common Portal.

3. Do I need to enrol for GST?

All existing taxpayers registered under any of the Acts as specified in Question 1 will be transitioned to GST. The enrolment for GST will ensure smooth transition to the GST regime.

The data available with various tax authorities is incomplete and thus fresh enrolment has been planned. Also, this will ensure latest data of taxpayers is available in the GST database without any recourse to amendment process, which is the norm to update the data under tax statutes today.

4. Why do I need to enrol myself as a taxpayer on the GST Common Portal?

The GST Common Portal has been made available to enable taxpayers enrol with GST. Paper based enrolment option is NOT available.

The GST Common Portal will enable taxpayers to meet the GST compliance requirement like filing return and making tax payment. Using the Portal requires existing taxpayers to enrol.

5. Who is not liable to register under GST?

The following persons shall not be liable to register, namely :

(a) any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under this Act or under the Integrated Goods and Services Tax Act;

(b) an agriculturist, to the extent of supply of produce out of cultivation of land.

(c) The Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.

6. Is there a concept of deemed enrolment under GST?

No. There is no deemed enrolment under GST. All the taxpayers registered under any of the Acts as specified in Question 1, are expected to visit the GST Common Portal and enrol themselves at the GST Common Portal.

7. Is there a fee or charge levied for the enrolment under GST?

No. There is no fee or charge levied for the enrolment of a taxpayer under GST.

REGISTRATION NUMBER : 03AAGFG9888G1Z0

WHILE SUBMITTING THE SAME IN ICEGATE TO GENERATE BILL OF ENTRY, ERROR IS RECEIVED REGARDING THE GST NUMBER.

Information available from the Official Website :

My commutation value is not communicated.