incometaxindiaefiling.gov.in Link PAN with Aadhaar : Income Tax Department

Organisation : Income Tax Department

Facility : Link Aadhaar

Applicable For : All India

Last Date : 31st March 2020

Website : https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Income Tax eFiling Link PAN with Aadhaar

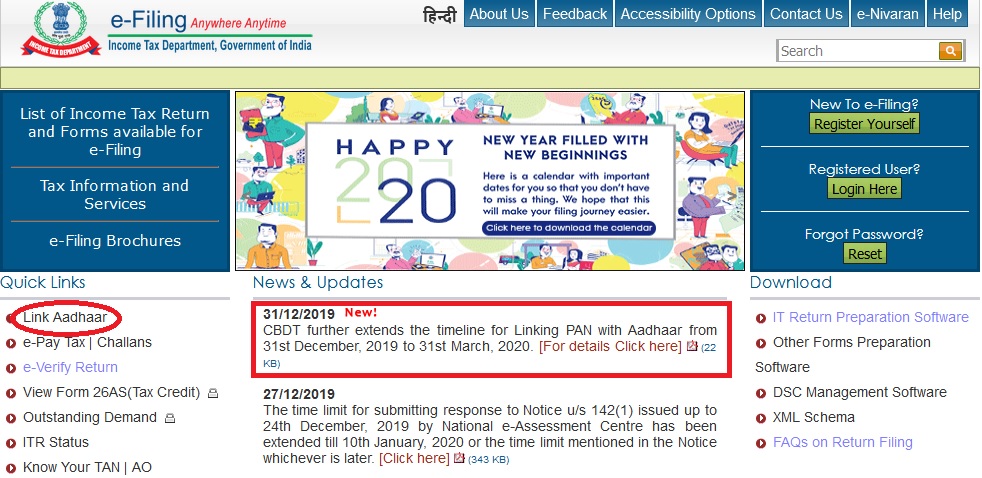

CBDT further extends the timeline for Linking PAN with Aadhaar from 31st December, 2019 to 31st March, 2020.

Related : Income Tax Department Know your TAN : www.statusin.in/25571.html

How to Link Aadhaar?

Just follow the below steps for Linking PAN with Aadhaar,

Steps :

Step 1 : Visit the official website of Income Tax Department through provided above.

Step 2 : Then, Click on “Link Aadhaar” link under Quick Links.

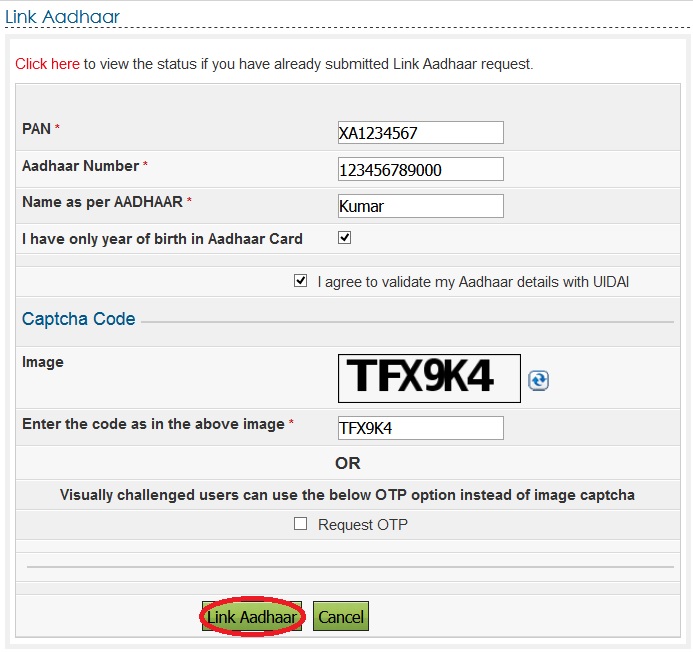

Step 3 : Please enter the following details,

1. Enter PAN *

2. Enter Aadhaar Number *

3. Enter Name as per AADHAAR *

4. I have only year of birth in Aadhaar Card

Captcha Code :

5. Image Type the text in the image

6. Enter the code as in above image * OR

Visually challenged users can use the below OTP option instead of image captcha.

7. Enter Request OTP

8. Enter mobile number *

Note :

** Please ensure the Date of Birth, Gender and Aadhaar Number is as per Aadhaar details to proceed further.

** If Date of Birth and Gender is fully matched and Name as per Aadhaar is not exactly matched then the user has to additionally provide Aadhaar OTP to proceed with partial name match.

FAQs

1. I am a Non- Resident User. I do not have a Mobile Number in India. How do I register in e-Filing?

For a Non-Resident, Mobile Number is not mandatory for registering in e-Filing portal. A valid email id will be sufficient to register. All the relevant verification PINs and intimations will be shared to such email id.

2. I’m not able to register, as I get an error message “Invalid PAN details”. What should I do?

It is possible that you’re typing in the Name details differently from what you have mentioned while applying for PAN card. Please call ASK, 1800 180 1961 and get the correct details and then try registering in the e-Filing application

3. The Principal Contact is a Foreigner/Non-resident and does not have a PAN and hence, not able to register in the new e-Filing Application. What should be done?

As per CBDT guidelines, Foreigners without PAN is allowed to be an authorized signatory and can file on behalf of the Company/Firm without a PAN encrypted DSC.

The assessee Company is required to send an email to efilinghelpdesk [AT] incometaxindia.gov.in mentioning details such as Name of the Company, PAN of the Company, Date of Incorporation, Name of the Principal Contact and DOB of the Principal Contact.

4. While updating the Principal Contact details in the Profile, PAN field is not available. What to do?

The possible reason can be that the previous Principal Contact was a Foreigner without a PAN and might have been added as an exception case in the e-Filing application.

To remove this exception, send an email to efilinghelpdesk [AT] incometaxindia.gov.in mentioning details such as Name of the Company, PAN of the Company, Date of Incorporation, Name of the Principal Contact, PAN of the Principal Contact and DOB of the Principal Contact.

The exempted details in the e-Filing application will be deleted and the Principal Contact will be able to register the PAN of the new Principal Contact.

5. The Principal Contact of my Company/Firm is a foreigner and does not have a PAN. The Principal Contact has been updated without PAN in the Company/Firm profile of the e-Filing portal. The Digital Signature Certificate (DSC) of the Principal Contact is with a dummy PAN. When I try to upload/register the DSC, PAN mismatch error comes up. What to do?

Digital Signature Certificate with dummy PAN will not be accepted by the e-Filing application.

In case the Principal Contact has been updated without PAN, Digital Signature Certificate without PAN encryption should be used. In case the Principal Contact is updated in the profile with a PAN, Digital Signature Certificate with the same PAN should be used.

Last Date

Last Date to link PAN card with Aadhaar card is extended till 31st March 2020.

Contact Us :

Shri.M. Jagadeesan,

Joint Director, e-Filing Unit,

Centralized Processing Centre,

Income Tax Department,

Bengaluru 560500.