bankofmaharashtra.in Know your Loan Application Status

Organisation : Bank of Maharashtra

Facility : Know your Loan Application Status

Applicable For : Bank of Maharashtra Customer

Website : http://www.bankofmaharashtra.in/loan1/proposal_status.asp

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Loan Application Status

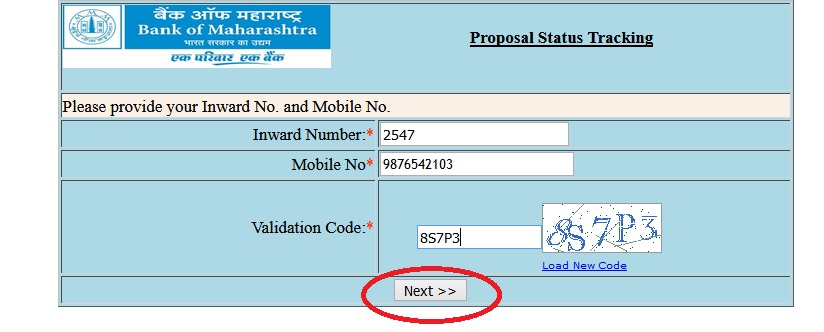

Please provide your Inward No. and Mobile No.

1. Enter Inward Number*

Related : Bank of Maharashtra Check Account Balance Online : www.statusin.in/8407.html

2. Enter Mobile No*

3. Click on the Next button

Term Loans, Overdrafts, Letters of Credit, Guarantees and many more such products are included in the credit basket. Recognising individual customer needs Bank Of Maharashtra has identified Customer segments. For the individual we have finance schemes that translate your dreams into reality.

The Standard Operating Procedures for the Retail Loans :

a) Providing the application form along with the checklist of the documents to be submitted.

b) Explaining to the customer of the legal documents to be submitted and the formalities regarding obtaining legal opinion / valuation report etc if any.

c) Accepting the application form along with documents.

d) Conducting Pre-sanction inspection at a time convenient to both the customer and the Bank official.

e) Verification of the documents and informing the deficiencies if any by phone/email/mail.

f) Processing the loan application and sanctioning of the loan.

g) The Bank official shall adhere to the time norms stipulated by the bank from time to time at each stage of loan processing.

h) In case of rejection of application, the same shall be communicated to applicant, with the reasons for rejection in writing against acknowledgement on the copy of letter of rejection.

i) Appraising the customer of the sanction and delivering a copy of the sanction letter against acknowledgement on the copy of sanction letter.

j) Submission of acceptance of terms and conditions of sanction from all concerned like borrower / co-borrower and guarantor/s.

k) Getting the loan documents executed, as per sanction.

l) Disburse the loan amount in stages as per requirement.

m) Obtaining ECS mandate/SI/PDC from borrower.

n) Monitoring of the loan account and following up with the borrower for ensuring repayment and other terms as per the sanction by email/phone/sms/personal contact/ letters.

About Us :

Maharashtra has a long history of commercial activity since ages because of its strategic location in Indian sub continent and its large natural resources.

Maharashtra has been a progressive region and the Banking activity was also started in this region quite early. Historically speaking, the Bank of Bombay established in 1840 was the first Commercial Bank in Maharashtra.

However, the first commercial bank set up in Maharashtra outside Mumbai was The Poona Bank established in 1889 at Pune followed by The Deccan Bank in 1890 and the Bombay Banking Company in 1898.

FAQs :

1. Who can become guarantor to a loan?

Any person ,known to bank and having worthiness to repay the loan of the borrower in case the borrower becomes defaulter, can become guarantor.

2. Is it necessary that guarantor should be account holder of Bank of Maharashtra?

Not necessary but he should be known to the bank and be capable to repay the dues of the bank if the borrower becomes defaulter.

3. What is margin money?

It is the contribution by the borrower towards the cost of project for which loan is applied for.

4. What is a clean loan?

It is a loan where no primary or secondary security is taken by the bank.However, bank can insist for a guarantor for the loan.

5. Why insurance of house is required in case of housing loan?

It helps in recovery of bank dues, in case of untoward incidence and reduces the liability of the borrower to a certain extent.

6. Is housing loan available for purchase of land?

Only for purchase of land, it cannot be availed. However, purchase of land is allowed along with construction of house within 2 years, which is mandatory. It is a composite loan for land & construction of house.

7. Is cost of stamp duty considered for housing loan?

Yes, up to Rs 1 lakh

8. What is PLR ?

It is minimum prime lending rate at which credit line is offered to prime borrowers. This rate is also offered to certain loan schemes like education loan scheme.