Surat Municipal Corporation SMC : ePay of Property Tax & Check Status

Organization :Surat Municipal Corporation

Facility :ePay of Property Tax & Check Status

Home Page :https://www.suratmunicipal.gov.in/epay/?SrNo=705005305405205406905406

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Surat Municipal Online Property Tax Information

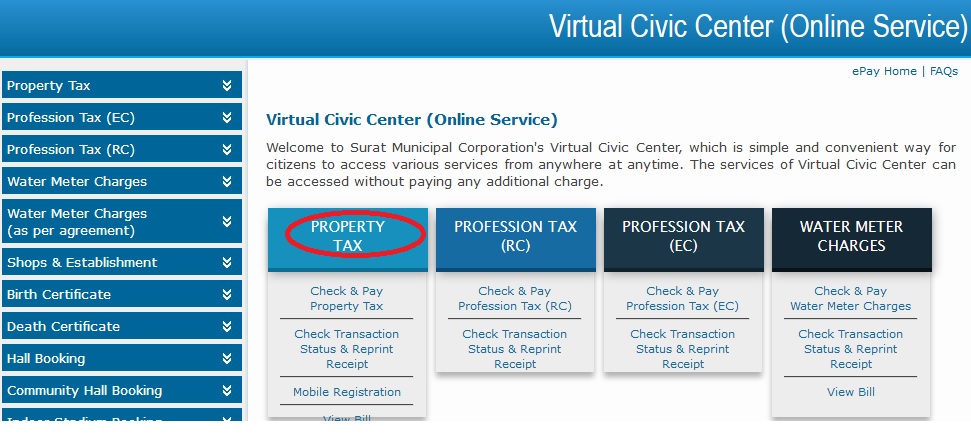

This facility is payment of ePay of Property Tax & Check Status. Go to the official web page click on the property tax on home page.

Related / Similar Service :

Surat Municipal Corporation Lodge Complaint Online

Check & Pay Property Tax

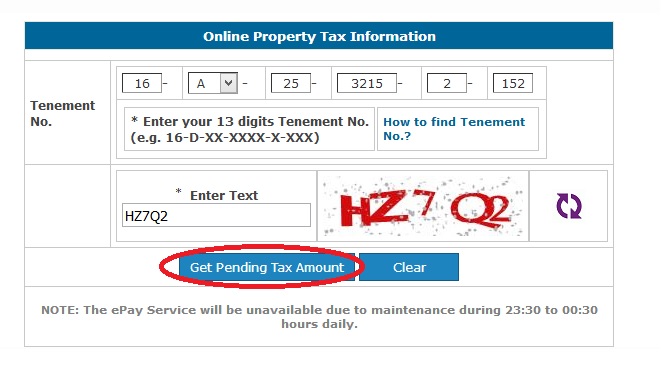

Online Property Tax Information :

Enter your 13 digits Tenement No.(e.g. 16-D-XX-XXXX-X-XXX)

Enter Captcha code shown below

Click on “Get Pending Text Amount”

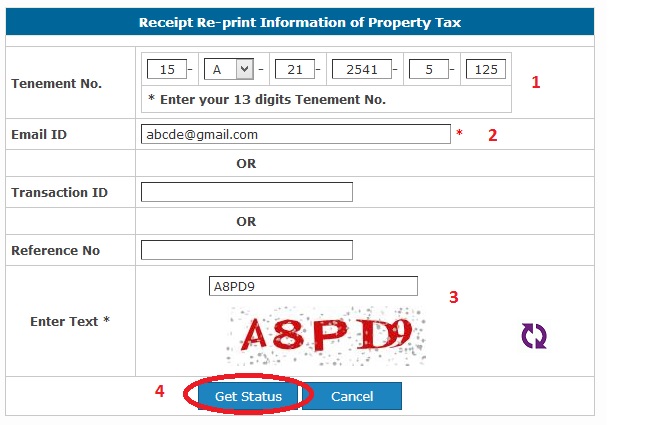

Receipt Re-print of Property Tax

Enter your 13 digits Tenement No.

Enter Email ID *

OR

Enter Transaction ID

OR

Enter Reference No

Click on Get Status button.

Note :

The ePay Service will be unavailable due to maintenance during 23 :30 to 00:30 hours daily.

ePayment Service :

ePay Service is simple and convenient way provided by Surat Municipal Corporation (SMC) to the citizens to pay their Property Taxes. It allows and enables the citizen to make payment online through SMC’s website instantly with multiple options like credit card, debit card and internet banking.

payment and required for it :

Online payment can be made by any citizen having valid tenement number of the property for which s/he wants to make payment. The payer needs to have either Net Banking facility with any of the listed banks or Master/VISA Credit Card or Master/VISA/Mastreo Debit Card.

make payment using Net Banking facility :

Ans. You can make payment using Net Banking facility provided by your bank. The Net Banking facility is available for 48+ banks. Your bank should be one of them.

FAQ On Surat Municipal Corporation

1. How do I make payment using Master/VISA Credit or Debit Card?

First ensure that your card has been enabled by VBV (verified by VISA) OR VBM (verified by MASTER) if yes then use your PIN number issued by your bank for making online payment. To obtain PIN number you need to call your bank, who will furnish it to you by E-Mail or SMS.

2. How can I check status of my transaction?

You can visit Check Status Page on SMC’s website to check status of your transaction. You need to provide Tenement No. and Email ID or Transaction ID or Reference No. to check the status.

3. When will my transaction considered as successful?

When you make the payment and the returned information is received successfully by SMC webserver, an online payment receipt will be generated and only such transactions are considered to be successful. You can check whether the transaction is successful or not by visiting Check Status Page.

4. When will my transaction considered as failed?

When you do not complete the payment procedure or due to some or the other reason the transaction information does not reach SMC after the payment, the transaction is considered to be failed.

5. My account is debited but Property Tax receipt is not generated?

First check the status of your transaction by visiting Check Status Page. If the status is failed, the transaction amount will be refunded to your account by the respective bank/Credit or Debit card authority. For such cases the tax remains to be unpaid and you should ensure payment of the same before the due date.

6. While the transaction was happening the power failed or session timed out or internet got disconnected, or for any other reason a message appeared that the transaction failed. However, my bank account has been debited. Will this be considered a successful transaction? How do I verify transactions status?

In such cases, you can first check the transactions status by visiting Check Status Page. If the payment information has reached successfully to SMC, the status will be shown as success and you can print the receipt from the same page. For successful transaction an email along with receipt is also sent to the email address provided while making the payment. If the payment information has not reached successfully to SMC, the status will be shown as failure and the debited amount will be refunded to your account by the respective bank/Credit or Debit card authority.

Functions of Surat Municipal Corporation

The Surat Municipal Corporation (SMC) is a local self-government body in Surat, Gujarat, India. It was established in 1852 and is responsible for providing a variety of civic services to the city’s residents.

The SMC’s functions include:

** Providing water supply

** Sewage treatment and disposal

** Solid waste management

** Street lighting

** Road maintenance

** Public health

** Education

** Slum improvement

** Fire protection

** Parks and gardens

** Urban planning

** Social welfare

** Animal husbandry

** Public works

** Revenue collection

** Law and order

The SMC is headed by a Municipal Commissioner, who is appointed by the State Government. The Commissioner is assisted by a team of officers and staff, who are responsible for carrying out the day-to-day functions of the corporation.

My tenement number is 19G4949820001. Transaction Id is SMCePTax49217F250414. I tried to make online transaction but it has failed. Please recover my payment.

Tenement number is 38E1104310001. I tried to make online transaction but it was failed. Please recover my amount.

Can I make the payment online?

You can make payment using Net Banking facility provided by your bank. The Net Banking facility is available for 48+ banks. Your bank should be one of them.

Information as provided in the official website of Surat Municipal Corporation.

How can I view property tax for 15/16?

How can I view my property tax bill for 16/17?

How can I download old property tax bill?

How to contact helpdesk?

From the Website:

How can you get Sat Bars or City Surveys online?

And the owners names should be in alphabetical order to locate easily.

Tenement no 64E1177410001

Transaction ID SMCePTax774116A190065, failed

Want to know in tenement no.83A-29-3825-0-001 as whose name is there?

You need email id also to check the status.