gvmc.gov.in Pay Property Tax & Check Status : Greater Visakhapatnam Municipal Corporation

Organization : Greater Visakhapatnam Municipal Corporation

Facility : Pay Property Tax & Check Status

Home Page : https://www.gvmc.gov.in/gvmc/index.php/online-services

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay GVMC Property Tax Online?

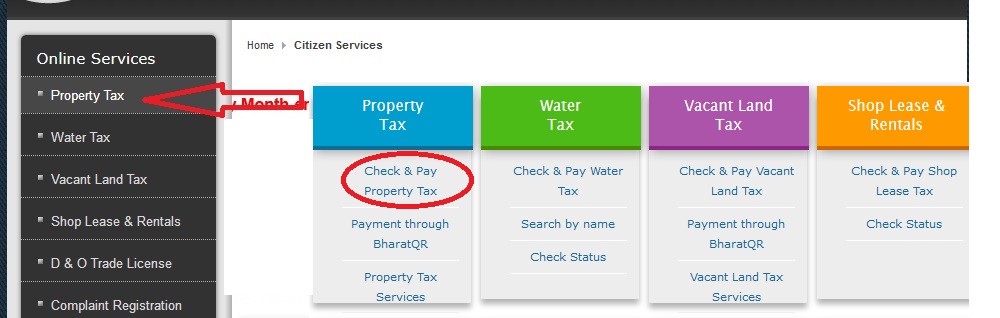

Go to GVMC home page and click Citizen Services tab to know about online services.

Related / Similar Service : GVMC Register Complaint Via Online/ SMS/ IVRS

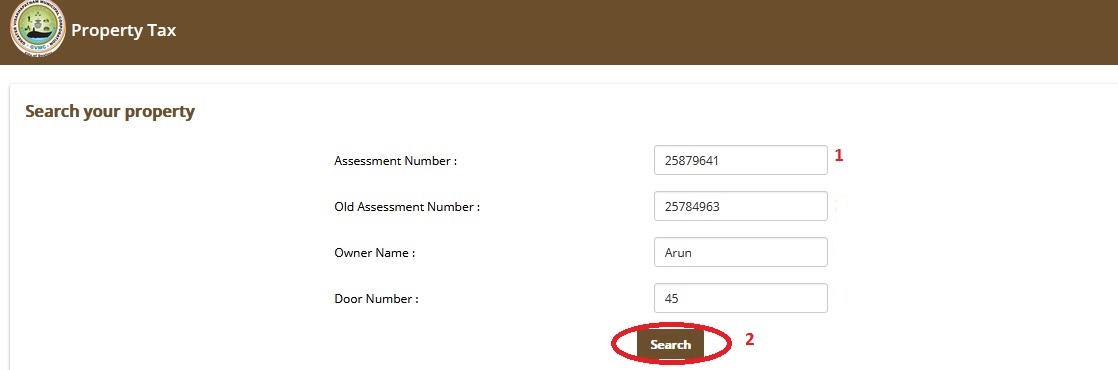

Click the link Check & Pay Property Tax.Enter the Following details. Enter your Assessment Number,Mobile Number and Reference Number/Transaction Id Assessment Number & Get your Status

1. You can search the property by any one of these criterias.

** Assessment Number

** Old Assessment Number

** Owner Name

** Door Number

2. Click on submit button.

Note :- Citizens can now pay Property Tax & VLT through PAYTM , PURASEVA App , Smart Vizag App & Any EMI with your new Assessment Number.

GVMC Online Payment Service

Online Payment Service is a simple and convenient way provided by Greater Visakhapatnam Municipal Corporation(GVMC) to the citizens to pay their Property Taxes. It allows and enables the citizen to make payment online through GVMC’s website instantly with multiple options like credit card and debit card.

FAQS On GVMC Payment

Frequently Asked Questions (FAQs) on GVMC Greater Visakhapatnam Municipal Corporation Payment

Who can make online payment and what is required for it :

Online payment can be made by any citizen having valid assessment number of the property for which s/he wants to make payment. The payer needs to have either a Master/VISA Credit Card or a Master/VISA Debit Card.

How do I make payment using Master/VISA Credit or Debit Card :

First ensure that your card has been enabled by VBV (verified by VISA) OR VBM (verified by MASTER) if yes then use your PIN number issued by your bank for making online payment. To obtain PIN number you need to call your bank, who will furnish it to you by E-Mail or SMS.

How can I check status of my transaction :

Transactions made in the period of 21st December 2013 to 26th January 2014 will be reflected soon in the website. Please do not pay again. For further details please contact IT Department,GVMC.

When is my transaction considered as successful :

When the amount is debited from your bank and the transaction page successfully returns back to GVMC portal, it will be considered a Successful Transaction.

When is my transaction considered as failed :

When you do not complete the payment procedure due to some or the other reason or the transaction information does not reach GVMC after the payment, the transaction is considered as failed.

My account is debited but Property Tax receipt is not generated :

If the status is shown as pending, the transaction amount will be reflected to your tax after few hours.

How To Pay Property Tax & Water Charges Through Online :

** Enter website address

** Select Payments menu and Select Pay Property tax.

** Then you transfer to tax enquiry page asking house no. After entering valid house number, you will get total demand and collection of given assessment number.

** After getting the details, Click here to pay property tax button appear on the screen.

** After clicking, It will be transfer to payment mode of easy2pay with asking debit or credit card number , valid month , year of the card and cvv2/cvc2 is the three digit security code printed on the back of your card , email address ,mobile number ,word verification and submit with valid data .

** After successful payment, you will be transfer to another page. On that page, you will find receipt of the payment . print that receipt and save in your records and also you can check the tax enquiry page you will notify your payment details.

Some Important Information From Comments

Comments:

1. I made a house tax payment of Rs.4412/- online on 02.05.2022. Amount has been debited but, still outstanding amount showing is the same. I haven’t received any acknowledgement. How should I proceed? Already raised a complaint and complaint number is 1004052200181. What’s next. How to track the status of my complaint?

2. I want to check status of payment for registered house tax in Visakhapatnam. But, I am not able to go through the website for checking house tax due and after that payment should be done online. I had tried so many times through url gvmc.gov.in and citizen services check and status in url but, site was not reaching. Earlier time, it is possible to check the status easily by anybody. Now it is not possible to check and make it possible in easy way.

3. There is only one house at one particular place, but two house taxes are being maintained. One is original one and second is indefinite tax. Indefinite tax is asked to put by the owner for her safety. Now, we are about to buy that particular house. So, Can we remove the tax for indefinite tax and continue the original one?

Benefits of GVMC Property Tax Online Payment

GVMC Property Tax online payment offers several benefits to taxpayers. Some of the key benefits are:

Convenience:

Online payment of GVMC Property Tax allows taxpayers to pay their taxes from the comfort of their home or office, without having to visit the tax office in person.

Time-Saving:

Online payment of GVMC Property Tax is a quick and easy process that saves taxpayers time and effort, as they can complete the payment process within a few minutes.

Secure:

GVMC Property Tax online payment is a secure and safe way to pay taxes, as the payment gateway is encrypted and secure.

Hi

I made a house tax payment of Rs.4412/- online on 02.05.2022.

Amount has been debited but still outstanding amount showing is the same.

I haven’t received any acknowledgement. How should I proceed??

Already raised a complaint and complaint number is 1004052200181.

What’s next. How to track the status of my complaint?

I want to download the duplicate bill of property tax paid. How can I get it online?

I want to check status of payment for registered house tax in Visakhapatnam. But I am not able to go through the website for checking house tax due and after that payment should be done online. I had tried so many times through url gvmc.gov.in and citizen services check and status in url but site was not reaching. Earlier time it is possible to check the status easily by anybody. Now it is not possible to check and make it possible in easy way.

WHAT IS THE PROCEDURE TO CORRECT THE NAME IN THE PROPERTY TAX BOOK? KINDLY INFORM ME.

I have applied for name change three weeks back. Please tell me my present status.

DNO : 27-4-72/2/14.4F-2

Customer id number : 201001088186909

I have applied for name changing from seller name instead of mine(buyer). My house tax no is 520100/1088212433, door no is 31-60-10-2-53,GF-101. Please tell me what is the status.

Gvmc.gov.in website is not working. Looks like DNS servers not found. Can someone from GVMC Support fix this ASAP?

How can I check my water tax pending bill online. Even after entering the assessment number I am not able to find the dues.

I have searched with door number and name, still it was not came.

How to get assessment no?

How can I get assessment of house when search with plot number in Vudalayout Madhavadara?

Whether I am entitled for any benefit of discount for advance payment of property tax to GVMC. Furnish the details so as to enable me to avail the discount facility.

Regards.

M.Padmakara Kumar

How to know property tax paid details?

HOW TO CORRECT THE NAME IN PROPERTY TAX ASSESSMENT?

HOW TO CORRECT THE NAME IN THE PROPERTY TAX ASSESSMENT?

How to check my property tax details?

How to get assessment number?

I want to check my vacant land tax. Kindly help me.

I have lost my house tax book and receipts, how can I pay house and get house tax book?

Mylapalli Lakshmanarao flat no. S1, Lakshmi Sri Nilayam,door no. 22-81-16, Chanchalaraopeta, Visakhapatnam 1 AP

What is the procedure for property tax name change?

There is only one house at one particular place, but two house taxes are being maintained. One is original one and second is indefinite tax. Indefinite tax is asked to put by the owner for her safety. Now we are about to buy that particular house. So, Can we remove the tax for indefinite tax and continue the original one?

Confirmation of name changing for house tax

My house tax assessment no.100006/64318

I made payment for the entire year at e seva madhavadhara during May 2015 and got the receipt also. Unfortunately payment bill misplaced. Can I get a duplicate bill?

I am trying to pay 2015-2016 property & water taxes. Even at Citizens’ Charter at GVMC office till today demands are not open and hence advance taxes could not be paid to avail 5% discount. Please arrange necessary action.

Regards,

M.Doraiah Babu.