trichycorporation.gov.in Check Tax Dues & Payment history : Trichy Municipal Corporation Tamil Nadu

Organization : Trichy Municipal Corporation Tamil Nadu

Facility : Check Tax Dues & Payment history

Home Page : http://www.trichycorporation.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Check Trichy Corporation Tax Dues?

Online Tax Balance Enquiry facilitates you to view the total balance due on your assessment and your recent payments applied to the tax balance due.

Related / Similar Service :

Trichy Municipal Corporation Tamil Nadu Search Assessment

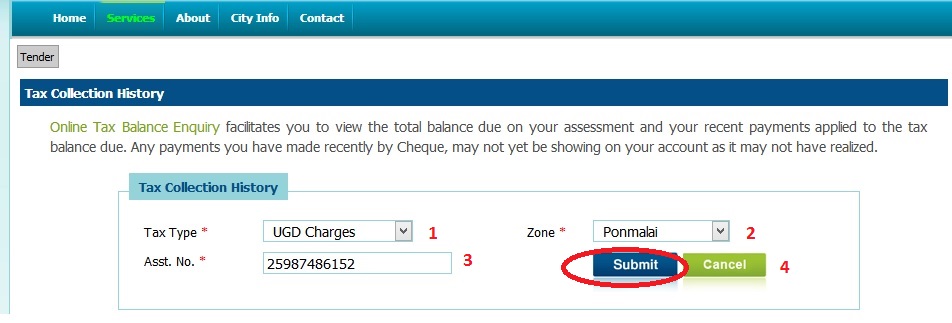

Go to the link of Tax Collection/Payment History as shown below.

You are required to provide all the below details to know the payment history.

Step 1 : Select Your Tax Type From the Drop Down List (Non Tax)

Step 2 : Select Your Zone (Ponmalai)

Step 3 : Enter Your Assessment No ( 657987465498)

Step 4 : Click Submit Button

About Us:

Tiruchirappalli, better called as Trichy, is the fourth largest city of Tamil Nadu and the transportation center of the State. It is located on the banks of the River Cauvery on which the first man-made dam KALLANAI was built across. The world famous landmark in Trichy is the 85m tall Rock Fort right in the middle of the City, which used to be a military fort during the Pre-British era.

Accordingly, the functions of the City Municipal Corporation are as follows :

** Urban planning including town planning.

** Regulation of land-use and construction of buildings.

** Planning for economic and social development.

** Safeguarding the interest of weaker sections of society, including the handicapped and mentally retarded.

** Slum improvement and up-gradation.

** Urban poverty alleviation.

** Water supply for domestic, industrial and commercial purpose.

** Formation and Maintenance of Roads and bridges within the Corporation Limit.

** Maintenance of public amenities including street lighting, parking lots, bus stops and public conveniences.

** Public health, sanitation facility and solid waste management.

** Burials and burial grounds; cremations, cremation grounds and electric crematoriums.

** Regulation of slaughter houses and tanneries.

** Vital statistics including registration of births and deaths.

** Provision of urban amenities and facilities such as parks.

** Promotion of cultural, educational and aesthetic aspects.

Contact

No.58, Bharathidasan Salai,

Contonment,

Tiruchirappalli – 620 001

Disclaimer :

The Contents of this Website are provided on an “as is” and “as available” basis without warranties of any kind, and are of a general nature. The Contents are made available for your general information only.

While every effort is made to ensure that the Contents herein are consistent with existing records, you are advised to refer to the relevant department to be certain of your information and obligations and should seek professional advice at all times before making any decision based on any such information or materials.

Neither Tiruchirappalli City Corporation nor any third party content providers is responsible for any errors or omissions, or for the results obtained from the use of the information and material in this Website or the tools contained in this Website.

FAQ On Trichy Corporation Tax

Here are some frequently asked questions (FAQ) on Trichy Corporation Tax:

Q: What is Trichy Corporation Tax?

A: Trichy Corporation Tax is a tax levied on properties located within the jurisdiction of the Trichy Municipal Corporation. The tax is used to fund various civic amenities and services provided by the Corporation.

Q: Who is liable to pay Trichy Corporation Tax?

A: All property owners within the jurisdiction of the Trichy Municipal Corporation are liable to pay Trichy Corporation Tax. The tax is applicable to residential, commercial, industrial, and other types of properties.

Q: How is Trichy Corporation Tax calculated?

A: Trichy Corporation Tax is calculated based on the annual rental value (ARV) of the property. The ARV is determined based on various factors such as the type of property, location, and facilities available. The tax rate is fixed by the Corporation and may vary from year to year.

Q: How can I pay Trichy Corporation Tax?

A: Trichy Corporation Tax can be paid both online and offline. Property owners can visit the Trichy Municipal Corporation website and make the payment using their credit/debit card or net banking. They can also visit the Corporation office and pay the tax in person.

copy of UGD DEPOSIT RECEIPT FOR ASSESSMENT NO 086/2000215 OF WARD

TELL, HAS ANY ONE OF YOU GOT ANY REPLY FOR THE QUESTIONS RAISED BY ALL THE 33 OF YOU?

What is SUC in property tax?

TRICHY CORPORATION IS VERY SLACK ON IMPLEMENTING ONLINE PAYMENT COLLECTION OF PROPERTY/WATER TAXES. IT IS POSSIBLE FOR PROPERTIES TO PAY ONLINE WHICH ARE LOCATED AT TOWN PANCHAYATS OF TAMIL NADU? TRICHY CORPORATION IS NOT SHOWING INTEREST MOVING TOWARDS DIGITAL INDIA.

I have a property in Trichy. I am in a transferable job. Please enable online payment of property and water taxes. Trichy corporation is lagging behind in digitization.

Before making a claim for a smart city, the Corporation should become smart by making use of the technology to pay all taxes online.

Please provide online Property tax system for Trichy city. I kindly request you for the same.

The online portal indicated is not active. It shows only googles ads in the portal if I click online payment or pay tax due.

How can I pay the tax dues to the Trichy municipal corporation through online? There is no online payment facility available in the E-services portal of the corporation. I am a senior citizen and my mobility is restricted within my house. Kindly help.

Can I make my both property and water tax online payment? Please send.

The govt of India wants digital India. Why you are lagging behind?

Can I pay my property tax and water tax online?

Payment of property tax is not yet available. User can only view or check the status. We request the Trichy corp to create online payment facility. So that, people away from Trichy can make payment in time.

If I press the yellow reply, it asks me to present the reply instead of corporation authorities making a reply for the posted queries.

These days online payment for various factors becomes very easier,faster,simple.

Why do not we adhere with it?

Professional tax slab rate for Trichy 2015-2016.

I have a tax receipt of my home. I tried to check my tax balance inquiry on the above link with my Assessment number mentioned in my tax receipt but it says an error “Invalid Assessment number”. What can I do?

Can we pay property tax online or not?

How do I pay property tax online for house in Trichy?

My house is in Pappakurichi kattur. How can I pay house tax and water tax online. Can I sign up by own ID?

Can I pay property tax & under ground drainage tax online for SRIRANGAM ZONE? If so kindly intimate the web site.

You can calculate your tax in the below link.

https://www.trichycorporation.gov.in/tax_cal.php#menu

How to pay assets & water tax pay online? Please help me.

I have a house at North Street, Rockfort, Tiruchirapalli-2 in my father’s name.(late) P.V.Ramanatha Iyer and the original documents of the house is misplaced during transit.

How can I get duplicate documents online? Please reply.

You can get help over phone by registering in the below link.

https://www.trichycorporation.gov.in/phone.php#menu

I applied for name transfer of my house after verification of related document. I was advised to pay a fee of 600/- and i paid it. I found hard to get the name transferred. Whom should i contact. The bill collector and their section peoples are not responding me.

Can the house tax for a house located at Bikshandar Kovil (Tiruchirapalli District)be paid online? If so what is the procedure? Which is the web site?

Online Tax Balance Enquiry facilitates you to view the total balance due on your assessment and your recent payments applied to the tax balance due. Any payments you have made recently by Cheque, may not yet be showing on your account as it may not have realized.

If your house comes with in Trichy corporation limits you can

Is there any license to be taken for house hold pet animals like dog?

If so what is the procedure?

Can I make payment for my property tax online for Trichy corporation?

Regards,

Elango

No. As on today i.e. 19/10/2016, you can only view the tax due details and payment history details. The facility to pay online has not yet hit Trichy corporation.

New home constructed VST Currently running. But home tax is not proceed, how is home tax receipt collect.

For making property tax payment in whose favor the cheque has to be made?

Can I make payment for my property tax online for Trichy corporation?

Regards,

Balu