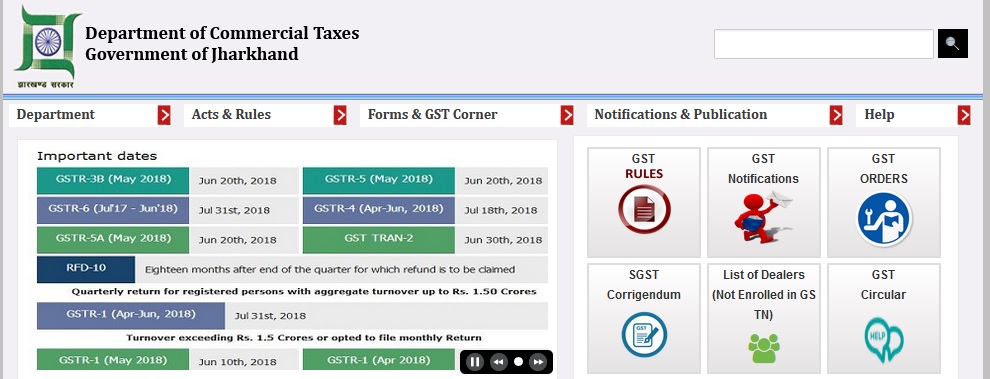

jharkhandcomtax.gov.in e-CST Registration Jharkhand : Department of Commercial Taxes

Organization : Department of Commercial Taxes

Service Name : e-CST Registration

Applicable State : Jharkhand

Website : http://jharkhandcomtax.gov.in/home

Details Here : https://www.statusin.in/uploads/36054-e-CST-Reg.pptx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

e-CST Registration Jharkhand

** Go through the link ‘eseva.jharkhandcomtax.gov.in’. Enter the email id and password and click on ‘Login’ button.

Related : Commercial Taxes Verify & Search Cancelled CST Form Jharkhand : www.statusin.in/36034.html

** On the home page, click e-Registration link under the list e-Services. The e-Registration screen opens. On the above screen, select form type as CST Registration and Click on Next button to continue.

** Click on ‘Ok’ button to continue.

** The e-Registration screen opens. In Basic Details tab, fill up all the mandatory fields.

** In Branch Details tab, fill up all the mandatory fields. Click on Next button to continue.

** In Activity Details Details tab, fill up all the mandatory fields. Click on Next button to continue.

** In Bank Details Details tab, fill up all the mandatory fields. Click on Next button to continue.

** In Commodity Details Details tab, fill up all the mandatory fields. Click on Next button to continue.

** An alert message will pop up for final submitting the form. Click on ‘Ok’ button to continue.

** Click “Click here” to move to the attachment upload page. The next page appears.

** Select the category and sub-category (if any) of the document to be uploaded. Select the document and click Upload to upload that document. After the document is uploaded it will be displayed in the table displayed below on the same page.

** An alert message will come of successfully upload the document. Click on ‘Ok’ button to continue.

** After submitting all the mandatory and required attachments, click Submit and Complete Registration Process. The acknowledgement receipt and task is generated in the back office for registration. The success screen appears.

** Click the Acknowledgement Number to view the acknowledgement receipt.

Central Sales Tax

(i) In relation to a dealer who has one or more places of business situated in the same State, that State;

(ii) In relation to a dealer who has places of business situated in different States, every such State with respect to the place or places of business situated within its territory;

Procedure on Receipt of Application

(1) On receipt of an appeal, the Authority shall cause a copy thereof to be forwarded to the assessing authority concerned as well as to each State Government concerned with the appeal and to call upon them to furnish the relevant records

PROVIDED that such records shall, as soon as possible, be returned to the assessing authority or such State Government concerned, as the case may be.

(2) The Authority shall adjudicate and decide upon the appeal filed against an order of the highest appellate authority.

(3) The Authority, after examining the appeal and the records called for, by order, either allow or reject the appeal : PROVIDED that no appeal shall be rejected unless an opportunity has been given to the appellant of being heard in person or through a duly authorised representative, and also to each State Government concerned with the appeal of being heard.

PROVIDED FURTHER that whether an appeal is rejected or accepted, reasons for such rejection or acceptance shall be given in the order.

(4) The Authority shall make an endeavour to pronounce its order in writing within six months of the receipt of the appeal.

(5) A copy of every order made under sub-section (3) shall be sent to the appellant, assessing authority, respondent and highest appellate authority of the State Government concerned.