jkcomtax : VAT Payment Online Jammu & Kashmir

Organization : Jammu & Kashmir Commercial Taxes Department

Facility : e-Payment of VAT

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

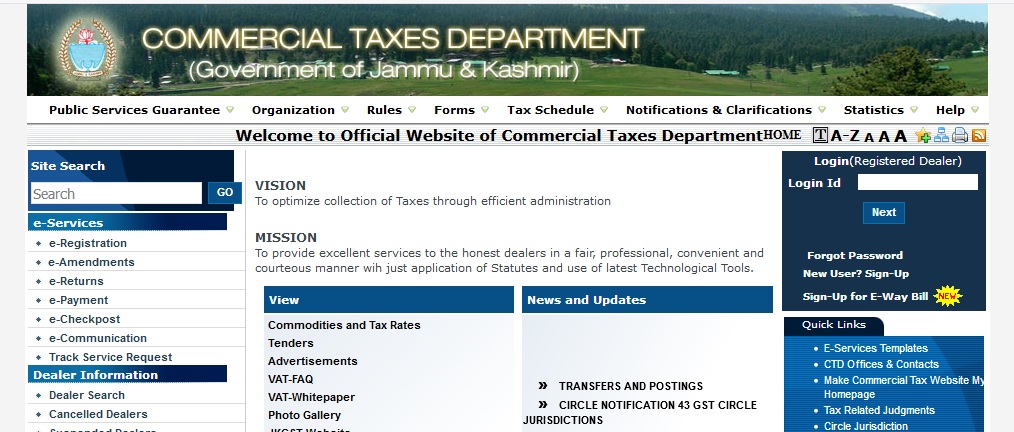

Home Page :https://www.jkcomtax.gov.in/

e-Payment of VAT

Operational Instructions :

Procedure to make online Payment is very simple. A computer with internet connectivity is required to make an e-Payment.

Related : Jammu & Kashmir Commercial Taxes Department VAT Registration Online : www.statusin.in/3733.html

There are four simple steps to make online Payment as mentioned below :

** Step 1 Sign Up on the Web Portal (One time Activity)

** Step 2 Login on to the Portal using assigned Id and Password

** Step 3 Fill the Payment details into the Challan form

** Step 4 Auto Redirection on the Bank’s Portal : where dealer needs to provide Internet banking Id and Password for successful completion of payment Step-1 Sign Up on the Web Portal (One time Activity) To create a Sign Up on CTD Web Portal, connect to Internet and write URL in the address bar as jkcomtax.gov.in The following screen would be shown.

Sign-Up Click on this button. :

A new screen as given below will open up. This screen will display the details required to be filled by the dealer for Sign-Up creation on the Web Portal. Dealer needs to enter the details on the screen as per the instructions given in the table below. Screen-2

** Select the Tax Type

** Enter TIN Enter RC Effective Date

** Click on Submit

** Tax Type Combo Box Yes Select the Tax Type

** Enter your Registration Date. (This date is mentioned in the registration certificate issued to you by the department.)

Complete VAT e-Payment :

** To complete the e-payment, select e-Payment option from the e-services home page.

** Enter all the details as mentioned in the challan form

** Once all details have been entered then click on Confirm

** On confirm, system will ask to check the data. Here check the data and if everything is correct then click on submit.

** System will redirect you to the selected bank’s portal.

** Enter the details of internet bank id and password

** Bank’s portal will display the challan details as it is

** Verify the details and click on the confirm button to proceed with the payment on the bank’s Web Portal.

** Once this activity will successfully complete, a payment confirmation message will be displayed. A unique reference number will also be generated by the bank along with acknowledgement receipt

** Here take the print out of the receipt for reference

** Once the payment is done, the dealer will be redirected back to the CTD Web Portal after few seconds, where the unique bank reference number and CIN number will be displayed on the screen

** Here you can view the e-payment transaction details through “view e-payment” facility.

Pre-Requisites :

** Have a Computer and Internet Connection at your Office / Home.

** Sign-up on CTD Web Portal using your VAT TIN.

** Internet banking Id and password

I am trying to fill online vat return. But I cant do.