mptax.mp.gov.in : Online Filing of Vat Return Madhya Pradesh

Organisation : Madhya Pradesh Commercial Tax Department

Facility :Filing of Vat e-Return

Applicable For : Madhya Pradesh

Home Page : https://mptax.mp.gov.in/

For More Details :www.statusin.in/uploads/3886-MPVAT_e-returns_VAT.docx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

MP Tax Online Filing of Vat Return

** The Madhya Pradesh government has launched a website with URL .mptax.mp.gov.in.The web portal offers different kind of information on VAT in Madhya Pradesh besides services to dealers including online return.

Related / Similar Service :

MP Commercial Tax e-Registration of VAT

** A dealer has to get registered on web portal to avail the facility of e- filing of return.This is a one-time activity.

** Since e-filing is a new concept, this booklet has been prepared with a view to provide step-by-step guidance to the dealers in filing e-return. This booklet contains details and screen shots for e-filing the return in Form. E-filing of returns will save time for the dealer and the Department will be in a better position to quickly verify, analyze, assess and grant refund, if any.

Note :

In order to file e-Returns it is mandatory for the dealer to be registered on the website.

Operational Instruction :

Procedure to file e-return is very simple. A computer with internet connectivity is required for the purpose. There are four easy steps to file e-return.

These steps are

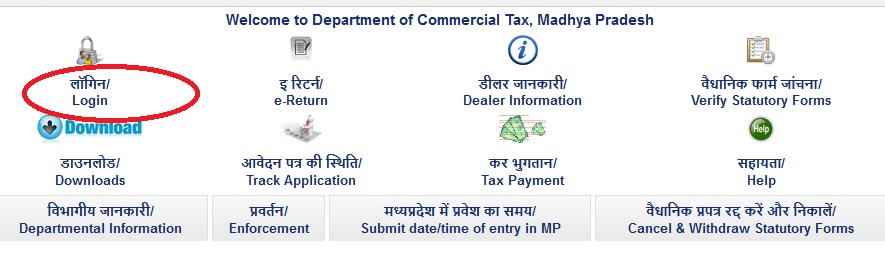

Step 1. Login.

Step 2. Preparation for the return.

Step 3. Uploading the return (.xls)

Step 4. Acknowledgement.

Step 5. Track Your Status

Login Details

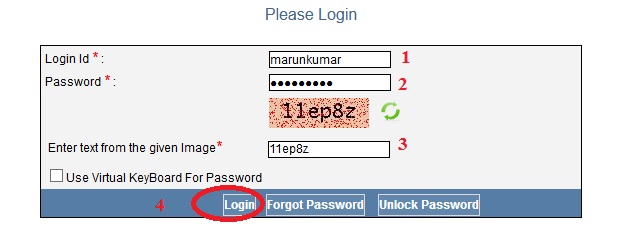

** A dealer registered on the web site is required to Login for filing e-return. Process of log in is as under

** Connect to Internet and open the website Home page.

** Enter the login id and password in left side of the screen

** Please enter following details in the screen

** Login id — your TIN

** Password — Password that you have entered at the time of Sign-Up. (If you have not yet registered n the Website then just click on the Sign-Up button to register yourself).

** Select VAT Returns Form 10 from e-returns.

Downloading necessary Templates :

** To fill up the return, you are required to download the templates from the website. It is advisable to download the Latest templates from website.

** To download the templates for filing e-Returns, just click on required form name (template)

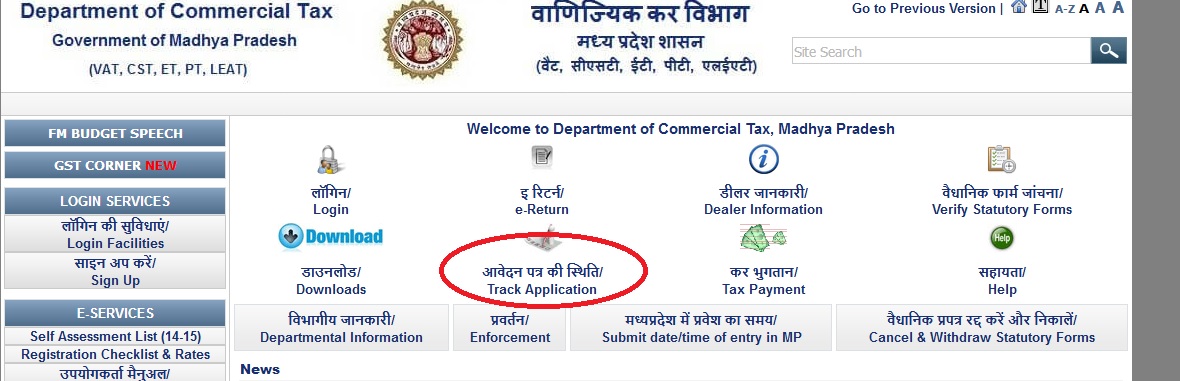

How To Track Your Status?

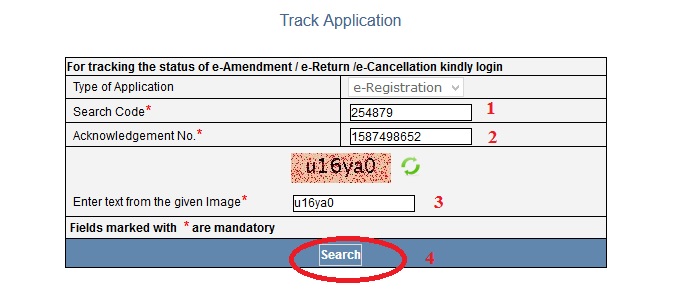

** Once the Acknowledgment receipt is generated, the dealer can track his status using acknowledgment number and search code.

** Click on Home in top menu.

** On Home Page click on Track Your Status link

** Select e-Return in Type of application.

** Enter search code and acknowledgment no. in above fields and click on search button.

** Screen will appear showing the status of your e-returns.

** Click on Export to excel link if you want to export the details to excel.

FAQ On MP Tax

Frequently Asked Questions FAQ On MP Tax

Q: What is MP Tax?

A: MP Tax refers to the various taxes levied by the government of Madhya Pradesh, a state in central India. These taxes include goods and services tax (GST), state excise duty, value-added tax (VAT), professional tax, and other local taxes.

Q: Who needs to pay MP Tax?

A: MP Tax is applicable to individuals, businesses, and organizations that engage in taxable activities such as manufacturing, trading, and providing services. The type and amount of tax vary based on the nature of the activity and the turnover of the business.

Q: How is MP Tax calculated?

A: MP Tax is calculated based on the turnover of the business and the applicable tax rate for the specific activity or service. The tax rate may differ for different activities, such as manufacturing, trading, and providing services.

Q: How to register for MP Tax?

A: Businesses and individuals can register for MP Tax online through the Madhya Pradesh Commercial Tax Department’s website. They need to submit their details such as name, address, nature of business, and turnover along with the required documents.

Q: What are the documents required for MP Tax registration?

A: The documents required for MP Tax registration include PAN card, proof of address, proof of business registration, bank account details, and other relevant documents based on the type of business.

I want to file e-return. So can I file? Show me form no 10-a.

I want password.What is the procedure to get password? Where is SIGN UP ?

Sign Up link is available on the left side tab under the Login Services of the home page.

I want to file vat return quarterly,

Please give me A to Z process.

I want 2015-2016 return status.

iwant to file vat retuen.pl tell me comleat processor

I want file vat return in MP

Please give me form NO

May I get all information about vat tax and all types of challan filling?