Oil India Payslip/ Employee Information Online : oilweb.oilindia.in

Organisation : Oil India Limited

Service Name : View & Download Payslip/ Employee Information Online

Applicable States/UTs: All Over India

Website : https://www.oil-india.com/default.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To View Oil India Payslip?

Now Oil India Employees can view their payslip online. Follow the below steps to View & Download Payslip/ Employee Information Online.

Related / Similar Service :

Adecco Payslip

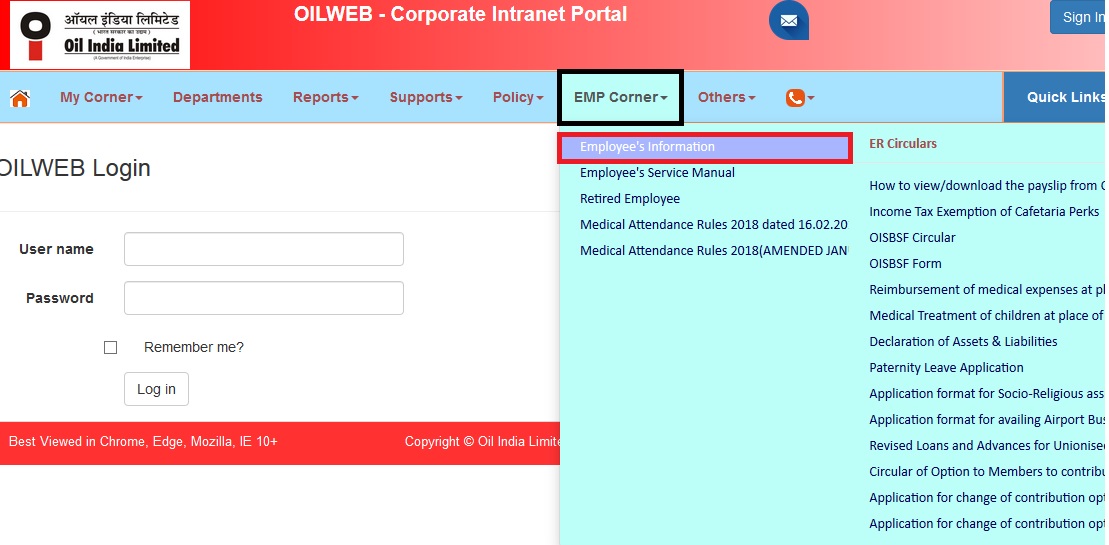

Go to OILWEB -> EMP Corner

Click on Employee’s Information

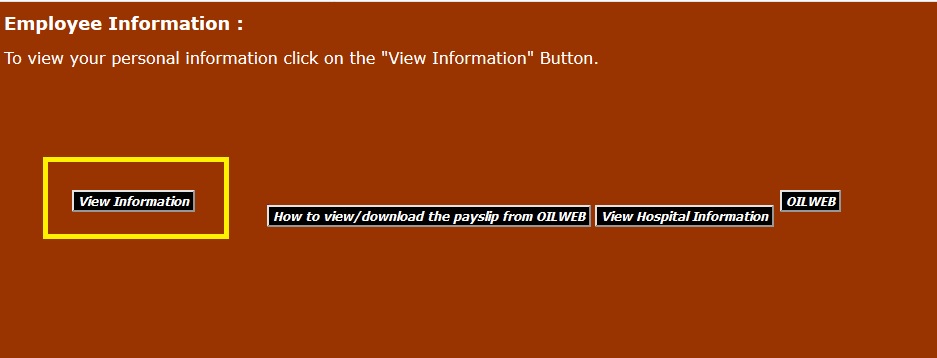

Click on View Information

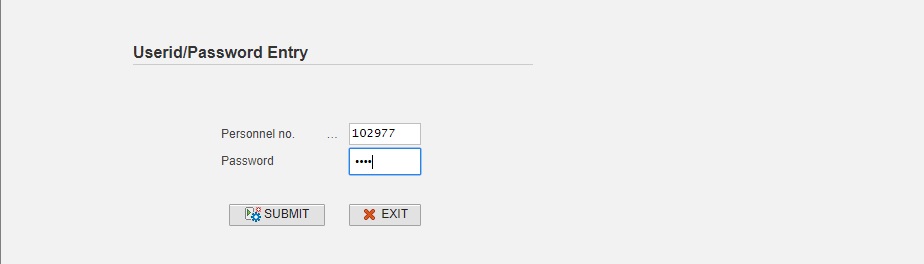

Enter Your User ID/ Password received from IT department and Click on ‘Submit’.(provided by IT Deptt)

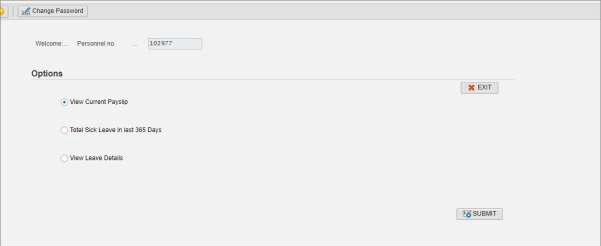

Select radio button options for available services and click on “Submit”button. Here the selection is for viewing payslip.

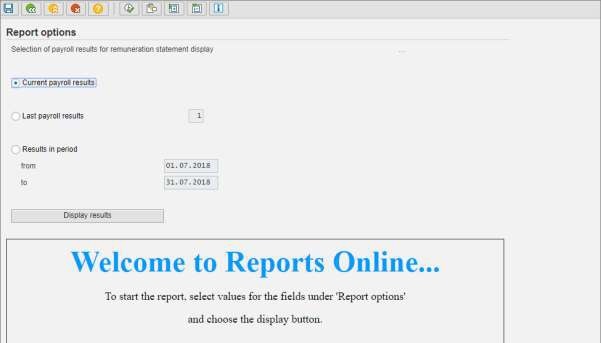

Select -> Current payroll Result for viewing current payslip. Click on “Display Results”.

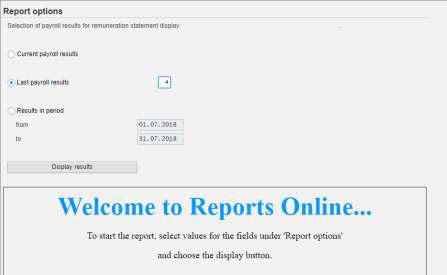

For viewing previous moths payslip -> Select Last payroll results and enter number of months to be viewed. Click on “Display Results”.

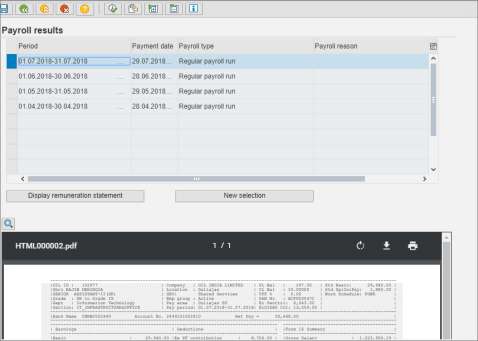

Payslip will be displayed in the bottom PDF viewer. You may select different period for viewing your old Payslips, if last payroll results option is selected.

You may use “zoom in” icon for enlarged view. Payslip can be downloaded and printed from the available icons on the PDF viewer window.

Retiral Benefits of Oil India

The Company’s concern for its employees and their dependants has a humanitarian facet. Hence it is limited not only to the period of their services but extends beyond one’s separation from the Company.

Social Security and Retiral Benefits have been designed and are as follows:

1) Oil India Limited Employees Provident Fund

2) Oil India Gratuity Fund

3) Oil India Pension Fund

4) Medical Benefit for Retired Employees

5) OIL Employees Benevolent Scheme

6) Group Personal Accident Policy

7) Group Savings Linked Insurance Scheme

8) Repatriation Expenses and Provision of Escort

9) LPG Connection to Retired Employees

Oil India Employees Provident Fund

Oil India Limited Employees Provident Fund :

i) In accordance with the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 (as amended from time to time) the Company maintains an exempted Fund known as the “OIL INDIA LIMITED EMPLOYEES’ PROVIDENT FUND” for its employees.

ii) The contribution of each member to the Fund is a sum equal to 12% of his/her monthly wages as defined under the Scheme (which is called “Members’ Compulsory Contribution”) and is deducted by the Company at each periodical payment thereof and is paid to the Trustees. The Trustees credits the contributions thus received to the individual account of each member, i.e. the “Member’s Compulsory Contribution Account” (Account `A’).

iii) Every month, the Company pays to the Trustees in respect of each member a sum equal to the Member’s Compulsory Contribution which is credited by the Trustees to the individual account of each member termed as the “Employer’s Contribution Account” (Account `B’).

iv) Every member may, with the consent of the Trustees, contribute a further sum to the Fund not exceeding 10% of his/her wages. This contribution is termed as the “Member’s Voluntary Contribution”. Such contribution commences with the commencement of each financial year of the Fund and can not be discontinued or varied in the course of the same financial year.

Oil India Gratuity Fund

Oil India Gratuity Fund :

i) Gratuity is payable to a workman who is separated from the company’s services other than for dismissal on account of misconduct involving moral turpitude or for misconduct involving financial loss to the company or damages to the company property or insolvency or inefficiency.

ii) The release of the gratuity amount of a workman is also kept in abeyance if any disciplinary action/ proceeding is / are contemplated or pending at the time of his/her separation from the Company. The release of gratuity in such cases depends on the final outcome of the disciplinary proceedings and also on the order of the Disciplinary Authority.

FAQ On OIEPF

Here are some of the most common questions (FAQ) people ask about the Oil India Employees Provident Fund (OIEPF):

What is the OIEPF?

The OIEPF is a retirement savings plan for employees of Oil India Limited. The fund is managed by the Employees’ Provident Fund Organisation (EPFO).

Who is eligible to join the OIEPF?

All regular employees of Oil India Limited are eligible to join the OIEPF.

How much do I need to contribute to the OIEPF?

Employees contribute 12% of their basic salary and dearness allowance to the OIEPF. The employer also contributes 12% of the employee’s basic salary and dearness allowance to the OIEPF.

How do I make a contribution to the OIEPF?

You can make a contribution to the OIEPF online or at any EPFO office. If you make a contribution online, you will need to provide your UAN and password. If you make a contribution at an EPFO office, you will need to provide your PAN card and Aadhaar card.