GST Puducherry Commercial Taxes Department : Online Issue of Form-F

Organization : Commercial Taxes Department Puducherry

Facility : Online Issue of Form ‘F’

Login here : https://vat.py.gov.in/e-returns/login.aspx?ReturnUrl=/e-returns/default.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

GST Puducherry Issue F-Form Online

** visit the Commercial Taxes Department’s official web-site gst.puducherry.gov.in. Click ‘Online Services’ link button and login to your account.

Related / Similar Service :

GST Puducherry Online Issue of Form C

Form-F can be downloaded online using P VAT- Online Services. Follow the below steps to download Form-F. Go to P VAT tab available in the home page.

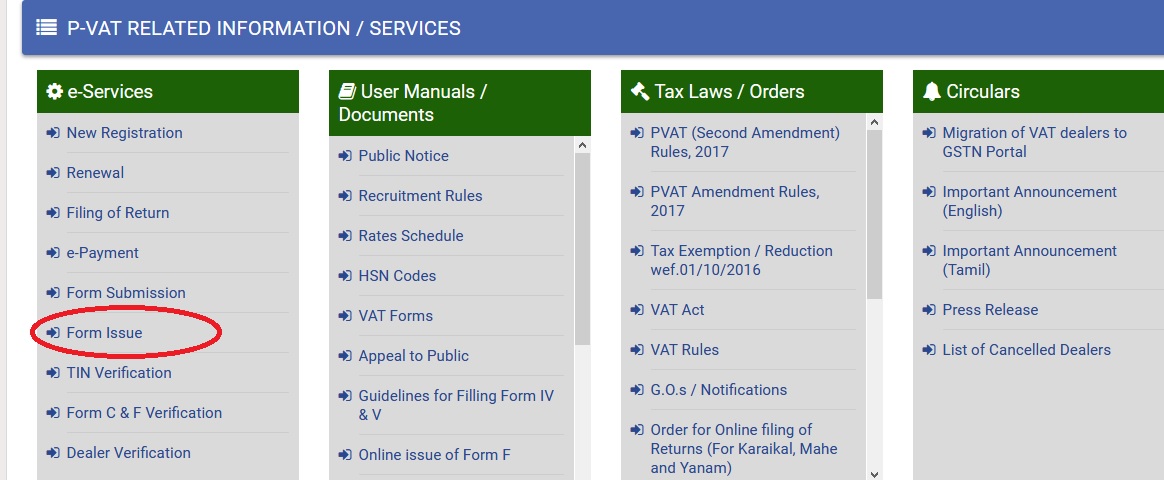

Click Form Issue link under e-Services tab. You will be redirecting to the website of the Commercial Taxes Department, UT of Puducherry.

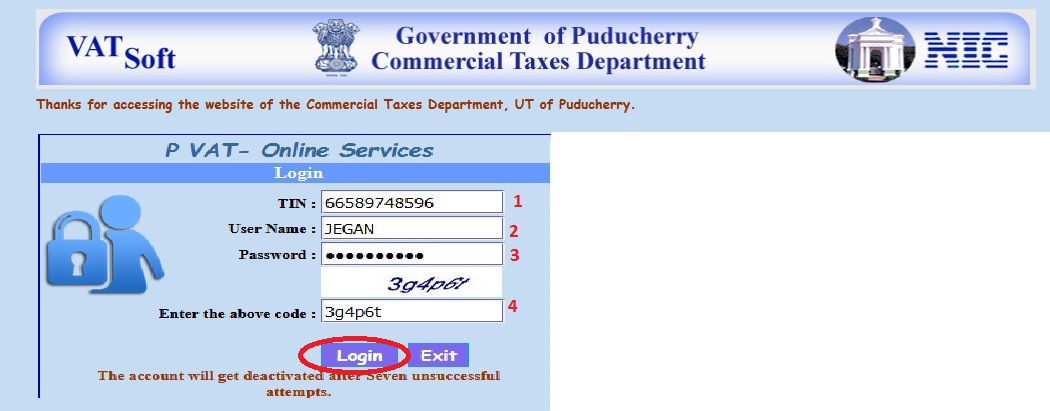

Login using all the credentials required.

Step 1 : Enter TIN Number

Step 2 : Enter User Name

Step 3 : Enter Password

Step 4 : Enter the Code

Step 5 : Click Login Button.

Important Message :

1. Captcha (entering image displayed) for login is made compulsory

2. Captcha is case sensitive

3. The account will get deactivated after Seven unsuccessful attempts.

4. Thereafter you have to contact the Assessing Officer for resetting the Username and Password

5. Kindly ensure that Java Script Enabled browser is used.

6. For availing hassle free service use of IE 6.0 and above browser is recommended.

Then select the ‘F-Form’ option under Online Issue of Forms menu.then You complete the procedure.

Upload Requirements For F-Form

** Also the dealer has the option to ‘upload XML file’ containing details of Transferor’s and goods transferred from other states. (Name of the uploading file should be TIN of the Transferor (i.e. other state dealer) Name of the Form and followed by the return period. (Ex : 33000448456-F-201004.xml)

** Dealer can also update or delete the entry before submission. Dealer can see the status of his request by clicking the view status option available the F Form menu

** If the Status is Approved, user can take printout of the F-Form by selecting ‘Print Forms’ in the F-Form menu under the online issue of forms.

FAQ On GST Puducherry

Here are some frequently asked questions (FAQ) about GST (Goods and Services Tax) in Puducherry:

What is GST in Puducherry?

GST is a single, indirect tax levied on the supply of goods and services across India. It is governed by the GST Council, which includes representatives from the Central and State governments.

Who needs to register for GST in Puducherry?

Any business whose turnover exceeds Rs. 20 lakhs (Rs. 10 lakhs for Northeastern and hill states) in a financial year must register for GST. Additionally, businesses engaged in inter-state supply of goods or services, or those required to pay tax under reverse charge, must also register for GST.

How do I register for GST in Puducherry?

You can register for GST online by visiting the GST portal and filling out the registration form. You will need to provide your business details, bank account details, and other relevant information. Once your application is approved, you will receive a GSTIN (Goods and Services Tax Identification Number).

How is GST calculated in Puducherry?

GST is calculated as a percentage of the transaction value, based on the applicable GST rate. There are four GST rates in India – 5%, 12%, 18%, and 28%.