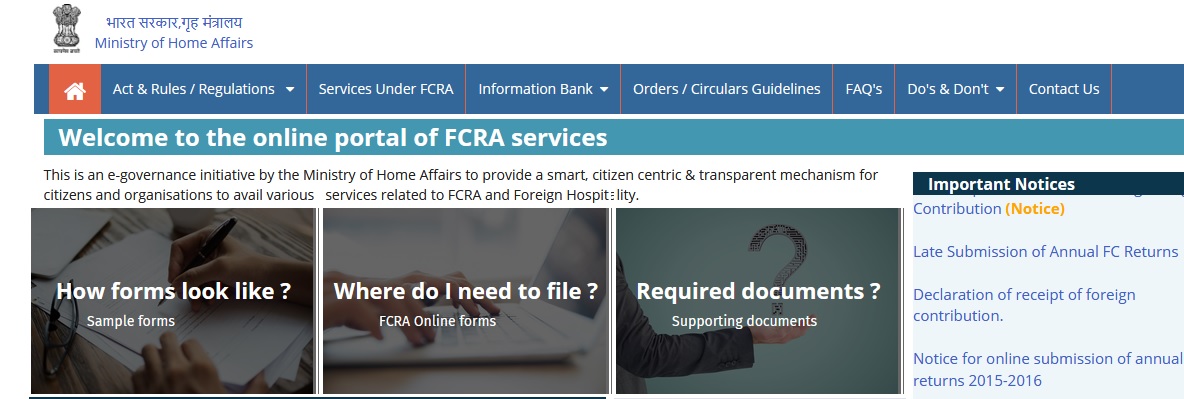

fcraonline.nic.in e-Filing of FCRA Annual Returns : Ministry of Home Affairs

Organization : Ministry of Home Affairs

Facility :e-Filing of FCRA Annual Returns

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page : https://fcraonline.nic.in/home/index.aspx

FCRA Online Filing of Annual Account in FC-6 Form

** For online filing of annual accounts, user ID is required to be created by the user through online registration.

Related : Ministry of Home Affairs Apply Online Grant FCRA Hospitality Registration : www.statusin.in/1441.html

** After successful registration, applicant/user can login to the ‘FCRA Online Services’ and select the option for the type of application to be filed, and click ‘Login’. For online filing and submitting Annual Account of Foreign Contribution (FC-6 Form), ‘FC-6 Returns’ may be selected.

** After the successful login, registration number, State and District may be filled in appropriate columns in the ‘FC-6 Returns Login’.

** The FC-6 form has been divided in three parts to facilitate online submission of account of foreign contribution for the year.

** Start with Click at ‘FC-Part-1’ of the menu item and fill the amount details. Click ‘Save Data’ after filling the amounts.

** For updating the above filled-in amount click at ‘FC-Part-1’ of the menu item again and modify the amount as desired followed by clicking at ‘Update’.

Download FC-6 Form : https://www.statusin.in/uploads/4619-FCform6.pdf

** Click at ‘FC-Part-2’ of the menu item to fill-in the details of the purposes for which foreign contribution has been received and utilized during the year. The amount of interest earned on the foreign contribution during the year should be shown under the purpose Activities other than those mentioned above against As second/subsequent recipient . After entering amount for each purpose(s), click ‘Save data’.

** If the total amount of foreign contribution received during the year is ‘zero’ and interest earned on the foreign contribution is also ‘zero’, then click at ‘Final Submit’ of the menu item and click at ‘Final Submit’ button to submit the returns to the Ministry (you are not required to fill details in ‘FC-Part-3’ of the menu item).

** Click at ‘FC-Part-3’ to fill details of donor wise receipts of foreign contribution during the year.

The steps to fill the details are as under :

** Select donor type i.e. institutional donor or individual donor.

** Select country of the donor.

** Select name of the donor from the list. If the same is not available in the list, click ‘Add new donor’ button and new window gets opened. Fill the details of donor, i.e. Name and Address. After adding donor details, click ‘Save Data’ and click ‘Back to Part-3’ to continue entering the amount details. You can go back without adding new donor by clicking ‘Back to Part-3’.

** Now select the name of the donor from the list.

** Select the purpose of the foreign receipt.

** Enter the date of receipt of amount (DD/MM/YYYY).

** Enter the amount of receipt.

** Click ‘Save Data’.

Note :

Please see that the amount of interest earned on the foreign contribution during the year is properly shown in ‘As second/subsequent recipient’ in ‘FC-Part-2’ and as amount received from Country – India and Donor – Others in ‘FC-Part-3’.

Some Important Information From Comments

Error / Problem:

1. I am trying to upload the necessary documents to fill FCRA Return for the block year 2015-16; but documents not uploaded nor I can move ‘Next’ page. Please suggest what to do next. Already, I have complained to FCRA department over e-mail and hard copies.

2. I have already filed FC 3 annual return, but I have got notice to file FC 4 instead of FC 3. I am trying to file FC 4 annual return for the year 2014-15 in the FCRA website but, I can’t find any FC 4 option to file the return in the site.

3. I am trying to file FC6 annual return for the year on 2014-15. Till date, we have not filed FC-6 for the year 2014-15. The website open only FC4 annual return. How can I open and filing of FC 6 annual return? Kindly intimate the website.

FAQ On MHA FCRA

Here are some frequently asked questions (FAQ) about the Foreign Contribution (Regulation) Act, 2010 (FCRA) as administered by the Ministry of Home Affairs (MHA):

What is FCRA?

FCRA is a law that regulates the acceptance and use of foreign contribution by Indian entities. The Act was passed in 2010 to prevent the misuse of foreign funds for anti-national activities.

Who is covered by FCRA?

FCRA applies to all Indian entities, including individuals, companies, trusts, and societies. However, there are certain exemptions, such as foreign diplomatic missions, international organizations, and government entities.

What is a foreign contribution?

A foreign contribution is any contribution, donation, or grant received by an Indian entity from a foreign source. Foreign sources include individuals, organizations, and governments outside India.

What are the requirements for receiving foreign contributions?

Indian entities that want to receive foreign contributions must first obtain a certificate of registration from the MHA. To obtain a certificate of registration, entities must meet certain requirements, such as being registered under the Societies Registration Act, 1860 or the Companies Act, 2013.

I want to know our status of FCRA registration of Khandual shelter bearing FCRA Number 104830146 of Odisha.

I have sent our organisation annual returns f/y2010-2011 & 2012 -2013 to the mha (hard copies )by the speed post. We have receipt. But not included fc6 return l in your office list. Can we again send the same copies to the mha or can we file now form fc6?

I am trying to upload the necessary documents to fill FCRA Return for the block year 2015-16; but documents not uploaded nor I can move ‘Next’ page. Please suggest what to do next. Already I have complained to FCRA dept over e-mail and hard copies.

i am trying to file form FC-4 for the year 2014-15 online but it is showing as access denied. Please help

I have submitted FC-4 successfully. But after filling I found there are some errors in the figure. Can I revise it? How can I?

I have already filed FC 3 annual return, but i have got notice to file FC 4 instead of FC 3. I am trying to file FC 4 annual return for the year 2014-15 in the FCRA website but I cant find any FC 4 option to file the return in the site.

I am trying to file FC6 annual return for the year on 2014-15. Till date we have not filed FC-6 for the year 2014-15. The website open only FC4 annual return. How can i open and filing of FC 6 annual return? Kindly intimate the website.

I HAVE FILED ANNUAL RETURN FORM-6 BUT DOCUMENTS ARE NOT UPLOADED. WHEN WE ARE GOING TO UPLOAD THE RETURN?

WE ARE FACING PROBLEM. WHETHER FILING OF FORM -6 IS NOW NOT NECESSARY?

I am trying to file for the 2014-15 online return but how can I file Fc-6 part 2?

Click at ‘FC-Part-2’ of the menu item to fill-in the details of the purposes for which foreign contribution has been received and utilized during the year. The amount of interest earned on the foreign contribution during the year should be shown under the purpose Activities other than those mentioned above against As second/subsequent recipient . After entering amount for each purpose(s), click ‘Save data’.

I am trying to file return for the 2013-14 online but block year is fixed as 2014-15. How can I file return for block year 2013-14?

Filing of FC-6 was closed by the FCRA in their website. Till date we have not filed FC-6 for the year 2013-14. What should we do now? How can we file form FC-6? Please guide us.

Registration link is opening.