Oriental Bank of Commerce : Account Balance Check Via Mobile

Organization : Oriental Bank of Commerce

Facility : Account Balance Check Via Mobile

Home Page : https://www.pnbindia.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Check OBC Account Balance Through Internet Banking

Any Customer of Bank having Java enabled Mobile phone irrespective of the Mobile Service Provider viz. Airtel, MTNL, Vodaphone, VSNL, Idea, Reliance etc., can register for “OBCmPAY” and avail following services- ;

Related / Similar Service :

OBC Check Account Balance Online

You are required to login to the Oriental Bank of Commerce internet banking to check the balance online. Open the internet banking page provided above. Click the link Internet Banking to go to the banking website.

Click the link Retail User Login available in the left of the net banking website.

Login with your user id to check the balance online. Enter your User-id and Sign-on Password to authenticate yourself. Here you can also use the Virtual keyboard utility to enter the User.id or password.

It is mandatory for you to change the passwords (PINs) allotted to you. You need to first type in the Password given in the mailer to do so.

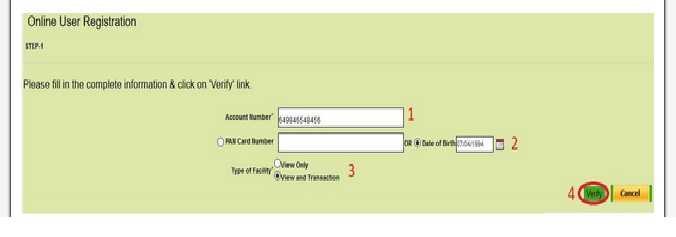

You can register for Internet Banking by following the below procedure. Click Register Now button as shown below.

You can register for Internet Banking by following the below procedure. Click Register Now button as shown below.

Step 1 : Enter Your Account Number (Eg : 4549845498)

Step 2 : Enter Your PAN Card Number or Date of Birth (Eg : 14/12/2000)

Step 3 : Select the Type of Facility as View Only or View and Transaction

Step 4 : Click Verify Button

Check OBC Account Balance Through Mobile Banking

Registration through Branches :

Customers are required to submit duly filled application form for enabling Mobile Banking services. The application is available at Branches and it can also be downloaded from Bank’s Web Site “www.obcindia.co.in (under Customer Service >> Forms Warehouse).

Registration through ATMs of Bank :

Customers can alternatively visit any ATM of Oriental Bank of Commerce OBC and register themselves using their debit card. The Process of registering for Mobile Banking through ATM is given hereunder-

The application can be downloaded by either of the following two modes :-

** Using Data Cable

** Using GPRS (Mobile Internet)

Using Data Cable :

The Mobile Banking application can be transferred to the Mobile Phone using the Datacable after downloading it on the Personal Computer or Laptop from the WebSite at the following url and putting in the mobile phone number and Activation code (for first time) and mPIN ( subsequently, if required) –

Using GPRS :

Alternatively, application can also be downloaded using the GPRS, to mobile phone itself from the link provided to customer in the SMS after their successful registration through ATM or Branch.

Activation of Application :

While login first time to the mobile banking application downloaded to Mobile phone through any of the above methods, customers are required to enter their activation code (received either through the SMS confirming registration or on the ATM slip, if registered through ATM) and change their mPIN.

Oriental Bank of Commerce Mobile Banking Services

Oriental Bank of Commerce Services are

Balance Enquiry :

** Select Balance Enquiry.

** Enter your 4 digit mPin.

** Get balance of account on screen

Mini Statement :

** Select Mini statement.

** Enter your 4 digit mPin.

** Get mini statement containing last 9 transactions of your account on screen .

Know Your Bank Note :

Banknotes with new numbering pattern and special features for the visually impaired (images of bank notes)

Salient Features

1. In the new numbering pattern, the numerals in both the number panels of these denominations ascend in size from left to right, while the first three alphanumeric characters (prefix) remain constant in size. Printing the numerals in ascending size is a visible security feature in the banknotes.

2. Special features for the visually impaired have been introduced in order to make it easier for them to identify banknotes, the size of the Identification Mark in ₹ 100, ₹ 500 & ₹ 1000 denominations has been increased by 50% and angular bleed lines – 4 lines in 2 blocks in ₹ 100, 5 lines in 3 blocks in ₹ 500 and 6 lines in 4 blocks in ₹1000 denominations, have been introduced.

3. The design of banknotes of ₹ 100, ₹ 500 and ₹ 1000 denomination is similar in all other respects to the current design of banknotes in Mahatma Gandhi Series 2005. All the banknotes in these denominations issued by the Reserve Bank in the past will continue to be legal tender.

About Us :

** Provide quality, innovative services with state-of-the-art technology in line with customer expectations.

** Enhance employees’ professional skills and strengthen cohesiveness.

** Create wealth for customers and other stakeholders.

Contact Us :

Oriental Bank of Commerce,

Corporate Office

Plot No. 5, Institutional Area

Sector-32, Gurgaon – 12200

FAQ On OBC Mobile Banking

OBC (Oriental Bank of Commerce) is a public sector bank in India that offers mobile banking services to its customers. Here are some frequently asked questions (FAQ) about OBC mobile banking:

Q: What is OBC mobile banking?

A: OBC mobile banking is a service provided by the Oriental Bank of Commerce that allows customers to access their bank accounts using their mobile phones.

Q: What are the features of OBC mobile banking?

A: The features of OBC mobile banking include checking account balance, transferring funds, paying bills, recharging mobile phones, opening fixed deposits, and viewing transaction history.

Q: How can I register for OBC mobile banking?

A: To register for OBC mobile banking, you need to download the OBC mPAY app from the Google Play Store or Apple App Store and follow the registration process. You can also register by visiting the OBC branch and submitting the mobile banking registration form.

Q: What are the requirements for OBC mobile banking registration?

A: To register for OBC mobile banking, you need to have an active account with the Oriental Bank of Commerce and a registered mobile number with the bank.

My account number is 11192010002980. Please check my account balance.

My account number is 21042341000168. Please check my balance.

My account number is 00812192009055. Please check and tell my balance.

My a/c number is 00982121047716. What is my current a/c balance? I want to check my current a/c balance.

Let me know if you have internet banking account.

What is my Account balance? My account number is 04201011002014.

My account number is 17192191035654. Please send my account balance.

My a/c number is 03902121035039. What is my bank balance?

My A/c no is 14872181000475.

52622041025120 is my account number. What is my current a/c balance?

My a/c no is 14032281001745.

My account no is 19812191006079. What is my current a/c balance?

My a/c no. is 01122191003833.

What is my current a/c balance?

What is my bank balance?

I want to check my account.

Account no : 18482191003708

My A/c no is 011372191034420.

What is my current a/c balance?

My a/c no is 00692011036156. What is my a/c balance?

My account number is 01562121010607. What is my account balance?

My a/c no is 05052221005147.

I want to change my registered mobile number. How can I do?

A/C no. 06412010021340

Check my balance.

My a/c no is 02472121040933.

My a/c no is 02472121040933.

00722121025099.

Balance details

16412191017339 is my account number. What is my current a/c balance?

I want to check my current balance.

Where is my account password?

A/c 06632191005553

My number is 11782191028228.

My number is 03402010041150.

A/c no : 14892171027886

A/C NO : 15652121022878

A/c No : 16095015001317

husan bano 00132011010164

KM Geeta 12/2/1191

A/c No 12128010000040

A/c no. 09722191007712

My account number is 16592011001219. Please check my Balance.