Zerodha Broking : Apply For Zomato IPO Online

Organisation : Zerodha Broking Limited

Facility Name : Apply for Zomato IPO at Zerodha

Dates : 14 Jul 2021 – 16 Jul 2021

Applicable State/UT : All Over India

Website : https://zerodha.com/ipo/285107/zomato

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Zerodha Zomato IPO

India’s biggest food delivery company is going public.

Date : 14 Jul 2021 – 16 Jul 2021

Price range : 72 – 76

Minimum order quantity : 195

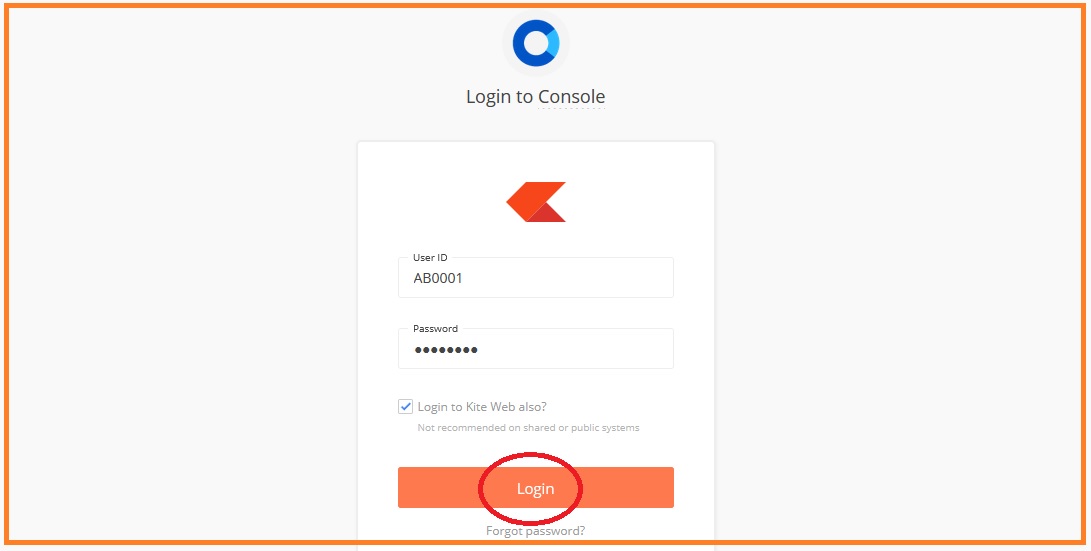

How To Apply For Zomato IPO At Zerodha?

Step-1 : Go to the link https://console.zerodha.com/portfolio/ipo

Step-2 : Enter User ID and Password

Step-3 : Login to apply online

Don’t have an account? Signup now!

How To Open Zerodha Account?

Step-1 : Go to the link https://zerodha.com/open-account?

Step-2: Enter your Mobile Number

Step-3 : Verify OTP and Continue

Step-4 : After registration, Login to apply online.

Zomato recently filed its DRHP with SEBI

As Zomato heads toward launching its IPO, you may want to check some of its financials. Here is a summary of its recent financials picked from the DRHP:

| Particulars | Nine-month period ended Dec 2020 | Fiscal 2020 | Fiscal 2019 | Fiscal 2018 |

|---|---|---|---|---|

| Equity Share capital (in Rs. crores) | 0.031 | 0.03 | 0.03 | 0.03 |

| Net worth (Rs. crores) | 6,330.07 | 2,083.10 | 2,596.75 | 1,207.85 |

| Revenue from operations (Rs. crores) | 1,301.34 | 2,604.73 | 1,312.58 | 466.02 |

| Loss for the period/year (Rs. crores) | (682.19) | (2,385.60) | (1,010.23) | (106.91) |

| Basic earnings per share | (8,496.65) | (34,121.10) | (16,027.31) | (2,243.76) |

| Diluted earnings per share | (8,496.65) | (34,121.10) | (16,027.31) | (2,243.76) |

| Net asset value per equity share | 78,863.30 | 30,026.70 | 43,130.82 | 26,140.47 |

Can a loss-making firm launch an IPO?

Yes, a loss-making company can launch an IPO. However, the portion of the IPO reserved for the retail category changes from the usual 35% to 10% of the overall issue size. We’ve covered the details on this here.

Issue size

One of the existing shareholders of Zomato is a listed company – Naukri. It will be selling Rs. 375 crores of shares in the IPO. Zomato is planning to raise 9000 crores in form of a fresh issue of shares. This will make the IPO a Rs. 9,375 crore issue. In terms of the issue size, Zomato will be the largest IPO in India since the beginning of 2021.

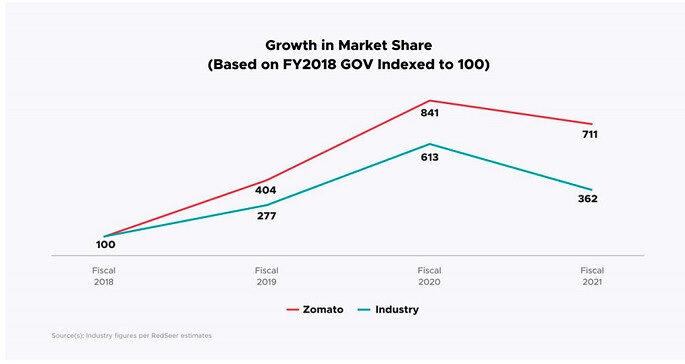

Zomato vs Food Delivery Industry

Zomato seems to have grown 7x since 2018 compared to the 3.6x growth of the overall food delivery industry:

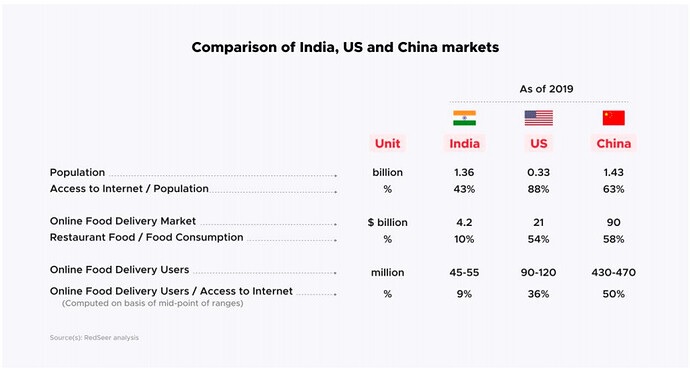

Growth Potential

Zomato has been growing at a very fast pace but how much headroom does the company have? This table comparing the total addressable markets in India, US & China may give us some indication:

About Zerodha:

Zerodha Broking Ltd.: Member of NSE & BSE – SEBI Registration no.: INZ000031633 CDSL: Depository services through Zerodha Broking Ltd. – SEBI Registration no.: IN-DP-431-2019 Commodity Trading through Zerodha Commodities Pvt. Ltd. MCX: 46025 – SEBI Registration no.: INZ000038238 Registered Address: Zerodha Broking Ltd., #153/154, 4th Cross, Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bengaluru – 560078, Karnataka, India.

For any complaints pertaining to securities broking please write to complaints@zerodha.com, for DP related to dp@zerodha.com. Please ensure you carefully read the Risk Disclosure Document as prescribed by SEBI | ICF