tdscpc.gov.in TRACES TDS/TCS Correction Statement : Income Tax

Organisation : Centralized Processing Cell (TDS), Directorate of Income Tax (Systems), Central Board of Direct Taxes (CBDT), Department of Revenue, Ministry of Finance, Government of India.

Facility Name : TDS/TCS Correction Statement

Website : https://incometaxindia.gov.in/Pages/tax-services/tds-correction-statement.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

TRACES TDS/TCS Correction Statement

TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration. It enables viewing of challan status, downloading of Conso File, Justification Report and Form 16 / 16A as well as viewing of annual tax credit statements (Form 26AS).

TDS/TCS Correction Statement Procedure

Returns/statements relating to TDS/ TCS should be complete and correct. However, Income Tax Department has provided a procedure for correction of any mistake in the original returns/statements by submitting ‘correction returns/statements’.

Step – I:

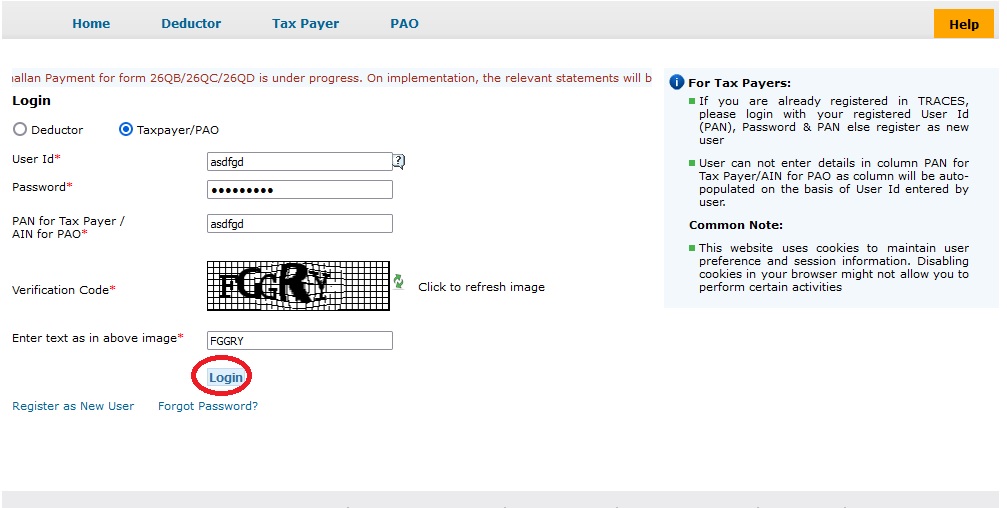

To prepare correction statement, first download Consolidated TDS/TCS file after login at TRACES login at www.tdscpc.gov.in

Step – II:

Import consolidated TDS/TCS file and Prepare the Correction statement as per the applicable Category;

Step – III:

Furnish only those records which require Corrections;

Step – IV:

Fill provisional receipt number of regular and previous correction statements

Step – V:

After preparation of correction statement, the same is to be validated through File Validation Utility (FVU).

Step – VI:

Furnish validated (.fvu) correction statement with a TIN-FC or directly through NSDL web-site (www.tin-nsdl.com).

Corrections:

26QB Correction functionality has been enabled on Tax Payer login -> 26QB -> Online Correction. Buyer of property can only submit request and file correction. Please refer the checklist displayed before filing correction for details. Default Summary and Justification Report will also be available in 26QB tab for Buyer’s login.

When there is any CPC generated demand in 26QB the same should be paid through demand payment link on TIN-NSDL only. View more to know the Procedure for Payment of TDS demand on sale of Property.

Note:

This link is available on Quick links: TDS on sale of property –> procedure for payment of TDS demand on sale of property –>View more to know the Procedure for Payment of TDS demand on sale of Property —- this link will open up a word document.

Caution:

** TRACES never asks for fee of any kind for registration on portal or for availing any electronic services delivered through its portal www.tdscpc.gov.in

** The Income Tax Department NEVER asks for your PIN numbers, passwords or similar information for credit cards, banks or other financial accounts through e-mail

** The Income Tax Department appeals to Tax Payers NOT to respond to such fee requests and e-mails and NOT to share information relating to their credit card, bank and other financial accounts

** It is hereby informed that CPC TDS does not send and has not sent any communication or email stating automatic tax deduction from Deductors’ or Taxpayers’ respective bank account/ net banking accounts.

** In case you have received such email/ communication, you are requested to** ignore it.

Contact

TDS Centralized Processing Cell

Call : 18001030344/ +91 – 120 – 4814600

Email : contactus@tdscpc.gov.in