SBI Salary Account : State Bank of India

Organisation : SBI State Bank of India

Facility Name : Apply For Salary Account

Applicable For : Salaried Person

Applicable State/UT : All India

Website : https://bank.sbi/web/salary-account

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

SBI Salary Account

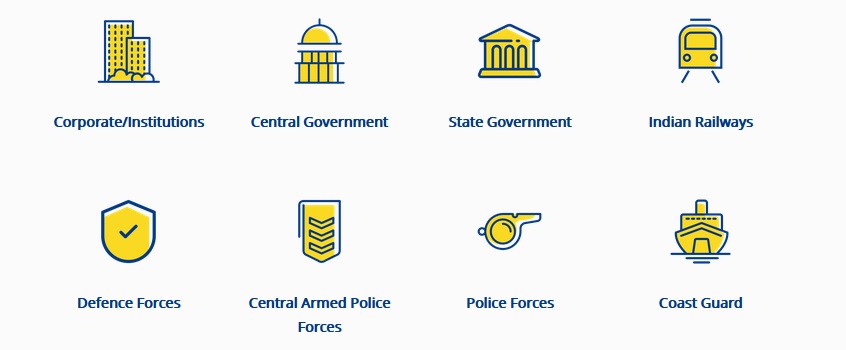

SBI brings to you an entire range of Salary Accounts, crafted to suit your needs. We offer special Salary Account Packages for varied sectors, such as Central Government, State Government, Defence Forces, Paramilitary Forces, Police Forces, Corporates/ Institutions etc.

Related / Similar Facility : PSB Alliance Doorstep Banking

These comprehensive packages provide a wide range of unique benefits and services, as well as seamless access to the most advanced and secure Net Banking and Mobile Banking services.

Account Benefits

Each Salary Package account offers unique benefits and services to the customers.

Here are a few benefits of our Salary Package Account:

** Zero Balance Account

** No Monthly Average Balance charges

** Employee Reimbursement Account

** Auto Sweep Facility

** Lifetime Free Debit Card with exclusive benefits

** Free unlimited transactions across any Banks’ ATMs

** Free Demand Draft

** Free Multi City Cheques

** Free NEFT/ RTGS

** Free SMS Alerts

** Complimentary Personal/ Air Accident Insurance

** Best Interest Rates on Personal Loans, Car Loans, Home Loans and Pension Loans

** Overdraft facility as per eligibility

** Concessions in Locker Charges as per eligibility

** Also comes with bundled SBI Credit Card

How To Open Salary Account?

A salaried person can approach SBI in any of the following ways:

1. Request a call back at Salary Account and our Sales team will contact you within 5 working days.

2. Walk into the nearest SBI Branch.

Request A Call Back Here : https://bank.sbi/web/home/csp-callback

Documents Required

The following documents are needed:

** Passport size photographs (2 nos.)

** Proof of Identity and Address as per standard account opening process

** Proof of Employment

** Latest Salary slip

Joint Accounts:

For joint accounts, the Proof of Identity & Proof of Address are required for both the applicant as well as the joint applicant(s).

FAQs

How do I get my account transferred from one State Bank branch to another?

Our Core Banking facility allows you to continue with the same account at all our Branches. However for transfer of an account, you would to need to submit an application/ request letter to your home branch or get your Account transferred through Internet Banking.

Can I continue to enjoy the Salary Account benefits if I change my job?

You may continue to draw your salary through Salary Package Account even in the case of change of employer. You would need to intimate your employer about your existing Bank details, so that the monthly salary credits are routed through the same account. You would also need to intimate your Bank branch for the required change in employer mapping with the Bank.

What happens to my existing Salary Package Account if there are no salary Credits to the Account?

In case, the monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under Salary Package will stand withdrawn and the account shall be treated as Normal Savings Account under our standard charge structure, and all charges shall be levied and applied as applicable to normal savings accounts.

What is Auto Sweep facility?

This is a facility to transfer your money to a fixed deposit account from Savings account to earn higher interest once your balance in the SB account reaches the threshold balance of Rs. 35000/-. If the balance in the account is not sufficient to honour a cheque/ ATM withdrawals, the system automatically pre closes the fixed deposit/ or part of it and credits the same to your SB account.

Can Overdraft facility be availed through Internet Banking?

Overdraft facility through Internet Banking is being offered only to pre-selected Diamond and Platinum variant Customers as on date.

What are the NEFT/ RTGS charges applicable for Salary Package customer?

NEFT/ RTGS services are free for Diamond & Platinum variant customers through all channels, whereas for Silver & Gold variant customers, the services are free through digital channels only.

Which Debit card is issued for Salary Package customers?

Debit Cards are issued free of cost to all Salary Package customers and annual maintenance charges are also waived. Issuance of Debit Card depends upon the variant of the Salary Account as under:

Platinum: International Platinum Debit Card with withdrawal limit of Rs. 1 lakh (or equivalent in foreign currency) per day

Diamond: International Gold Debit Card with withdrawal limit of Rs. 50,000/- (or equivalent in foreign currency) per day

Gold: International Gold Debit Card with withdrawal limit of Rs. 50,000/- (or equivalent in foreign currency) per day

Silver: Domestic Classic Debit Card with withdrawal limit of Rs. 20,000/- per day

Contact

For assistance, call on 1800 425 3800/1800 11 22 11 (Toll Free)/ 080 26599990 or write to us at citu@sbi.co.in