Bajaj Finserv Check Your CIBIL Score : bajajfinserv.in

Organisation : Bajaj Finserv

Facility Name : Check your CIBIL score

Website : https://www.bajajfinserv.in/check-free-cibil-score#;

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is CIBIL score?

CIBIL score is a three-digit number, ranging from 300 to 900, which acts as a measure of your credit worthiness. The score is derived after taking into consideration your credit history and details found in your CIBIL report, which is maintained as a record by Transunion CIBIL.

Your lender checks your CIBIL score to verify your ability to repay the loan before giving you approval. The closer you are to a credit score of 900, the better are your chances of getting easy approval on your loan. A score closer to 300 is considered poor.

How to check your CIBIL score?

You can check your CIBIL score for free right here on the Bajaj Finserv website (no consumer login or registration required).

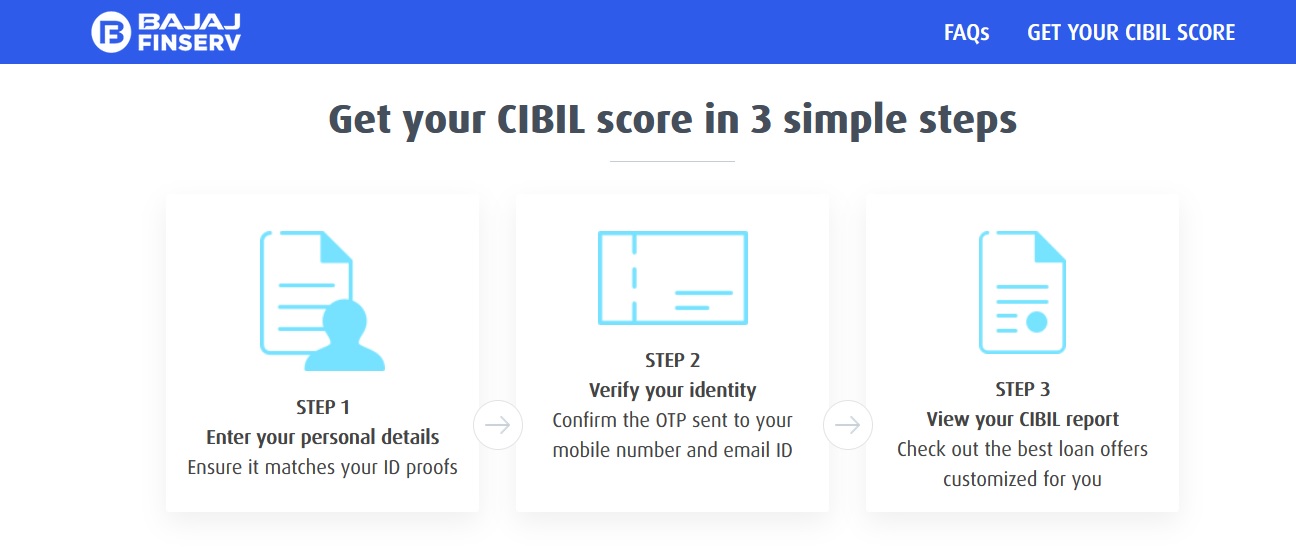

All you need to do is follow these three simple steps:

Step 1: Share some basic information about yourself

Step 2: Verify your identity by confirming the OTP sent to your mobile number and email ID

Step 3: Check your CIBIL score and report.

It’s free and it is really that easy. And the best part? Checking your CIBIL score on the Bajaj Finserv website has no impact on your credit score!

FAQs on CIBIL score

Frequently Asked Questions (FAQs) on CIBIL score

What is your CIBIL score and how does it work?

Your CIBIL score is a three-digit number, ranging from 300 to 900, which acts as a measure of your credit worthiness. The score is derived after taking into consideration your credit history and details found in your CIBIL report, which is maintained as a record by Transunion CIBIL.

Your lender checks your CIBIL score to verify your ability to repay the loan before giving you approval. The closer you are to a credit score of 900, the better are your chances of getting easy approval on your loan. A score closer to 300 is considered poor.

What is the minimum CIBIL score to get a personal loan?

For most lenders, the minimum CIBIL score required to approve a personal loan is 750. Having a higher CIBIL score boosts your prospects of getting a better deal on your personal loan. A score on the lower side, however, hurts your chances of availing finance.

How can you maintain a good CIBIL score?

Here are a few simple tips you can use to maintain a good CIBIL score:

** Pay your monthly instalments on time to build a good track record

** Manage your credit card carefully, set payment reminders and limit your usage

** Choose longer loan tenure carefully, try to make part-prepayments when you can

How to improve your CIBIL score?

If you have a poor CIBIL score, there is plenty you can do to improve it. Here are some handy tips:

** Avoid being a co-signer for a loan unless you are sure of not needing to borrow anytime soon

** Avoid acquiring too much debt

** Ensure you repay all your EMIs and credit card bills on time

** Use debt consolidation loans as and when necessary to manage your loans

** Be cautious when borrowing and always have a proper repayment plan in place

Why do lenders check your CIBIL score before approving your loan?

As you may be aware, your CIBIL score measures your creditworthiness. Your lender chooses to check your score for a several of reasons, including:

** To check your credit record and history

** To measure your capacity to repay the loan

** To review your credit balance and sense the risk level of your profile

** To identify if you meet the lender’s loan eligibility criteria

** To arrive at the loan amount and interest rate suitable for you