wbprofessiontax.gov.in : Pay West Bengal Profession Tax

Organisation : Directorate of Commercial Taxes, West Bengal

Facility Name : Pay Profession Tax (Profession Tax e-Payment)

Applicable State/UT : West Bengal

Website : https://wbprofessiontax.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Profession Tax?

Profession Tax is a tax levied on a person engaged in any profession, trade, calling and employment in West Bengal. The West Bengal State Legislature enacted the “West Bengal State Tax on Professions, Trades, Callings and Employments Act, 1979” in exercise of the power conferred by the Article 276 of the Constitution of India (under Entry No. 60 of the “State List” relating to taxes on professions, trades, callings and employments).

How To Pay West Bengal Profession Tax?

To Pay Profession Tax in West Bengal, Follow the below steps

Steps:

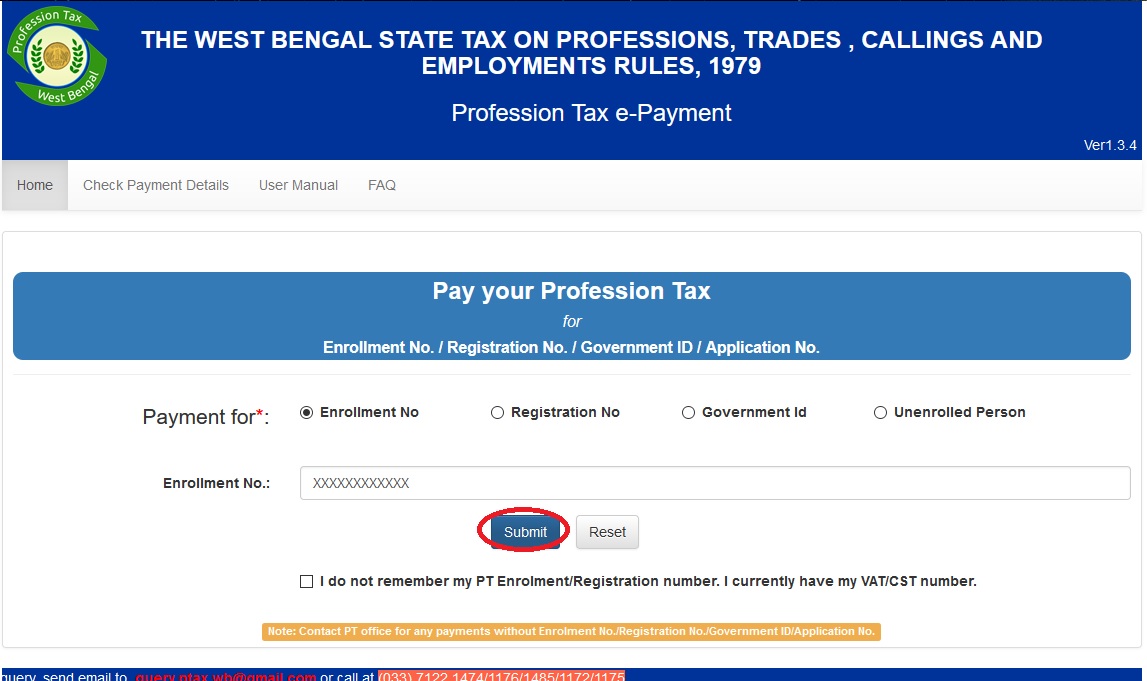

Go to the link https://egov.wbcomtax.gov.in/PT_ePayment/home

1.Using Profession Tax Enrolment Number(12-digit numeric):

1.Choose Enrolment Number

2.Provide your 12-digitPT Enrolment Number

3.Click Submit

2.Using Profession Tax Registration Number (12-digit numeric):

1.Choose Registration Number

2.Provide your 12-digit PT Registration Number

3.Click Submit

3.Using Profession Tax Government ID (12-digit numeric):

1.Choose Government ID

2.Provide your 12-digitGovernment ID Number

3.Click Submit

4.Using Application Number for new Profession Tax Enrolment (11-digit numeric):

1.Choose Unenrolled Person

2.Provide your 11-digitApplication Number

3.Click Submit

5.Using VAT Number (11-digit numeric):

1.Check do not remember my PT Enrolment / Registration number;I currently have my VAT / CST number if you do not have PT Enrolment / Registration Number

2.Provide your 11-digit VAT / CST Number

3.Click Submit

How To Check Status of West Bengal Profession Tax Payment?

To Check Status of West Bengal Profession Tax Payment, Follow the below steps

Steps:

1.Enrolment No / Registration No / Government ID / Application No.

2.Government Receipt No. (GRN)

3.GRN Date

4.Bank Name

5.Bank Reference Number (BRN)

6.BRN Date

7.Period of Payment

8.Amount Paid

9.Click Click Here to Generate TAX PAID CHALLANto download the GRIPS’s Challan.

10.Click Make Another Payment button to make another payment otherwise click Proceed to Complete Application if you’ve paid Profession Tax as Unenroled Person to complete your Application.

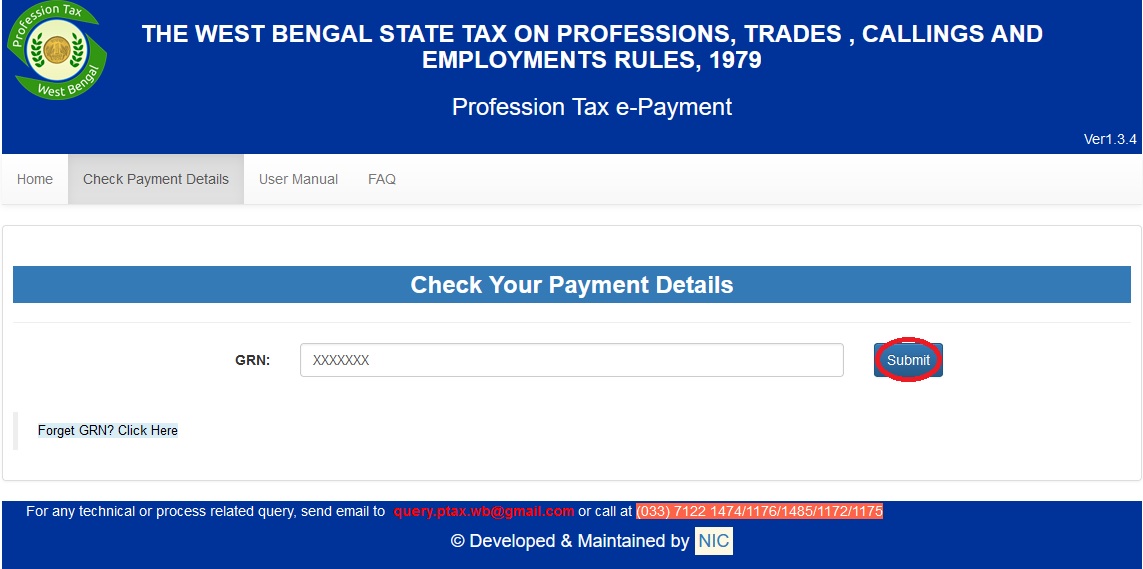

How To Check West Bengal Profession Tax Payment Details?

To Check West Bengal Profession Tax Payment Details, Follow the below steps

Steps:

1.Click on the Check Payment Details option at Menu-bar.

2.Provide your GRN.

3.Click Submit to get the GRIPS’s Challan.

4.Click Forget GRN? Click Here if you forget your GRN.

FAQ On West Bengal Profession Tax

Frequently Asked Questions (with Answers) FAQ on West Bengal Profession Tax e-Payment Module

Q-1: Who should pay tax through this PT E-Payment application module ?

Ans: Following classes of tax payers shall be able to pay profession Tax through this module:

A.Any person holding a valid 12-digit enrolment number

B.Any employer holding a valid 12-digit registration number

C.Any Government office holding a valid 12-digit Government ID number

D.Any person applied for enrolment and holding a valid 11-digit application number

Q-2: If I do not have any enrolment number yet, should I pay tax before application for enrolment ?

Ans. You have to apply first for new enrolment through www.wbcomtax.gov.in> Profession Tax > PT-Enrolment > First Time Applicant to obtain the 11-digit application number. Then you will be asked, by the system, to pay tax, as per information provided by you in the application

Q-3: If I have not updated my enrolment records yet, should I pay tax before application for updating enrolment ?

Ans. It is mandatory to get you old enrolment record (for the old 12-character alpha-numeric enrolment number) updated through www.wbcomtax.gov.in> Profession Tax > PT-Enrolment > Update old enrolment record. The payment required during such updation should be made as per the answer for question number 3. Successful completion of the application process shall enable you to obtain the 12-digit enrolment number and generating the demat enrolmentcertificate. From next occasion, you will have to make payment using the 12-digit enrolment number only.

West Bengal Profession Tax Helpdesk

PT Help Desk:

Call : (033)7122 1176/1485/1175/1172/1474

Email : query.ptax.wb AT gmail.com