Andhra Bank : Registration of Mobile Number for Mobile Banking Services

Organisation : Andhra Bank

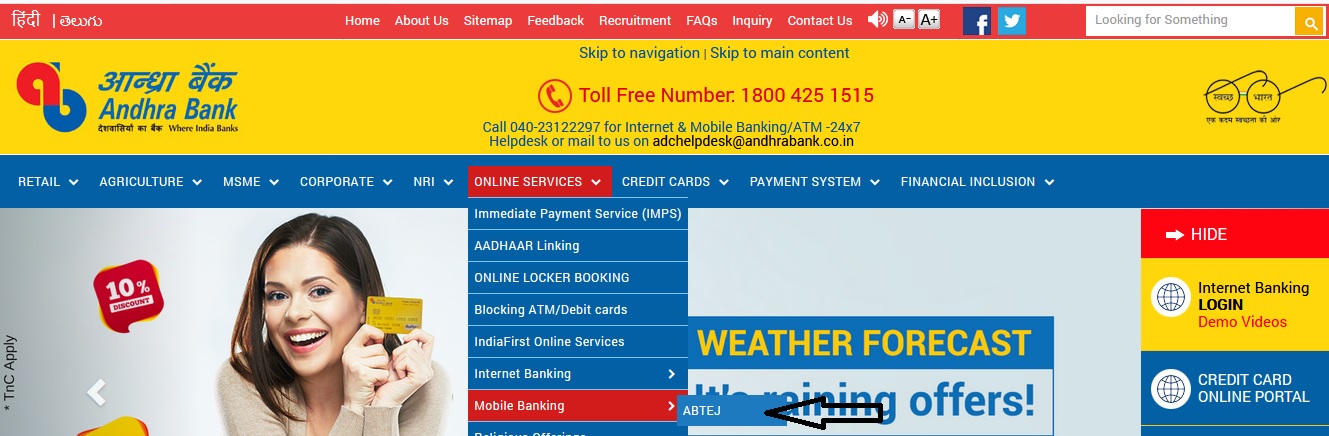

Facility : Registration of Mobile Number for Mobile Banking Services Online

Home Page : https://www.andhrabank.in/English/home.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Andhra Bank Mobile Banking Services Registration

Registration of Mobile Number for MOBILE BANKING SERVICES on Andhra Bank ATMs :

Basic requirements for availing AB-Mobile Banking Services are :

** Customer should have an Andhra Bank ATM/Debit Card.

** Customer should have registered his / her Mobile Number for SMS alerts.

Related / Similar Service :

Andhra Bank Check Account Balance Via SMS

** Customers having any basic Mobile handset can avail of the various facilities including intra/interbank fund transfer thru SMS Mode subject to a maximum of Rs.5000.00 per day.

** Customers having Mobile handset with JAVA and GPRS (General Packet Radio Service – enabled by the Service Provider) can download the Mobile Banking Application on their mobile and avail of the various facilities including intra/interbank fund transfer subject to a maximum of Rs.50,000.00 per day.

** Customers whose hand sets are not Java / GPRS enabled, can also avail of Mobile Banking thru SMS or USSD (Unstructured Supplementary Service Data).(Presently this facility available for BSNL/MTNL user only)

Only one time Registration at any Andhra Bank ATM (No Need to visit branch) :

** Customer has to visit any Andhra Bank ATM and register for Mobile Banking Services. . Click here for the procedure to be followed for registration at ATM. à should point to Registration of Mobile Number for MOBILE BANKING SERVICES on Andhra Bank ATMs in this page

** After successful registration, Customer receives an ATM receipt which contains mPIN (transaction password) and Application Password (login password).

** Customers having basic mobile phones can start using the said service thru SMS (Click here for details of various keywords). à should point to SMS Tags messages for Mobile Banking (m-Pay)

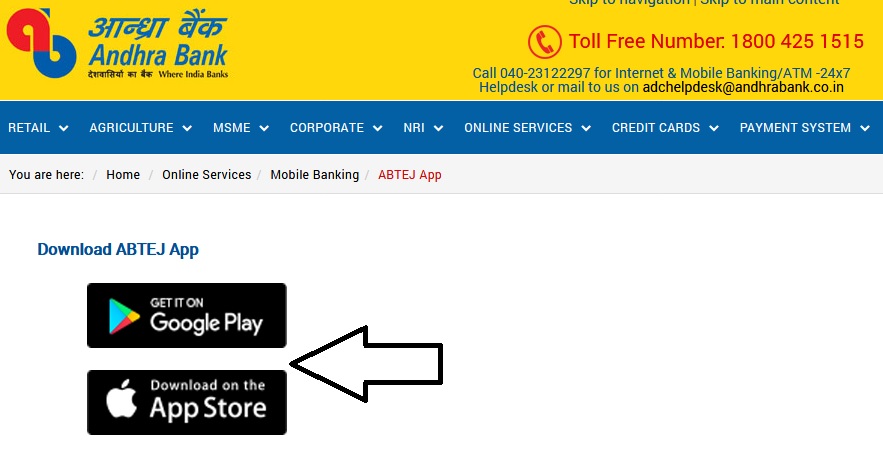

** Customers having JAVA and GPRS enabled mobile phones have to download the Mobile Banking Application through URL given thru SMS to the Mobile and save the same in their mobile.

Facilities/Options available under Andhra Bank Mobile Banking (for JAVA and GPRS Enabled mobiles) :

** Balance Enquiry

** Mini Statement

** Immediate Payment Service (IMPS)

Within Bank :

** Mobile to Mobile (Beneficiary should be our Mobile Banking Customer)

** Mobile to Account (Any account of Andhra Bank)

Andhra Bank mPay Application

Steps for using mPAY Application (for JAVA and GPRS Enabled mobiles) :

Invoke the “mPAY” application available in Applications/Games folder in mobile handset. Enter the Application Password to get the menu which will have the following options.

Balance Enquiry :

Customers can view the balance in the account which has been registered for Andhra Bank mPAY.

Mini Statement :

Last 9 transactions (both credit and debit legs) in the registered account can be viewed using this option.

IMPS :

Immediate Payment Service Bank has provided IMPS services to our customers through NPCI for remitting funds to and receiving funds from other bank account holders. Immediate Payment Service (IMPS) is an instant real-time interbank electronic fund transfer service through mobile phones. It facilitates customers to use mobile phone as a channel for remitting funds to accounts in other banks. The pre-requisite for fund transfer through IMPS is remitter has to register for Mobile Baking services.

Funds transfer through IMPS using MMID (P2P) – Person to Person

MMID Generation :

The MMID can be generated in two ways.

(i) Using mPAY Application : Mobile banking customers of the bank can generate the MMID using the mPAY application available in their handset through the option Immediate Payment Service à To Mobile Number àGenerate MMID

(ii) Using SMS Tags : For availing IMPS facility in case of non-mobile banking customers, their mobile number should be registered with the bank for SMS alerts. For getting the MMID, the customer needs to send SMS as <MMID> to 9223173924. This is required for receiving funds from other bank customers.

Note :

In case of Registered Mobile Banking customers, it is mandatory to change the MPIN first before sending the tag for MMID generation. The SMS tag format for MPIN change is provided in Annexure-2.

Procedure For Fund Transfer Through IMPS

(i) Using mPAY Application :

** Funds can be remitted to other bank accounts using the option Immediate Payment Serviceà to Mobile NumberàQuick IMPS. Customers can use this facility for one time remittance of funds. Customers have to enter the beneficiary mobile number, MMID and Amount to transfer funds.

** Customers can also register beneficiary details for repetitive payments by giving beneficiary Mobile number, MMID and Nick Name using the option Immediate Payment Service-To Mobile Numberà IMPS à Register IMPS.

** Payment : Customer has to select the beneficiary (to whom funds to be transferred) from the list which will appear in the screen.

** Beneficiary De-Registration : Customers can de-register the already added beneficiary using this option.

(ii) Using SMS Tags :

This facility can be used by the customer who has registered for Mobile Banking and not installed the application in handset. The syntax for remitting funds using SMS tags is :

IMPS<Space><Beneficiary Mobile Number><Space><Beneficiary MMID> <Space><Amount><Space><MPIN>

Where <Space> stands for one blank space.

Important Caution Note : Customers using Mobile Banking thru SMS Tags, should delete these Messages from Sent Items in their Mobiles immediately after sending the SMS as the same will contain their mPIN. They should keep their mPIN secret and should NOT save the same in their mobile.

Features of Andhra Bank Mobile Banking

Andhra Bank Mobile Banking is a convenient way to manage your finances from your smartphone. You can access your account information and perform transactions anytime, anywhere.

Here are some additional details about the features of Andhra Bank Mobile Banking:

** Check account balance: You can check your account balance at any time by logging in to the app.

** View recent transactions: You can view a list of your recent transactions by logging in to the app.

** Transfer funds: You can transfer funds to other Andhra Bank accounts or to accounts at other banks.

** Pay bills: You can pay your bills for utilities, credit cards, and other services.

** Check mini statement: You can view a summary of your recent transactions by logging in to the app.

** Set up alerts: You can set up alerts to be notified when your balance falls below a certain amount or when a transaction is made.

** Block your ATM card: If your ATM card is lost or stolen, you can block it using the app.

** Request a cheque book: You can request a new cheque book using the app.

** Apply for a loan: You can apply for a loan using the app.

** Invest in mutual funds: You can invest in mutual funds using the app.

** Buy insurance: You can buy insurance using the app.

How can I register my Mobile number wi9th my account? Please let me know.

Kindly register my mobile number in my account.

Please provide my account details. My account number is xxxxxxxxxx3773.

How can I register my account with my mobile number?

How can I register my mobile no in Andra bank?

How can I register mu mobile number?

How can I register my mobile number?

How can I register my mobile number with my Andhra Bank account for first time ?

I want to register my mobile number.

I want to register my mobile number.

I want to register my mobile number.

How can I change the mobile number of my account?

How can I change my phone no to get sms alerts?

I want to change my number. Is there any process through internet?

How can I register my account with my mobile number?

HOW TO CHANGE THE PHONE Number to get my sms alert of my account?

How to register my mobile number to account number?

How to register my account with my phone number?

How to change the phone number to get sms alerts of my account?

How to register my account with my phone number?

Have you gone through the above procedure mentioned in the post?

You need to visit your branch of the account provided. They will ask you to fill an application or write a letter to manager to change the mobile number. Once done it we will start getting alerts <24 hours(Once they update in the server).

How to change the phone number to get sms alerts of my account?

How to register my account with my mobile number?

GO TO YOUR(BANK) BRANCH OFFICE.