Reliance General Two Wheeler Insurance Renewal : reliancegeneral.co.in

Organisation : Reliance General Insurance

Facility Name : Two Wheeler Insurance Renewal

Website : https://www.reliancegeneral.co.in/Insurance/Motor-Insurance/Two-Wheeler-Insurance.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Two Wheeler Insurance?

A Two Wheeler (bike) insurance policy is a shield that protects you from financial loss, if your bike or scooter gets damaged due to road accidents, natural disasters, or theft. It also provides protection against liabilities arising due to damages to any third-party, be it property or person. Having a bike insurance plan ensures that your vehicle is replaced or repaired without putting a dent in your finances. According to the Motor Vehicle Act, 1988, it is mandatory to buy a third-party bike insurance policy.

How To Renew Reliance General Two Wheeler Insurance?

Want to renew your bike insurance policy? Your search ends here! Insure your bike with Reliance Two Wheeler Insurance policy that offers instant renewal with zero paperwork. Take a free quick quote using just your registered mobile number and ride worry-free with us. You are insured with a Personal Accident cover of Rs. 15 lacs. Terms and conditions apply. Not applicable on TVS models. The discount is applicable only on OD two wheeler insurance premium

Steps:

To Renew Reliance General Two Wheeler Insurance, follow the below steps

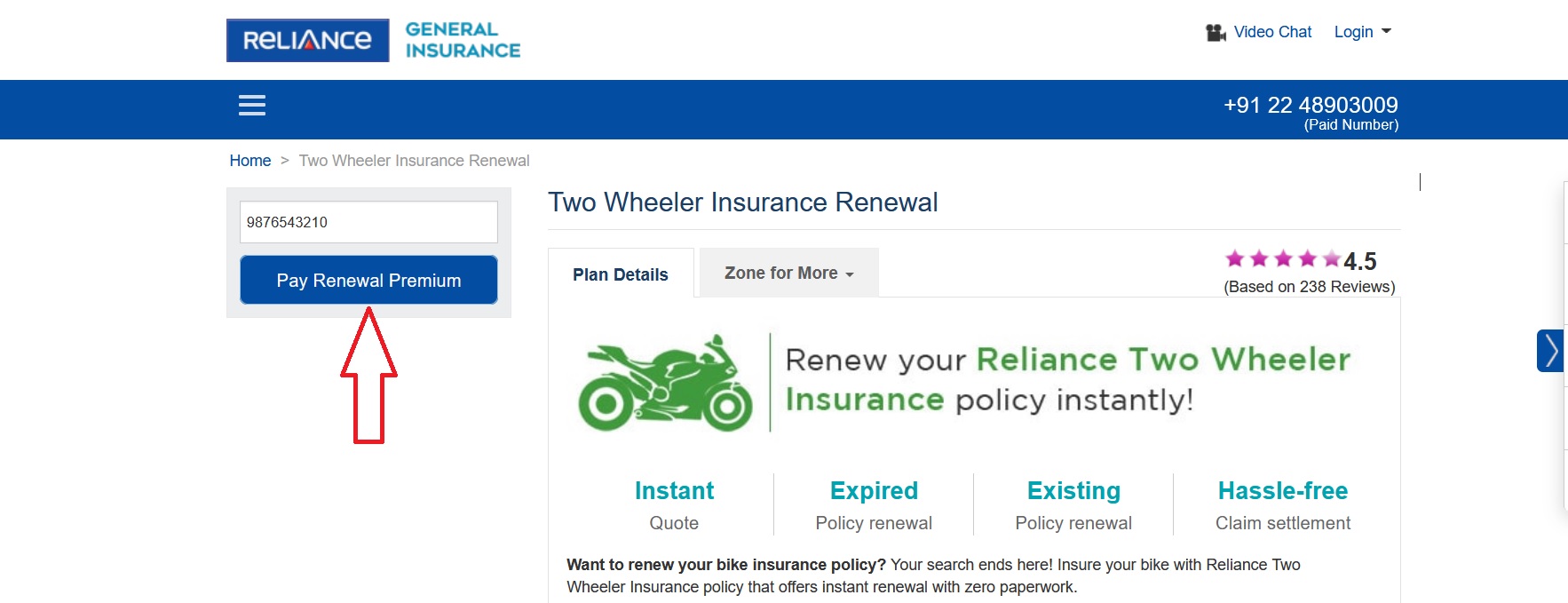

Step-1 : Go to the link https://www.reliancegeneral.co.in/Insurance/Motor-Insurance/Two-Wheeler-Insurance/Renewal.aspx

Step-2 : Enter your Policy Number (or) Mobile Number in the space provided

Step-3 : Click on the link “Pay Renewal Premium”

What Do We Cover?

We’ve tried our best to offer you a two wheeler insurance policy with comprehensive coverage insuring not only your vehicle but even the owner and any third party involved in a liability concerning the vehicle.

The policy covers damage or loss to the vehicle due to:

** Accident

** Fire

** Lightening

** Self-Ignition

** Explosion

** Theft

** Riot & Strikes and / or Malicious Acts

** Terrorism

** Earthquake

** Flood

** Cyclone

** Inundation

** Transit by Rail, Road, Air & Elevator

Apart from this, we recommend that you opt for a Third-Party Liability Cover for your bike, motorcycle or scooter because it is now compulsory to be taken as per the Motor Vehicles Act. It covers third-party property damage and provides liability for the third-party in case of injury or death. In other words, this motor insurance cover offers you protection if the other party is uninsured or underinsured.

What We Don’t Cover?

We’ve tried to cover you for most of the situations. However, there are still some exclusions.

They are:

** Normal wear-and-tear of the vehicle

** Mechanical and electrical breakdown

** Vehicle being used other than in accordance with the limitations as to use. For example, if you use your two-wheeler for remuneration purposes.

** Damage to / by person driving without a valid driving license

** Loss or damage caused while riding under the influence of alcohol or any other intoxicating substance

** Loss or damage due to depreciation of the vehicle’s value

** Consequential loss – if the original damage causes subsequent damage / loss, only the original damage will be covered.

** Compulsory deductibles – a fixed amount that gets deducted at the time of the claim.

FAQ On Reliance General Two Wheeler Insurance

Frequently Asked Questions FAQ On Reliance General Two Wheeler Insurance

Why do I need to insure my two wheeler?

Firstly, the Motor Vehicles Act 1988 makes to mandatory for all vehicle owners to have a valid insurance policy. That apart, you should get your vehicle insured because it saves you from any financial loss caused due to accidents, damage or theft of your vehicle. Additionally, insurance covers the safety of the co-passengers, someone else’s property and pedestrians too.

What are the types of two-wheeler insurance in India?

Well, there are two types of two-wheeler insurance: ‘Third-Party Insurance’ and ‘Comprehensive Insurance’. Third-party insurance protects you against losses, which occur due to bodily injury or death to a third party or any damage to that person’s property. It is mandatory, by law, to have third-party insurance.

Comprehensive insurance, on the other hand, protects you against losses caused to you, your co-passengers and your vehicle in addition to third-party coverage.

What are the benefits of buying two wheeler insurance online?

The biggest benefit an online platform offers you is the ability to make any purchase decision in a simple and convenient manner. Since most insurance companies now offer this service, it is very easy to compare costs and features of all the policies. You can even calculate your motorcycle policy premium online and get a clear picture of the kind of expenses involved in buying your insurance plan. Payments also become easier via Net Banking and Credit Card.

Apart from all this, online insurance portals offer facilities like renewal reminders and tracking, which make your life a lot easier.