Chola MS Renew Two Wheeler Insurance Policy Online : cholainsurance.com

Organisation : Chola MS

Facility Name : Renew Two Wheeler Insurance Policy Online

Website : https://www.cholainsurance.com/motor-insurance/two-wheeler-insurance

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Two-Wheeler insurance?

Two-Wheeler insurance or a Bike/Scooter insurance policy protects your bike against damages occurring as a consequence of accidents, fire, theft, natural disasters, etc. It also protects you against the costs of treatment for injuries sustained in the accident as well as third-party liability.

Chola MS offers simple policy purchase and renewal process, Hassle-free claims and customized IDV. Chola MS has wide network of 8500+ cashless garages.

How To Renew Chola MS Two Wheeler Insurance Policy Online?

When buying or renewing your bike insurance online, we at Chola MS provide three simple steps to get the work done with zero hassle. All you have to do is:

Steps:

Simple Steps To Renew Chola Ms Two Wheeler Insurance Policy Online

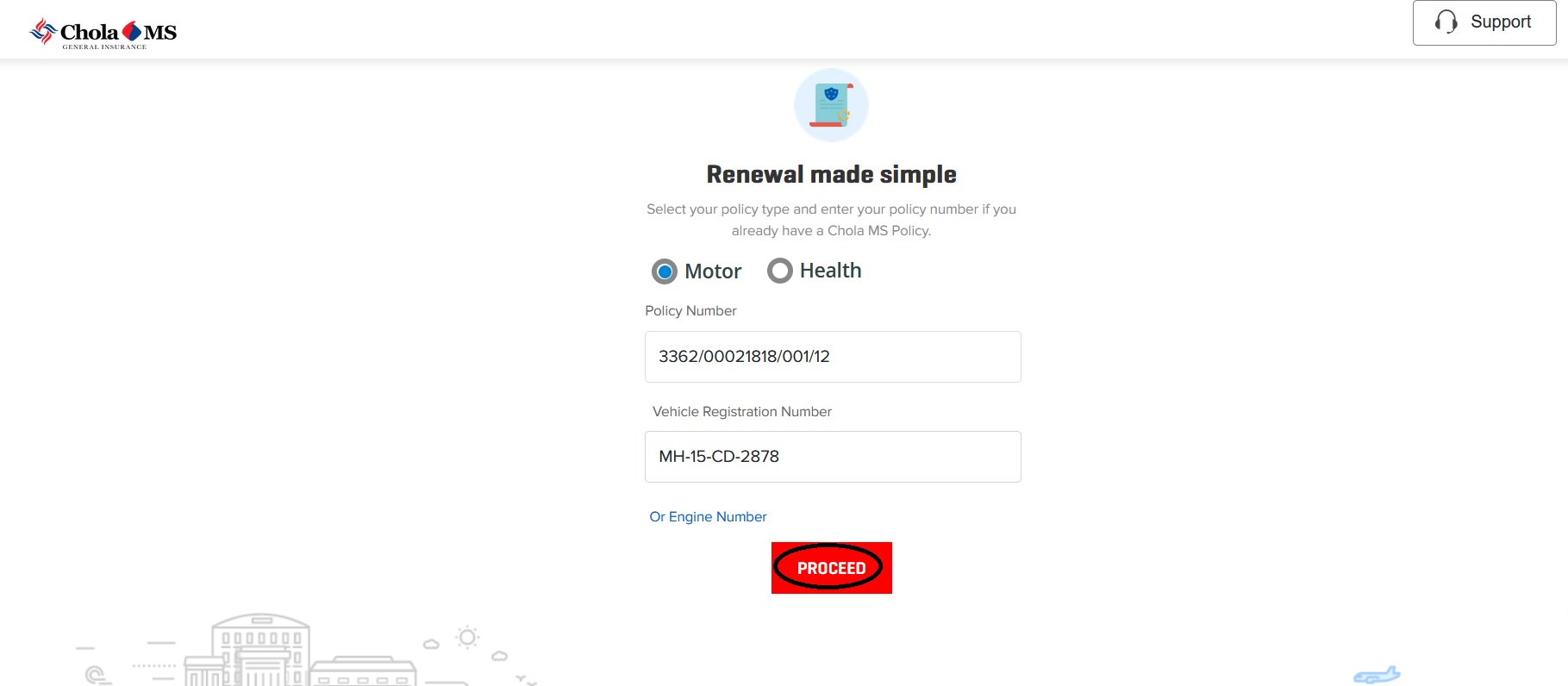

Step-1 : Go to the link https://infinity.cholainsurance.com/infinityrenewal/#/login

Step-2 : Enter the Policy Number

Step-3 : Enter the Vehicle Registration Number

Step-4 : Click on Proceed button

How To Choose The Right Two-Wheeler Insurance?

Now, we’ve already established that having two-wheeler vehicle insurance is a mandatory legal requirement, then why not choose the best one?Just like how you consider many different factors while purchasing the vehicle, the same should be done while choosing the best insurance policy.Let us help you and give you some insights into what exactly should be done while deciding on a new insurance policy.

Vehicle Insurance Coverage:

After going ahead with the research, the next comes your coverage. The main aim of purchasing an insurance policy is to minimize your monetary losses as much as you can during times of accidents or any unfortunate events. While conducting the research, you should also look forward to finding what kind of coverage you need.

The market has a lot of different types of insurance. Usually, an insurance provider will give you a list of different policies that you can choose from. These policies are determined by what they are offering, as well as their prices.

The company will tell you that the comprehensive insurance policy offers the best coverage since it provides everything. You should go for an insurance policy that provides third-party liability insurance, own damage, and desirable add-ons. Once you come to know about your needs, you’ll automatically know what type of policy you need.

Factors Other Than Premium:

Now that you know about your coverage, you can research various insurance providers and their vehicle insurance policies that offer coverage at lower prices. The prices depend on the providers mainly and also on what they offer. Researching about different providers and policies will help you know about the different prices and related coverage.

Some people say paying a low amount of premium makes up a good policy, while some believe in investing excess money to get the best insurance. Now, it’s for you to decide by doing a bit of research and knowing your needs.

Know Your Bike Properly:

Usually, your two-wheeler vehicle’s cubic capacity or cc decides the rate of insurance premium you will have to pay. Make sure that you know all your vehicle specifications before choosing an insurance policy. Normally, there’s a direct relationship between the cubic capacity and the premium prices.

Look for IDV:

IDV, or Insurance Declared Value, is technically your vehicle’s current market price/value. This price is the maximum amount that can be insured and is fixed while purchasing the insurance policy. This amount is also the one that would be paid; if so, it happens that you undergo a total loss or direct theft of your two-wheeler.

This is an important consideration because, over the years, your two-wheeler’s value will get lowered due to factors such as depreciation. This will also cause the IDV to get lowered, along with the premium.