incometax.gov.in Apply For e-PAN : Income Tax

Organisation : Income Tax Department

Facility Name : Apply For e-PAN

Applicable For : Residents of India

Website : https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is e-PAN?

e-PAN facility is for allotment of Instant PAN (on near-real time basis) for those applicants who possess a valid Aadhaar number. PAN is issued in PDF format to applicants, which is free of cost.

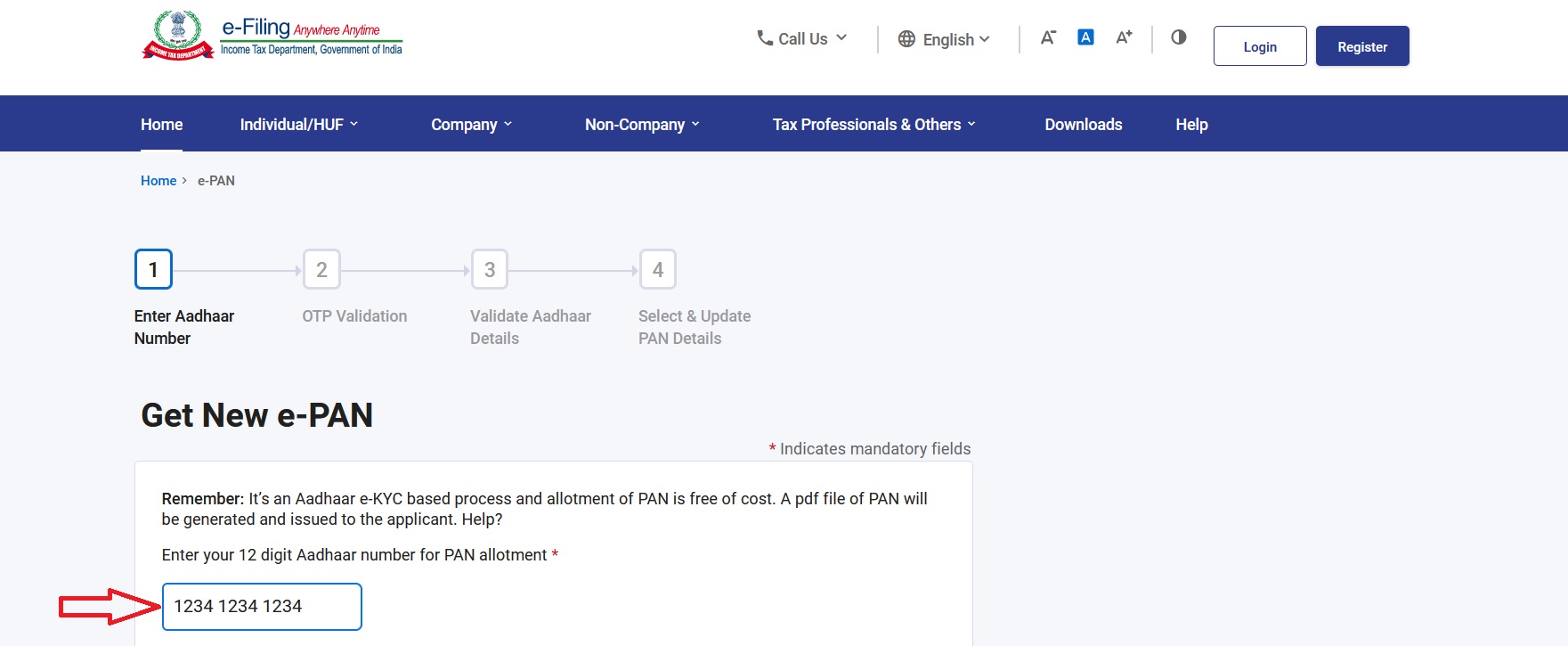

How To Apply For e-PAN?

To Apply For e-PAN, Follow the below steps

Step-1 : Go to the link https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan/getNewEpan

Step-2 : Enter the Aadhaar Number

Step-3 : Enter the OTP Validation

Step-4 : Enter the Validate Aadhaar Details

Step-5 : Select & Update PAN Details

Remember:

It’s an Aadhaar e-KYC based process and allotment of PAN is free of cost. A pdf file of PAN will be generated and issued to the applicant.

FAQ On Instant e-PAN

Frequently Asked Questions FAQ On Instant e-PAN

1. I have a PAN but I have lost it. Can I get a new e-PAN through Aadhaar?

No. This service can only be used if you do not have a PAN but have a valid Aadhaar and your KYC details are updated.

2. Are there any charges / fee for e-PAN?

No. It is completely free of cost.

3. Who can apply for Instant e-PAN through Aadhaar?

PAN applicants who have an Aadhaar number from UIDAI and have linked their mobile number with Aadhaar can apply for instant e-PAN.

4. What documents do I require for new e-PAN?

You only require a valid Aadhaar with updated KYC details and a valid mobile number linked with your Aadhaar.

5. Why do I need to generate an e-PAN?

It is mandatory to quote your Permanent Account Number (PAN) while filing your Income Tax Return. If you have not been allotted a PAN, you can generate your e-PAN with the help of your Aadhaar and a mobile number registered with your Aadhaar. Generating e-PAN is free of cost, online process and does not require you to fill up any forms.

6. The current status of my PAN allotment request status is updated as – PAN allotment request has failed. What should I do?

In case of failure of your e-PAN allotment, you may write to epan AT incometax.gov.in.

7. How will I know that my e-PAN generation request is submitted successfully?

A success message will be displayed along with an Acknowledgement ID. Please keep a note of the Acknowledgement ID for future reference. Additionally, you will receive a copy of the Acknowledgement ID on your mobile number registered with Aadhaar.

8. I am not able to update my Date of Birth in my e-PAN. What should I do?

If only year of birth is available in your Aadhaar, you will have to update the date of birth in your Aadhaar and try again.

9. Can foreign citizens apply for PAN through e-KYC mode?

No.

10. If my Aadhaar authentication gets rejected during e-KYC, what should I do?

Aadhaar authentication may get rejected due to using the wrong OTP. The problem can be resolved by entering the correct OTP. If it still gets rejected, you have to contact UIDAI.

11. Do I need to submit the physical copy of KYC application or proof of Aadhaar card?

No. This is an online process. No paperwork is required.

12. Do I need to upload a scanned photo, signature etc. for e-KYC?

No.

13. Do I need to do in-person verification (IPV)?

No. The process is completely online. You do not need to visit to any centre.

14. Will I get a physical PAN card?

No. You will be issued an e-PAN which is a valid form of PAN.