IDBI Bank Positive Pay System (PPS) : idbibank.in

Organisation : IDBI Bank Ltd

Facility Name : Positive Pay System (PPS)

Applicable State/UT : All India

Website : https://www.idbibank.in/index.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Positive Pay System?

Positive Pay System enables an additional security layer to the cheque clearing process wherein the issuer (drawer) of the cheque shares cheque details with the Bank. When the bene iciary submits the cheque for clearing, the presented cheque details will be compared with the details provided to the Bank through Positive Pay.

Related / Similar Facility : IDBI Bank Complaint Online

To avail this facility, the account holder (drawer of the cheque) needs to share cheque details at the time of issuance of the cheques for amounts of `50,000/- and above online through Internet Banking and Mobile Banking app of IDBI Bank Bank , 24×7

Cheque details to be shared as under:

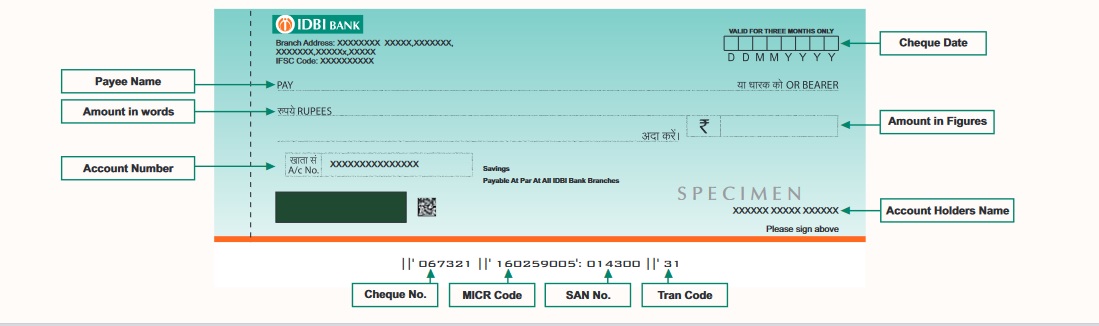

Account Number Cheque Number (6 digits) Cheque Date (Date mentioned on the cheque) Cheque Amount Name of Bene iciary (Payee’s Name)

Please follow the steps below to submit information for Positive Pay through Internet Banking:

A. Retail Customers :

Click on Menu > Service & Request > New Requests > Positive Pay : Con irm Cheque Details.

B. Corporate Customers:

Click on Menu > Accounts > Positive Pay – Con irm Cheque Details.

Important Information On Positive Pay System

** The Positive Pay updation must be done atleast one working day prior to the day of presentment.

** In case of data mismatch or incorrect details bank has the right to return the cheque unpaid. The positive payment details much match with specified cheque .

** Cheque may be returned to presenting bank due to other technical & financial reasons even if the Positive Payment details are available.

** Cheques compliant with the Positive Pay system will only be accepted under RBI dispute resolution mechanism between the presenting and paying banks.

FAQ On Positive Pay System

Frequently Asked Questions FAQ On Positive Pay System

1. What is Positive Pay?

Reserve Bank of India (RBI)* has directed all banks to introduce the Positive Pay System (PPS) to make cheque transactions safer. The concept of Positive Pay involves a process of recon irming key details of cheques issued by customers.

Under this process, the issuer of the cheque submit electronically certain minimum details of a cheque for value `50,000/- and above with IDBI Bank to add an additional veri ication before processing the transaction, to reduce instances of fraudulent transactions.

The key details include:

** Account Number

** Cheque Number

** Beneficiary/ Payee name

** Cheque amount

** Cheque date

2. Is it mandatory to use Positive Pay?

It is not mandatory to use Positive Pay. However, cheques issued for value `50,000/- and above shall be accepted for dispute resolution mechanism under CTS grid only if Positive Pay facility is used.

3. If I have not used Positive Pay, will my cheque be processed?

Yes, the cheque will be processed even if Positive Pay facility is not used. However, any issue in relation to the cheque will not be accepted for dispute resolution mechanism under Cheque Truncation System (CTS) grid by NPCI.

4. Are there any charges for using Positive Pay?

No, Positive Pay facility is provided free of charge to all customers.

5. I am a Savings Account customer of IDBI Bank, do I have to use Positive Pay?

Yes, Positive Pay is applicable for all customers issuing cheques (Current Account, Savings Account, CC OD etc.) for value `50,000/- and above. Customer has to enter required data in the Positive Pay system at the time of issuing the cheque. In case the information is provided on the day of presentment, it may not get considered.

6. What are the Channels available for using Positive Pay ?

Currently, Positive Pay is available only through Internet Banking and Mobile Banking app of IDBI Bank Bank, 24×7