New India Assurance Quick Premium Payment : newindia.co.in

Organisation : New India Assurance

Facility Name : Quick Premium Payment

Applicable State/UT : All India

Website : https://www.newindia.co.in/portal/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay New India Assurance Premium Online?

To Pay New India Assurance Premium Online, Follow the below steps

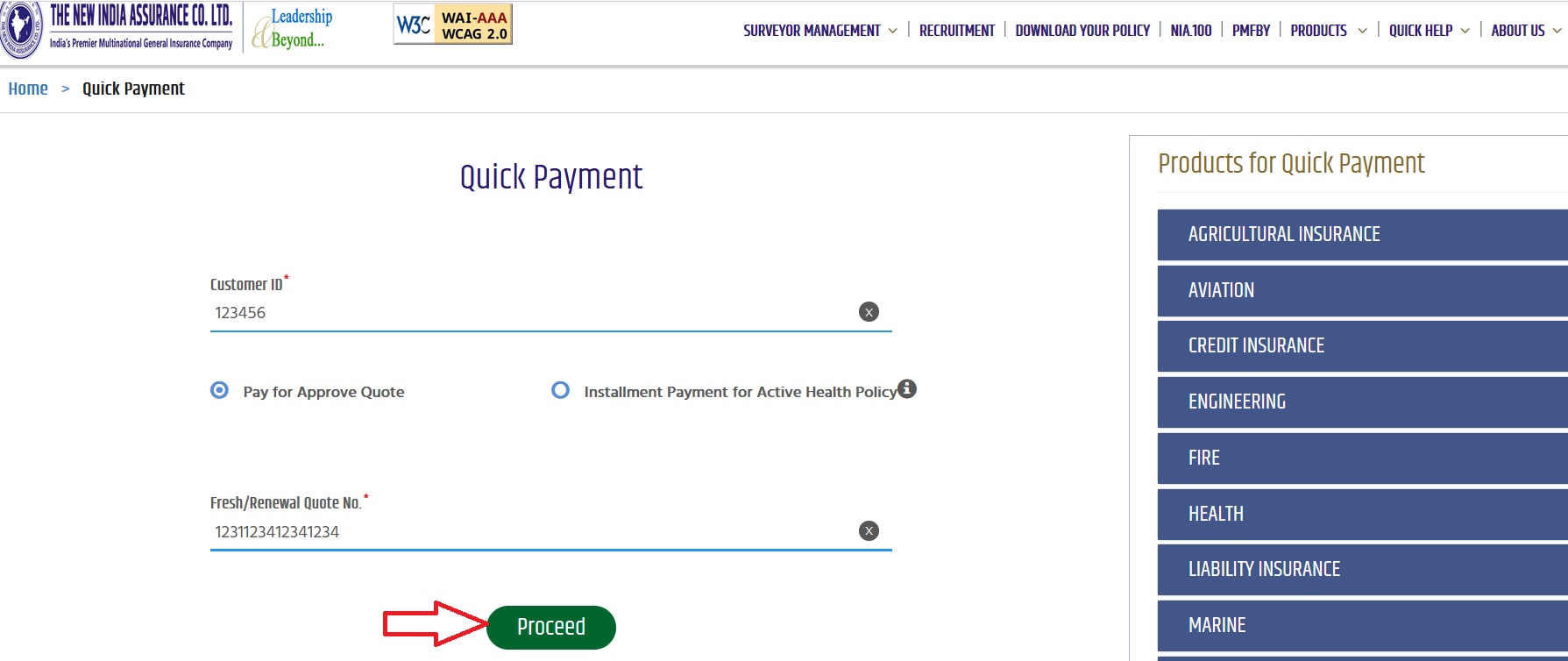

Quick Payment:

Convert an approved quote to active policy, by paying premium online using Credit Card/Debit Card/Net Banking.

Quick Renewal:

Get a policy renewed online, by paying premium using Credit Card/Debit Card/Net Banking.

Steps To Be Followed:

1. For Quick Payment – Enter the Customer ID and Approved Quote No.

2. Pay premium using Credit Card/Debit Card/Net Banking.

Pay Online : https://www.newindia.co.in/portal/quickRenewPost/payment

On successful completion of payment, the policy will be issued / renewed.

Note:

1. In case of any queries please do mail us at tech.support@newindia.co.in

2. Customer ID should be the one mentioned in your policy document and not your Login ID.

Disclaimer:

Premium will be calculated with applicable “Goods & Services Tax”. If eligible for “Goods & Services Tax” exemption, please contact your nearest New India Assurance branch with supporting documents, to buy /renew a policy.

FAQ On New India Assurance

Frequently Asked Questions FAQ On New India Assurance

What is Insurance?

It is a system by which the losses suffered by a few are spread over many, exposed to similar risks. Insurance is a protection against financial loss arising on the happening of an unexpected event.

Why do I need Insurance?

Insurance is a hedge against the occurrence of unforeseen incidents. Insurance products help you in not only mitigating risks but also helps you by providing a financial cushion against adverse financial burdens suffered.

What does General Insurance do for me?

Accidents… illness… fire… financial securities are the things you’d like to worry about any time. General Insurance provides you the much-needed protection against such unforeseen events. Unlike Life Insurance, General Insurance is not meant to offer returns but is a protection against contingencies. Under certain Acts of Parliament, some types of insurance like Motor Insurance and Public Liability Insurance have been made compulsory.

How much Insurance do I need?

It is very important to have adequate amount of coverage for each insurance policy. For any asset or property insurance, the value of the asset based on market value or reinstatement value should be taken into consideration before deciding Sum Insured. If the Sum Insured is not adequate, the percentage representing the uncovered portion of the asset is to be borne by the insured.

What all can I get covered under insurance?

Almost everything that has a financial value in your life and has a probability of getting lost, stolen or damaged, can be covered through insurance. Property (both movable and immovable), vehicle, cash, household goods, health, dishonesty and also your liability towards others can be covered.

Why should one cover oneself immediately?

Accidents and mishaps can occur anytime and anywhere. It is important to identify the risks faced and insure oneself against these at the earliest.

What is Premium?

Premium is the fixed amount of sum paid over the period by the insured to the insurance company to take insurance policy and to complete the contract of insurance.

Why should I fill up proposal form for buying Insurance?

Insurance is a contract between the insured and the insurer. The proposal form is the basis of contract and it contains all the required information for the preparation of the policy which is a contract document.

What is Underwriting?

It is the consideration of material fact to asses the risk and to take the decision whether to accept the risk for insurance contract and if so at what rate of premium.

What is deductible?

The amount, which the insured has to bear in all cases and this amount is first, deducted from the total assessed payable claims amount before determining insurance company’s liability.

What is Reinsurance?

It is an arrangement by which insurance companies spread their risk with other underwriters or reinsurance companies called Reinsurance.

Contact

Call : 1800-209-1415