KSFE Previous Transactions Online Search : Kerala State Financial Enterprises

Organisation : The Kerala State Financial Enterprises Limited (KSFE)

Facility Name : Search Previous Transactions Online

Applicable State/UT : Kerala

Website : https://ksfeonline.com/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Search KSFE Previous Transactions Online?

To Search KSFE Previous Transactions Online, Follow the below steps

Related / Similar Facility : Join KSFE Chitty

Steps:

Step-1 : Go to the link https://ksfeonline.com/payment

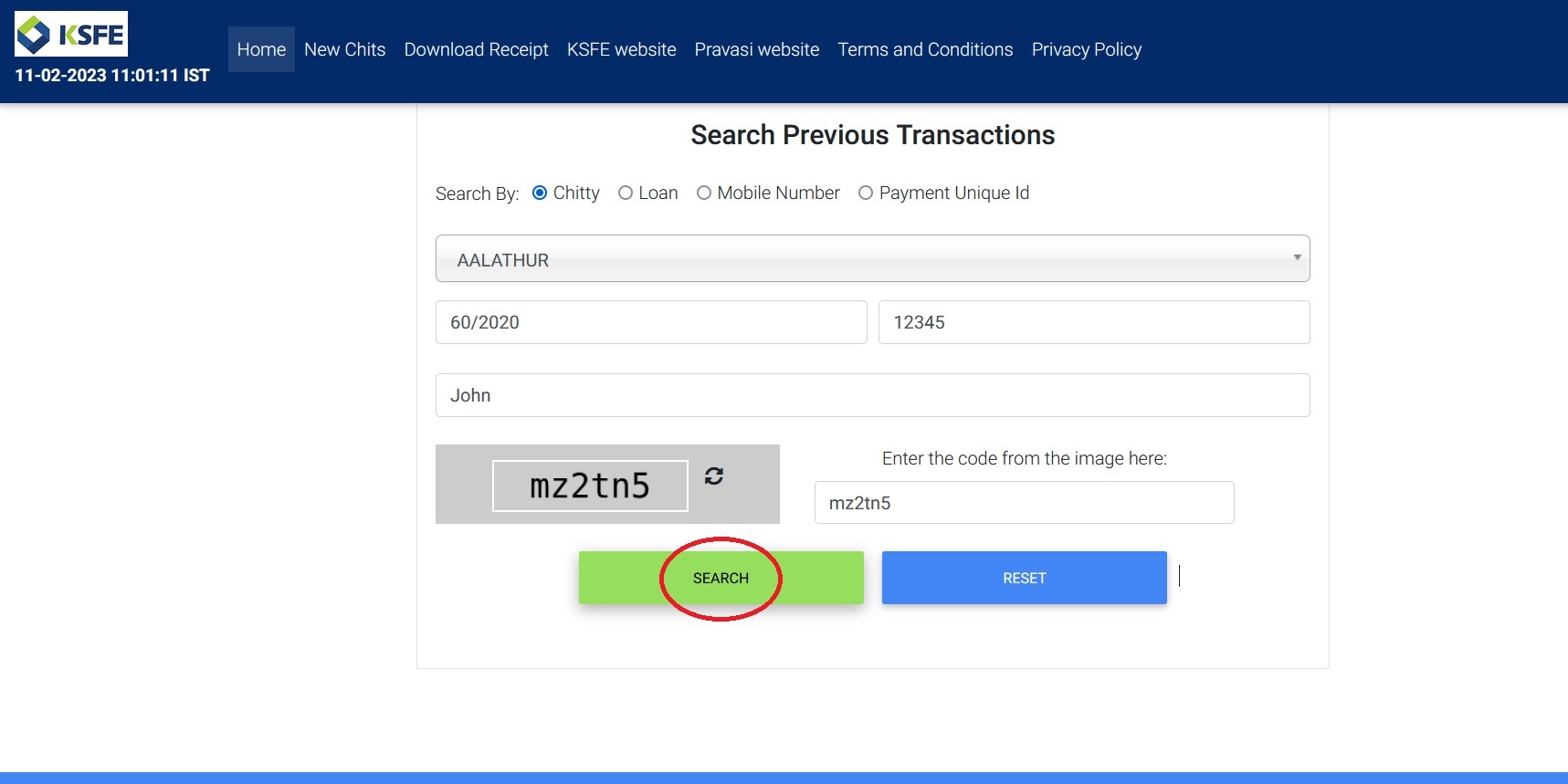

Step-2 : Select the “Search By” option

Step-3 : Select the Branch

Step-4 : Enter the Chitty Number

Step-5 : Enter the Chittal Number

Step-6 : Enter the Chittal Name

Step-7 : Enter the Captcha code

Step-8 : Click on the button “Search”

FAQ On KSFE Chitty Loan

Frequently Asked Questions FAQ On KSFE Chitty Loan

What is the maximum amount of advance?

The maximum amount of advance is Rs.1,00,00,000/- under this category.

How are the Principal and the interest of the Chitty loan settled?

The principal of the advance is settled by adjustment from the Chitty Prize Money.However the interest has to be remitted every month.

What is Chitty Loan For?

Chitty Loan is a bridge between your actual financial need and the delay in chitty getting prized in your favour

Eligibility For Chitty Loan

If you are a non-prized subscriber in a chitty and remitted 10% of the total number of instalments promptly, you are eligible for an advance up to 50% of the total chitty amount or sala (gross subscription to be remitted per month multiplied by the number of instalments in the Chitty).

What are the main attractions of enrolling in KSFE Chitties over enrolment in other savings instruments?

Chitty is a unique scheme incorporating the aspects of a recurring deposit and an advance scheme. In chitty, the subscriber has an opportunity to bid and avail of advance which amounts to a certain percentage of the total denomination of the chitty (sala), whereas in recurring deposit the advance can be availed only on the paid up amount. In case bidding is delayed due to draw of lots in the initial instalments, one can resort to availing of chitty loan, which is a loan that “bridges” the gap between the need of the subscriber for money and the delay in the chitty getting prized.

What are the advantages of the KSFE Housing Loan over similar schemes of other institutions?

Housing Loan Scheme of KSFE is designed to cater to the needs of all segments of population such as Traders, NRIs, Business persons, Professionals, Salaried class etc. Rate of interest is competitive and the terms are simple. KSFE provides advance under this category for purchase of plots as well as purchase of dwelling house and for construction of dwelling houses.

Contact

Send your online transaction related queries to ecollection@ksfe.com

Phone: +91 9446001861 (between 10:00 AM to 2:00 PM and 2:45 PM to 5:00 PM on working days)