NKGSB Co-Operative Bank Quick Pay Service

Organisation : NKGSB Bank

Facility Name : Quick Pay

Applicable State/UT : All India

Website : https://www.nkgsb-bank.com/quickpay.php

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is NKGSB Bank Quick Pay?

Keeping in mind the busy lives of people, NKGSB Bank makes it easier to pay your society maintenance bills and school fees payment through NKGSB Bank QUICK Pay gateway, provided the society and school should have an account with our Bank. Payment can be done via UPI/ Debit/ Credit card/ Net banking on the go. Quick Pay is a secured and convenient mode of electronic payment which gets credited directly to their respective society and school bank account maintained with us.

Related / Similar Facility : NKGSB Bank QuickMobil/ Scratch Card Service

Features of NKGSB Bank Quick Pay

** Online collection/payment 24 X 7.

** Pay in one place, through the channel of your choice.

** No need of waiting to drop your cheque in the society bills collection box.

** Now you need not wait in long queue for the payment of school fees.

** Pay anytime, from anywhere.

** Auto – generation & auto-mailing of payment receipt. Absolutely paperless.

** Your transactions are protected by high levels of security.

** Each member also can view his or her respective payment status in a click of a button.

How To Avail NKGSB Bank Quick Pay?

To avail NKGSB Bank Quick Pay service, Follow the below steps

Steps:

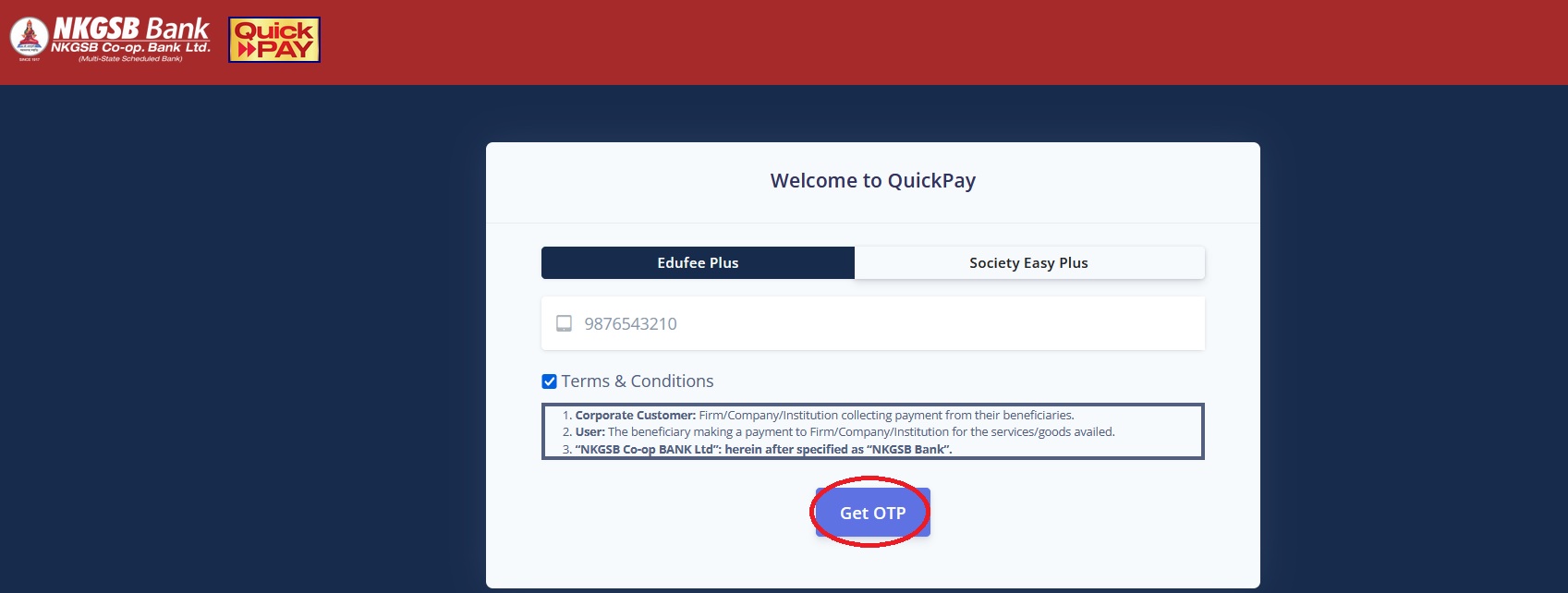

Step-1 : Go to the link https://quickpay.nkgsb-bank.com/

Step-2 : Enter your registered Mobile Number (or) Email ID

Step-3 : Click on “Get OTP” button to verify it.

Step-4 : After successful verification, pay online.

Terms and Conditions On NKGSB Bank Quick Pay

1. Corporate Customer: Firm/Company/Institution collecting payment from their beneficiaries.

2. User: The beneficiary making a payment to Firm/Company/Institution for the services/goods availed.

3. “NKGSB Co-op BANK Ltd”: herein after specified as “NKGSB Bank”.

4. “Chargeback” shall mean any approved reversal of any online card transaction made by the Customer of firm/company/institution of –

(i) any alleged forgery of his card or other details

(ii) duplicate processing of the transaction ;

(iii) any amount required to be refunded due to, denial of transaction by the Customer as wrongly charged payment/ extra payments and/ or due to the fraudulent use/ misuse of the personal and financial information of the Customer by any unauthorized person;

(iv) non-delivery or deficiency in the School/ Society Service and/ or any other reason as required / approved by the concerned banks, as the case may be. The School/ Society payment made in respect of any Customer Order, in respect of which the Customer or Issuing Bank raises a claim, demand, dispute or chargeback on the Bank for any reason whatsoever or in case of refund initiated by the School/Society shall be the financial responsibility of the School/ Society.

5. The User shall not publish, display, upload or transmit any information prohibited under Rule 3(2) of the Information Technology (Intermediaries guidelines) Rules, 2011

6. In case of non-compliance of the terms and conditions of usage by the User, the Bank has the right to immediately terminate the access or usage rights of the User to the computer resource of the Bank and remove the non-compliant information

7. Bank shall not be responsible, in any way, for the quality or merchantability of any product/merchandise or any of the services related thereto, whatsoever, offered to the User by the Corporate Customer. Any disputes regarding the same or delivery of the Service or otherwise will be settled between Corporate Customer and the User and Bank shall not be a party to any such dispute. Any request for refund by the User on any grounds whatsoever should be taken up directly with the Corporate Customer and the Bank will not be concerned with such a request.

8. “NKGSB Bank” is not liable whatsoever for any monetary or other damage suffered by the User on account of: (i) the delay, failure, interruption, or corruption of any data or other information transmitted in connection with use of the Payment Gateway/net banking/Cash/Cheque/UPI or Services in connection thereto; and/ or (ii) any interruption or errors in the operation of the Payment Gateway/net banking/Cash/Cheque/UPI.

9. Transaction Settlement of the Net Amount from all the payment modes opted for will be released within 2 business days.

10. The User agrees, understands and confirms that his / her personal data including without limitation details relating to debit card / credit card /Net-Banking transmitted over the Internet may be susceptible to misuse, hacking, theft and/ or fraud and that “NKGSB Bank” have no control over such matters. The User is hereby informed that “NKGSB Bank” will never ask the User for the User’s details in an unsolicited phone call or in an unsolicited email.

11. The User agrees and confirms that he/she is authorizing debit of the nominated card/ bank account for the payment of fees selected by such User along with the applicable Fees.

12. “NKGSB Bank” do not make any representation of any kind, express or implied, as to the operation of the Payment Gateway/Net banking other than what is specified in the Website for this purpose. By accepting/ agreeing to these Terms and Conditions, the User expressly agrees that his/ her use of the aforesaid online payment Service is at own risk and is the sole responsibility of the User himself/herself.

13. Refund for fraudulent/duplicate transaction(s): The User shall directly contact the Corporate for any fraudulent transaction(s) on account of misuse of Card/ Bank details by a fraudulent individual/party and such issues shall be suitably addressed by the Corporate alone in line with their policies and rules.

14. The payments deposited through Credit Card/Debit Card/Net Banking/cheque will normally reach the account of the corporate within 2 working days. It is the sole responsibility of the candidate to ensure that the payment is deposited well in time. The corporate/ “NKGSB Bank” shall not be responsible for any delay in receipt of fee payment for any reason. The corporate /”NKGSB Bank” also shall not be responsible, if the payment is refused or declined by the credit/debit card issuer for any reason.

15. Under no circumstances, the Bank shall be held responsible for any such fraudulent/duplicate transactions and hence not claim is to be raised to “NKGSB Bank”. The “NKGSB Bank” shall not entertain any such request raised by the user.

16. Do not provide your username and password anywhere other than in this page.Your username and password are highly confidential. Never part with them

17. Payment confirmation is subject to realisation of Cheque.