Tamil Nadu e-Town Panchayat Quick Pay : etownpanchayat.com

Organisation : Directorate of Town Panchayats

Facility Name : e-Town Panchayat Quick Pay

Applicable State : Tamil Nadu

Website : https://www.etownpanchayat.com/Index.aspx#!

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

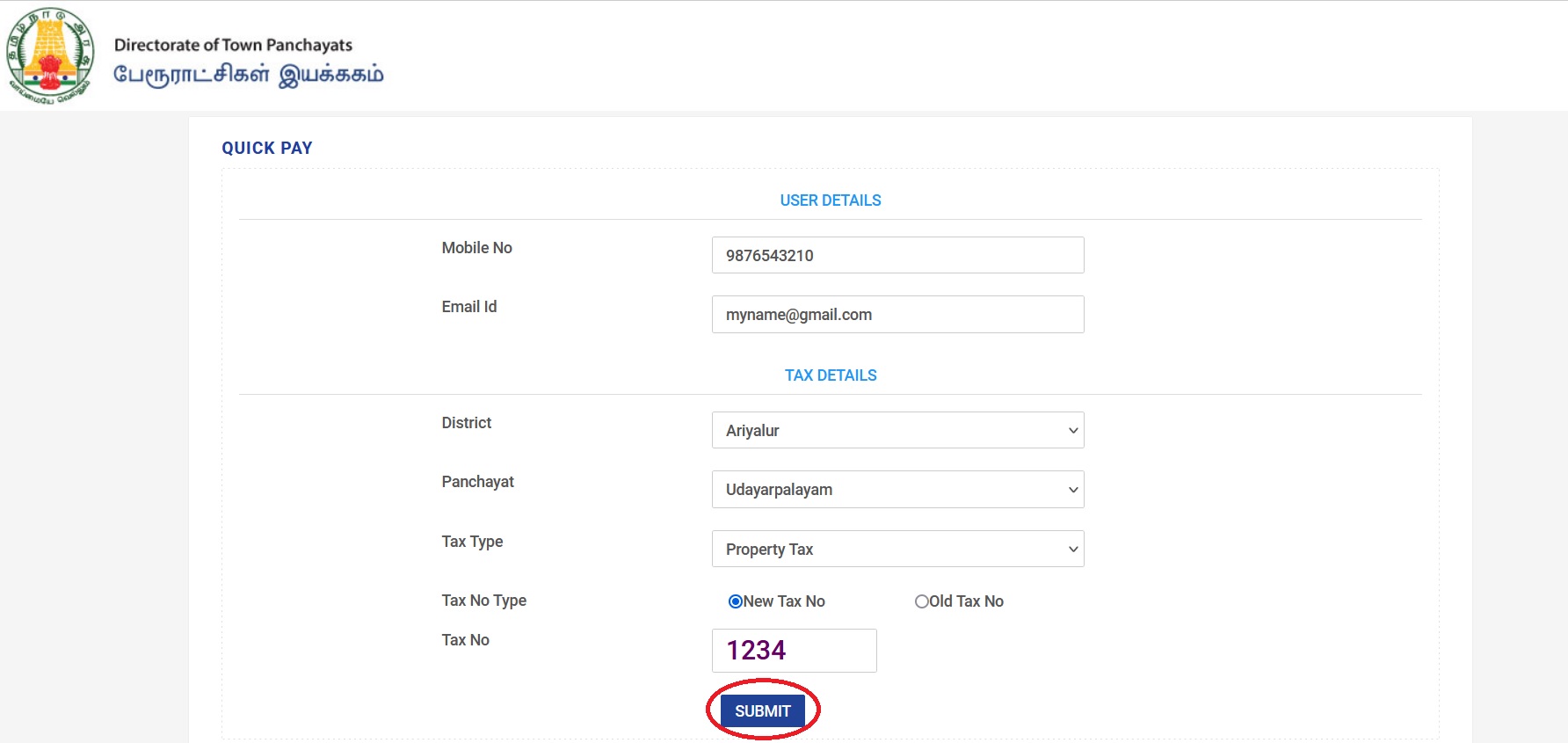

How To Do e-Town Panchayat Quick Pay?

To Do Tamil Nadu e-Town Panchayat Quick Pay, Follow the below steps

Related / Similar Facility : Thangamayil Saving Schemes Quick Pay

Steps:

Step-1 : Go to the link https://www.etownpanchayat.com/PublicTax/Quick.aspx

Step-2 : Enter the User Details and Tax Details

Step-3 : Click on the “Submit” button

FAQ On e-Town Panchayat

Frequently Asked Questions FAQ On Tamil Nadu e-Town Panchayat

1. Is an e-mail id essential?

Yes. Without a valid mail id registration cannot be successful.

2. What should I do if I forget my password/username?

You can recover your password through “Forgot Password” link in the login page.

3. How to pay using debit/credit card?

You can pay using credit / debit card of any one of the bank listed under (Any Master / Visa credit card or Debit card of the following banks can be used for making payment) through the “PAYMENT GATEWAY OPTION” by selecting one of the available gateway whose bank charges are displayed. After entering into any one of the gateways, give your debit/credit card details when asked and proceed for payment.

4. What shall I do If Receipt Is Not Generated / Error Page Displayed ?

After a successful transaction, if error page is displayed instead of the receipt , kindly check whether your bank account is already debited with the amount of earlier transaction before attempting to pay again for the same Tax No. If debited, please do not attempt to pay again for the same Tax no. The receipt will be sent to your registered email id in reasonable time after receiving the confirmation from the Bank. Also the receipt can be viewed in the Payment History in your login id.

5. Should I have to print the e-receipt everytime?

Not essential. It is only for the purpose of record. You may view Payment History in the login and also Payment Status in www.etownpanchayat.com web site.

6. What to do for name transfer?

An application request has to be submitted to the concerned Town Panchayat along with attached supporting documents. The name will be transferred to the new owner on payment of necessary name transfer fees.

7. The address in the web site appears to be wrong.

The address corrections have to be done at the concerned Town Panchayat office.

8. Can I pay for multiple services? Can I pay for owner / tenant / relative / friends?

You may pay for any number of Taxes. The Tax nos. can be added using the Add Assessment Links.

9. I have got an SMS with OTP. What is this?

While creating an User Id for you on www.etownpanchayat, for your security, an OTP is sent. Simply enter it on OTP textbox to verify your account. You will need to go for Create Account.

10. Any Mobile App is Available for Paying Taxes?

Yes. You Can Download “Etowns App” in Play Store / App Store.

Privacy Policy:

** Your privacy is very important to us. Accordingly, we have developed this Policy in order for you to understand how we collect, use, communicate and disclose and make use of personal information. The following outlines our privacy policy.

** Before or at the time of collecting personal information, we will identify the purposes for which information is being collected.

** We will collect and use of personal information solely with the objective of fulfilling those purposes specified by us and for other compatible purposes, unless we obtain the consent of the individual concerned or as required by law.

** We will only retain personal information as long as necessary for the fulfillment of those purposes.

** We will collect personal information by lawful and fair means and, where appropriate, with the knowledge or consent of the individual concerned.

** Personal data should be relevant to the purposes for which it is to be used, and, to the extent necessary for those purposes, should be accurate, complete, and up-to-date.

** We will protect personal information by reasonable security safeguards against loss or theft, as well as unauthorized access, disclosure, copying, use or modification.

** We will make readily available to customers information about our policies and practices relating to the management of personal information.

Contact

Directorate of Town Panchayats

Kuralagam, Chennai – 600108, Tamilnadu.

Telephone : 044-25358744

Email : dtp@tn.nic.in

I tried to pay my Property Tax online for Chitlapakkam of Chengalpat Dist,using the below web site

etownpanchayat.com/PublicTax/Quick.aspx.

After filling all details, when I press pay button,I get this information:

‘Server Error in /”Public tax” application

Object Reference not set to an instance of an object’

Kindly guide me how to pay the P.Tax on line. Thanks