Pramerica Life Insurance Premium Online Payment : pramericalife.in

Organisation : Pramerica Life Insurance Limited

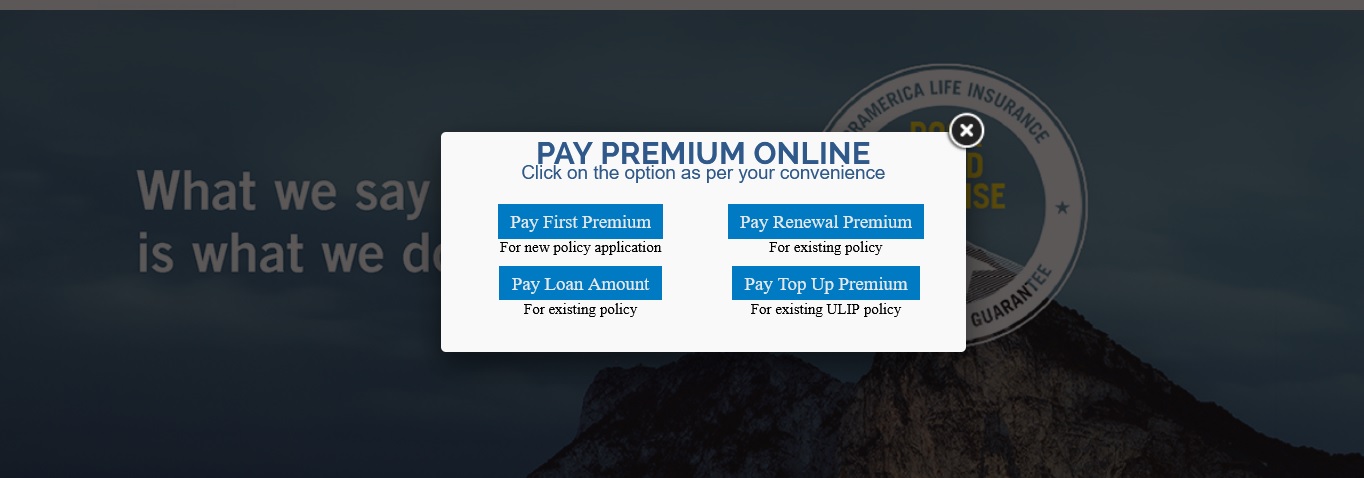

Facility Name : Pay Premium Online

Applicable State/UT : All India

Website : https://www.pramericalife.in/index

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Pramerica Life Premium Online?

To Pay Pramerica Life Premium Online, Follow the below steps

Related / Similar Facility : Sundaram Finance EMI Online Payment

Steps:

Step-1 : Go to the link https://www.pramericalife.in/PremiumPolicyPayment

Step-2 : Enter the Policy Details

Step-3 : Select the payment method

Step-4 : Click on the “Pay Here” button

FAQ On Pramerica Life Insurance

Frequently Asked Questions FAQ On Pramerica Life Insurance

What is Life Insurance?

Life insurance is a contract that pledges payment of an amount to the person assured (or his nominee) on the happening of the event insured against.

The contract is valid for payment of the insured amount during:

** The date of maturity or

** Specified dates at periodic intervals or

** Unfortunate death if it occurs earlier

Among other things, the contract also provides for the payment of premium periodically to the Company by the policyholder. Life insurance is universally acknowledged to be an institution, which eliminates risk, substituting certainty for uncertainty and comes to the timely aid of the family in the unfortunate event of death of the breadwinner.

Life insuranceis concerned with two hazards that stand across the life-path of every person:

** That of dying prematurely leaves a dependent family to fend for it

** That of living till old age without visible means of support

Which policy should I choose?

Your need for protection and / or planned savings at a point in time is the determining factor when you consider the insurance options. Our Sales Person would normally be able to assist you in making the right choice. However, while your advisor will recommend a life insurance policy that he or she thinks will meet your needs, you need to carefully examine the recommendations to make sure that your financial goals and protection requirements are indeed met.

In India, the IRDAI has made it mandatory for insurance companies to provide each of the customers with an “illustration” that provides details of the premium outflows and the expected inflows for insurance products tailored to meet your specific requirements. Do ask your advisor to explain the illustration to you and clear any doubts that you have.

Are my existing policies enough for me? (I already have life insurance policies, what should I do?)

Your need for protection is not fixed as life progresses, there are new developments that happen and these developments impact the extent to which you need protection. Hence the requirement for protection should be reviewed periodically and if there is a shortfall, it should be covered as soon as possible by buying additional insurance cover.

For the purpose of illustration, some of the events in your life that are likely to have an impact on the levels of protection that you need are:

** You or your children are getting married.

** You have become or are becoming a parent

** Your parents or your spouse have retired / are retiring and are / will be financially dependent on you.

** The health of your dependents or your own health has taken a downturn.

** You have acquired large capital assets like a new home or a car.

** Your children are about to enter school or college.

** You or your spouse has got a large raise in salary or the family income levels have significantly increased.

You should consult your Agent/ Financial Advisor if any events similar to the ones mentioned above have happened to evaluate if your need for protection has changed.

How much Life Insurance do I need?

The need for life insurance is based on various factors including your current lifestyle, expected outflows in future, your present age and your family size. The first step should be to estimate how much financial support your dependents would need in order to continue to enjoy the same lifestyle as they enjoy today in the event that you are not around to provide that support.

In estimating this support, you should consider all regular monthly expenses including food, rentals, conveyance, school fees, medical expenses, any debts to be repaid, etc. and also estimated ones like for childrens education and marriage and your expected needs after retirement.

Always provide for unforeseen contingencies that your dependents might need during the period of adjustment. Based on this analysis and the expected returns on the investments in future, you can work out a sum of money that would help your dependents achieve financial independence even if you are not around to support them.

While the situation of every individual would be different, and should be evaluated separately, one rule of thumb is to buy a cover for an amount equal to 6-10 times your annual income. Clearly, the need for insurance is not static and will change as your life-stage changes so you must re-work the requirement periodically and review the coverage available from time to time. It is advisable to speak to a trained financial consultant / insurance advisor to determine the extent of coverage that you require.

Contact

Telephone Number : 1860 500 7070