Yes Bank Overdue Loan EMI Payment Online : yesbank.in

Organisation : Yes Bank

Facility Name : Overdue Loan EMI Payment Online

Applicable State/UT : All Over India

Website : https://www.yesbank.in/online-loan-payments

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Yes Bank Overdue Loan EMI Online?

Pay your overdue Loan EMIs/Charges in a convenient way If you have missed your EMI or have any outstanding charges against your existing loan you need not to worry. Simple ways to pay overdue amount at your own convenience.To Pay Yes Bank Overdue Loan EMI Online, Follow the below steps

Steps:

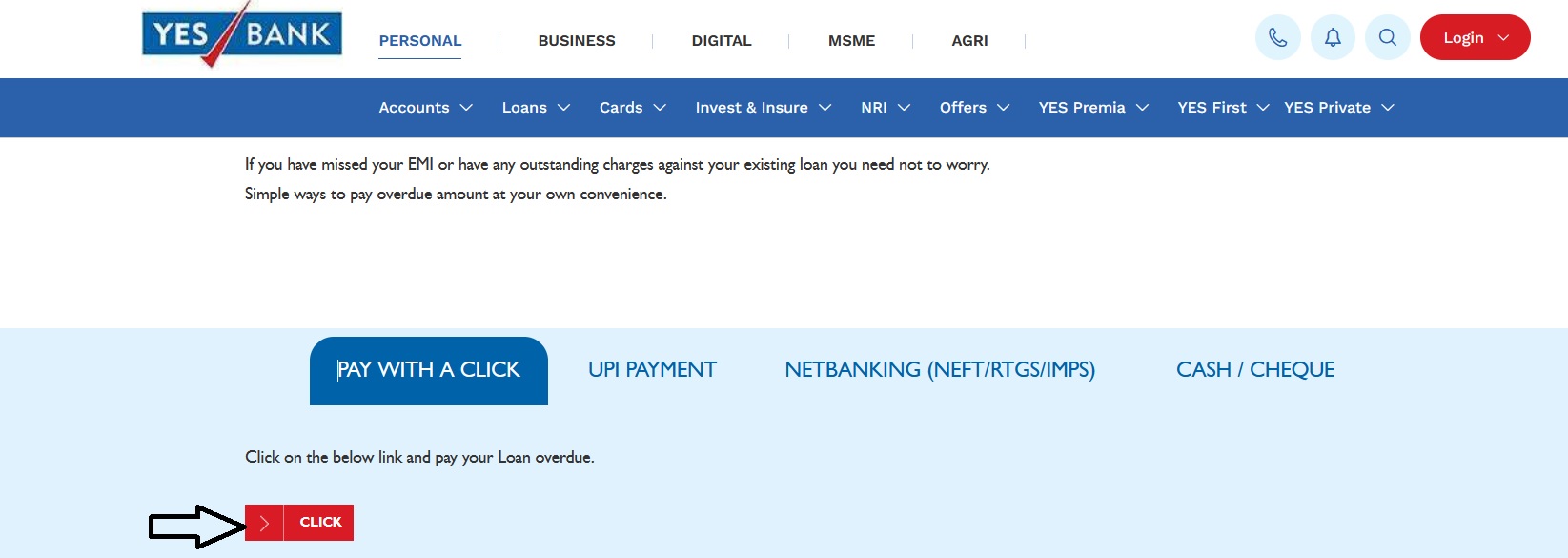

Step-1 : Go to the link https://www.yesbank.in/online-loan-payments

Step-2 : Click on the “Pay With A CLICK” link and pay your Loan overdue.

UPI Payment:

1.Open UPI option (Paytm, PhonePe, Gpay or any other UPI in your mobile.

2. Input the UPI ID : ‘retail<loan-account-no>@yesbankltd’. e.g: If YES Bank loan account number is ALN000123456789 , the UPI Id will be ‘retailaln000123456789@yesbankltd’

3. You will see “YES BANK RETAIL LOAN” as the name in Payment To / Beneficiary field.

4. Enter the amount to be paid and proceed

5. Complete the payment by entering the UPI PIN

Netbanking (NEFT/RTGS/IMPS) :

1. Login to Net Banking of your Bank a/c from which you wish to initiate the payment.

2. Add your Yes Bank Loan account as New Payee by prefixing ‘RETAIL’ to your loan account number i.e. beneficiary account e.g. RETAILALN000123456789.

3. Enter the YES BANK Ltd IFSC code – YESB0CMSNOC (please note it is zero after YESB and it is alphabet ‘O’ after CMSN).

4. Click on Funds Transfer and select the payee e.g. RETAILALN000123456789

5. Enter the Amount you would like to transfer towards the loan account.

6. Click on submit for making the payment.

Cash / Cheque:

Walk into nearest YES Bank Branch

1. Ask for a loan deposit slip at the branch counter.

2. Fill in the details in slip such as: 15 digit Loan number, Date, Name, Mobile, Amount in value, Amount in rupees, etc.

3. Submit the slip along with Cash or Cheque at the branch counter.

Note:

Cheque should be favoring Yes Bank Ltd – <mention 15 digit Loan number> e.g. Yes Bank Ltd – ALN000123456789

FAQ On Yes Bank Loan

Frequently Asked Questions FAQ On Yes Bank Loan

Q. What is EMI? How is it calculated?

A. EMI stands for Equated Monthly Instalments. This instalment comprises both principal and interest components. Your EMI would be calculated depending on the tenure you choose, to repay your loan. The EMI would be higher if you choose to repay within a shorter period as against a longer-term loan.

Q. Do I need a guarantor for New Car Loans?

A. No, but if your income does not meet our credit criteria then you may be required to have a Guarantor. A Guarantor is the one who has contracted to be responsible for another, especially one who assumes responsibilities or debts in the event of default for your loan. However, the bank may ask for a guarantor if needed.

Q. Which cars can be financed for New Car Loans?

A. We finance most passenger cars and multi-utility vehicles manufactured by India’s leading automobile companies

Q. What is prepayment?

A. When a borrower pays off his/her loan entirely or in part before the defined due date, it is termed as prepayment. You can pre-pay the loan any time after 6 months of availing of the loan. You just have to pay a small pre-payment fee on the outstanding loan amount.

Q. Who can avail of YES Bank New Car Loans?

A. We offer New Car Loans to the following: 1. Salaried individuals in the age group of 21 to 60 years (at the end of the tenure) 2. Self-employed individuals in the age group of 21 to 65 years (at the end of the tenure) 3. Proprietorship firm 4. Partnership Firms 5. Public & Private Ltd. Companies

Q. What are the tax benefits of a home loan and how can I avail them?

A. Both principal as well as interest of home loans attract tax benefits. As per Income Tax Act 1961 rules, the current applicable exemption under section 24(b) is INR 2,00,000/- for the interest amount paid in the financial year and up to INR 1,50,000/- (under section 80C) for the principal amount repaid in the same year. The same is subject to changes in the Income tax Act from time to time. We suggest that you may please consult your tax advisor for details.

Q. Do all co-owners of a property must be co-applicants for the home loan?

A. Individuals often apply for Loan with a co-applicant, such as a spouse or a family member. The income of a co-applicant is used to enhance the loan amount eligibility and improve the chances of your loan being sanctioned. However, it should be noted that this increase will again depend on the monthly income, employment status and other financial obligations of your co-applicant. However, all co-owners of the property must be the co-applicants on the loan.

Q. What is the Pre-EMI interest?

A. Before the full and final disbursement and commencement of EMI customers are required to pay interest only on the portion of the loan disbursed to them. This is also known as the pre-EMI interest rate and is payable every month from the date of each disbursement up to the date of commencement of the EMI.

Contact

Customer Care Toll Free: 1800 1200