Aavas Financiers Overdue Loan Payments Online

Organisation : Aavas Financiers Ltd

Facility Name : Overdue Loan Payments Online

Applicable State/UT : All India

Website : https://www.aavas.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Aavas Overdue Loan Online?

To Pay Aavas Overdue Loan Online, Follow the below steps

Related / Similar Facility : Check Aavas Credit Score Online

Steps:

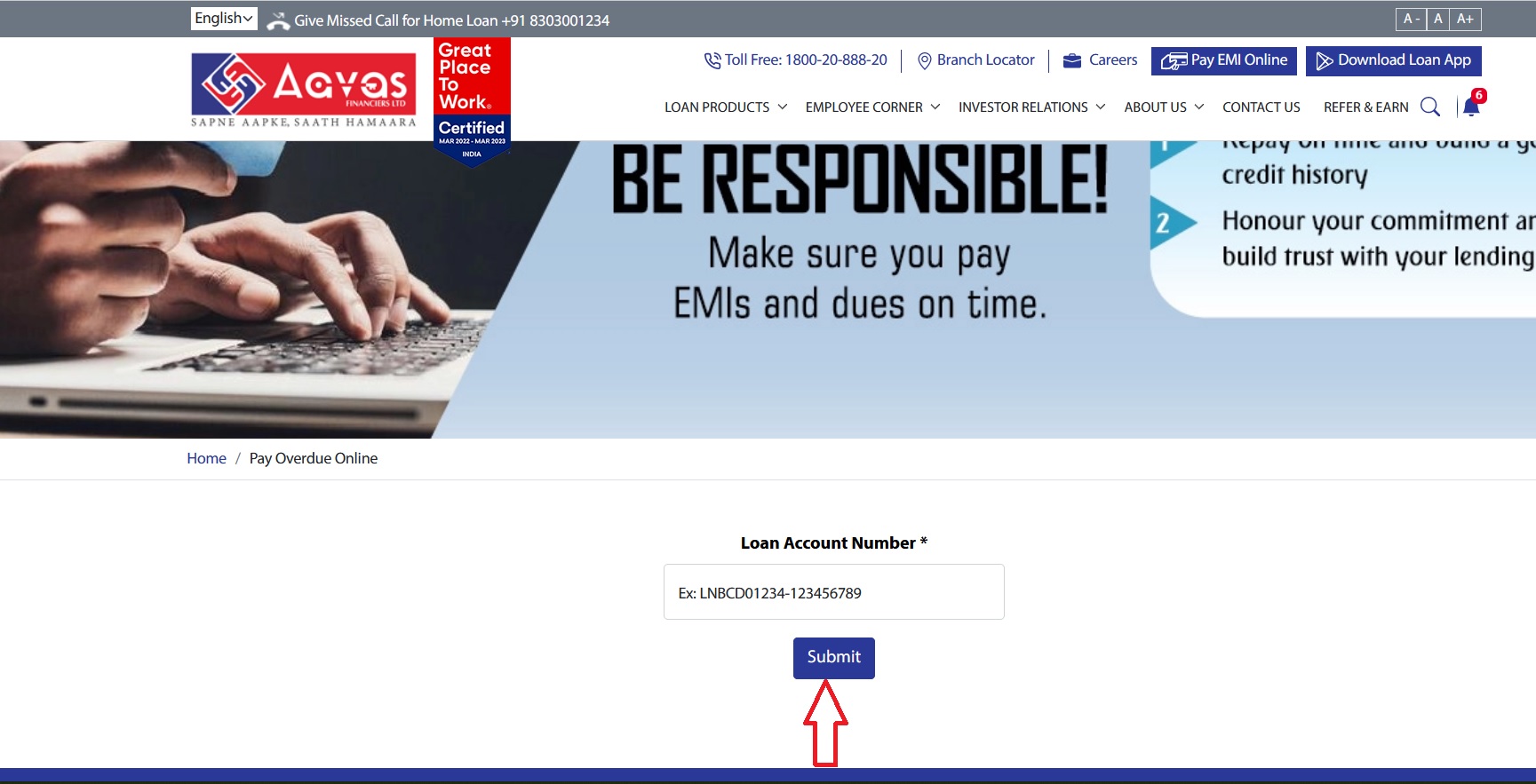

Step-1 : Go to the link https://www.aavas.in/pay-overdue-online

Step-2 : Enter the Loan Account Number

Step-3 : Click on the “Submit” button

FAQ On Aavas Loan

Frequently Asked Questions FAQ On Aavas Loan

What Is Pre-EMI?

Pre-EMI is the Interest paid on the Loan Amount availed in part and before the start of the actual EMI. This generally occurs in Self Construction or Construction Stage Linked Disbursals. The EMI doesn’t get started till the loan is disbursed in full and hence interest is charged on partially disbursed loan amount only which is Pre EMI.

Can I Foreclose My Loan? What Are Charges For The Same?

Yes you can foreclose your loan by:

** Visiting our nearest branch and giving a request for Foreclosure Statement Request

** Applicable charges are available in the Schedule of Charges and Guidelines are updated on the Foreclosure Statement issued.

Can I Do Part-Prepayment On Loan? What Is The Process For The Same?

Yes you can do part payment in your loan by:

Visiting our nearest branch and giving a request for Part Payment

What Is EMI?

You repay the loan in Equated Monthly Installments (EMIs) comprising principal and interest. Repayment by way of EMI commences from the month following the month in which you take full disbursement.

What Is Amortization Schedule?

An amortization schedule is a table giving the reduction of your loan amount by monthly installments. The amortization schedule gives the break-up of every EMI towards repayment interest and outstanding principal of your loan.

Who Can Be The Co-Applicants For The Loan?

Following persons can be co-applicants:

** Spouse -Blood relative (immediate family members)

** Co-owner must be necessarily co-applicant in the loan.

How Do I Apply For Loan?

You can apply for loan through any of the following methods:

** Through Aavas Loan App

** Calling us at our Toll Free Number:-18002088820, Sending SMS “GHAR” at 56677

** By visiting our nearest branch

** Online through our website:- www.aavas.in

Can I avail the benefits of New Interest rate and Conversion Policy?

Yes, as per the ROI Switch/ Conversion Policy, as available on the website of the company.

What are the charges for migrating to new Rate structure for availing Conversion Policy?

In case of a partly or fully disbursed loan, the Switch/Conversion fee payable to avail the Switch/Conversion shall be up to maximum of 2% on the principal outstanding (POS) plus applicable taxes.

What are the online payment modes available for a customer to pay dues?

Customer can pay their dues by the following online payment modes: ECS/ACH/Electronic Transfer/Fund Transfer/NEFT/RTGS/Net Banking/Debit Card/ RuPay Debit Card/UPI/UPI QR code (BHIM UPI QR code).

Contact

Customer Services : 0141-6618888.

Whatsapp: 91166-32180