How to apply for Income Certificate Himachal Pradesh?

Organization :Government of Himachal Pradesh

Facility :Application for Issue of Income Certificate

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page :https://eserviceshp.gov.in/login.action

Login here:https://eserviceshp.gov.in/EFormsOnlineModule/loginAuthenticateAction.action

Get more details here : eserviceshp [dot] gov [dot] in

Issue of Income Certificate

Income certificate is an important document to avail of some of the benefits that are passed on by the government to citizens below certain level of income.

Related : How to apply for OBC Certificate Himachal Pradesh : www.statusin.in/2363.html

Competent Revenue officers to issue certificates :

The Tehsildar/Naib Tahsildar Mohal shall be the competent authorities to issue Income certificates within their respective jurisdictions.

Application/Declaration :

The applicant, who wants to obtain the Income certificate, shall apply to the competent authority using the prescribed Forms available on the eServices Portal under Application for Issue of Income Certificate.

Verification of application/ declaration :

The applicant shall submit the application Form duly filled-in and verified. He shall state true facts in the application. For obtaining Income certificate he shall attach certificates of income from Municipal authorities, if the family has any income from house property in a town. Similarly he shall obtain income certificate from concerned Pradhan Gram Panchayat in case the family derives income from house property, in panchayat area. In case the applicant runs business in the town or in a village, he shall obtain income certificate from Sales Tax and Income Tax authorities and shall attach the certificates with the application. The employee of an organization shall attach salary certificate from the Drawing and Disbursing Officer.

Eligibility criterion :

Supporting documents :

** For agriculture based income -Patwari report(details of land income)

** If non agriculture business- sale tax/income tax and municipal authorities(counselor report) + patwari report

** Salaried class- Drawing and Disbursing Officer Report + patwari report

** Affidavit (stating the total income)

** In case of BPL families, will require BPL certificate also.

Note :

In case of married it should be report of the caste of father.

Application Fee :

Applicant should pay Rs.7/- as application fee, through payment gateway. If submitted through LMK, an additional charge of Rs. 9/- will be collected by LMK directly.

How to apply :

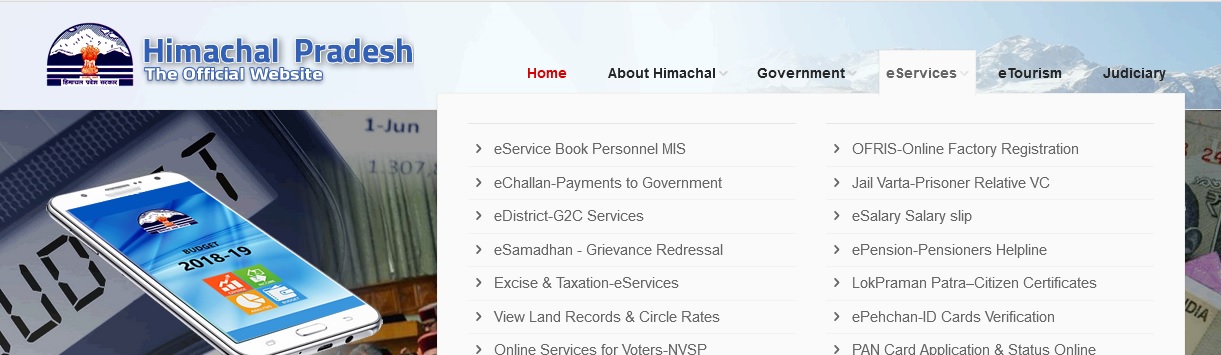

** Open the eServices Portal on the following URL eserviceshp.gov.in

** Login to the Portal with registered user id. Register yourself in case of first time usage.

** Select Revenue Department.

** List of all services under the department will be displayed.

** Select Application for Issue of Income Certificate, click on the Action link, which will navigate to Action Page.

The Action Page contains the links to different methods for accessing & submitting the Application :

(a) Submit Online,

(b) Print Form,

(c) Download Form and

(d) Upload form

a.Submit Online : The application can be submitted in an online mode by choosing this option. User should fill necessary information on the application form and submit for processing. Details on what to fill in each field are provided to assist the user in filling the application. This can be accessed from the Help link displayed on the Menu bar.

b.Print Form : A printable version (PDF) of the Application form can be

downloaded using this option. This serves as the template of the form which can be printed and submitted manually if required at the department. The downloaded PDF file can be opened with Adobe Acrobat Reader.

c.Download Form : An offline version of the Application form can be downloaded using this link. The downloaded form can be filled with the help of an Offline client, without a need for Internet connection. The offline form is secured and can be used only with the Offline client provided on eServices portal. Offline client can be downloaded from the portal from Downloads section.

d.Upload Form : The offline version of the application form downloaded and filled through the offline client can be uploaded & submitted for processing using this option. Once uploaded, the attachments required for the service will need to be uploaded. The portal will accept only a valid file that was filled using the Offline Client.

** The Status of submitted application can be tracked using the My Services link on the Portal.

Note :

You are advised to submit forms online for faster processing of the application.

Steps involved

Step 1 :

The applicant shall submit the application in prescribed format, along with necessary supporting documents, using one of the available methods.

Step 2. :

The Patwari shall report on the application from regarding applicant’s income from agriculture, horticulture and all other sources.

** He shall record the details record the details of the land owned and possessed by the applicant’s family in his patwar circle as owner or tenant and shall mention cultivated and uncultivated lands separately. Income from uncultivated lands like private forest, ghasni etc. shall be assessed by the patwari, by local inquiry from the reliable and respectable residents of the estate.

** The patwari shall also report the number and kind of bearing and non-bearing fruit trees with age owned and possessed by the family. The age of the fruit trees shall be ascertained after local inquiry from the applicant and other reliable residents of the village. If an applicant or members of his family is in Govt. or Semi-Govt. or autonomous bodies or private service, the patwari shall report the facts in his report. He shall report income of the family from all other sources.

** If the applicant owns/possesses land in other patwar circle, the patwari shall make a mention of this fact in his report after local inquiry.

** He will submit his inquiry report along with application to the competent Revenue Officer for further necessary action within a week.

Step 3. :

The Competent Revenue Officer to issue certificate shall satisfy himself about the correctness of the inquiry and report of the patwari. He may make further inquiry as he deems necessary in the matter before issuing the certificate.

Step 4 :

.If satisfied with the report, The Competent Revenue Officer calculates the Income of the Applicant from all sources and forwards the application to Jr. Assistant for Certificate preparation.

Step 5. :

Jr. Assistant prepares the Certificate digitally on the eForms application and forwards a printed copy for The Competent Revenue Officer’s signature.

Step 6. :

The Competent Revenue Officer signs the Certificate and forwards to Jr. Assistant for Delivery.

Step 7. :

The Jr. Assistant scans the signed copy and uploads the certificate to eForms application and marks the Application status as completed.

Step 8. :

The applicant will be notified about the completion status along with the Product ID of the Online Certificate, which can be downloaded from eProduct module of the Portal.