vptax.tnrd.tn.gov.in : Pay Village Panchayat Tax Online Tamilnadu

Organisation : Tamil Nadu Rural Development & Panchayat Raj Department (TNRD)

Facility Name : Pay Village Panchayat Tax Online

Applicable State/UT : Tamilnadu

Website : https://vptax.tnrd.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Village Panchayat Tax Online in Tamilnadu?

To pay Tamilnadu Rural Development & Panchayat Raj Department (TNRD) Tax Online, Follow the below steps

Related / Similar Facility : Check TNRD Village Panchayat Tax Dues Online Tamil Nadu

Steps:

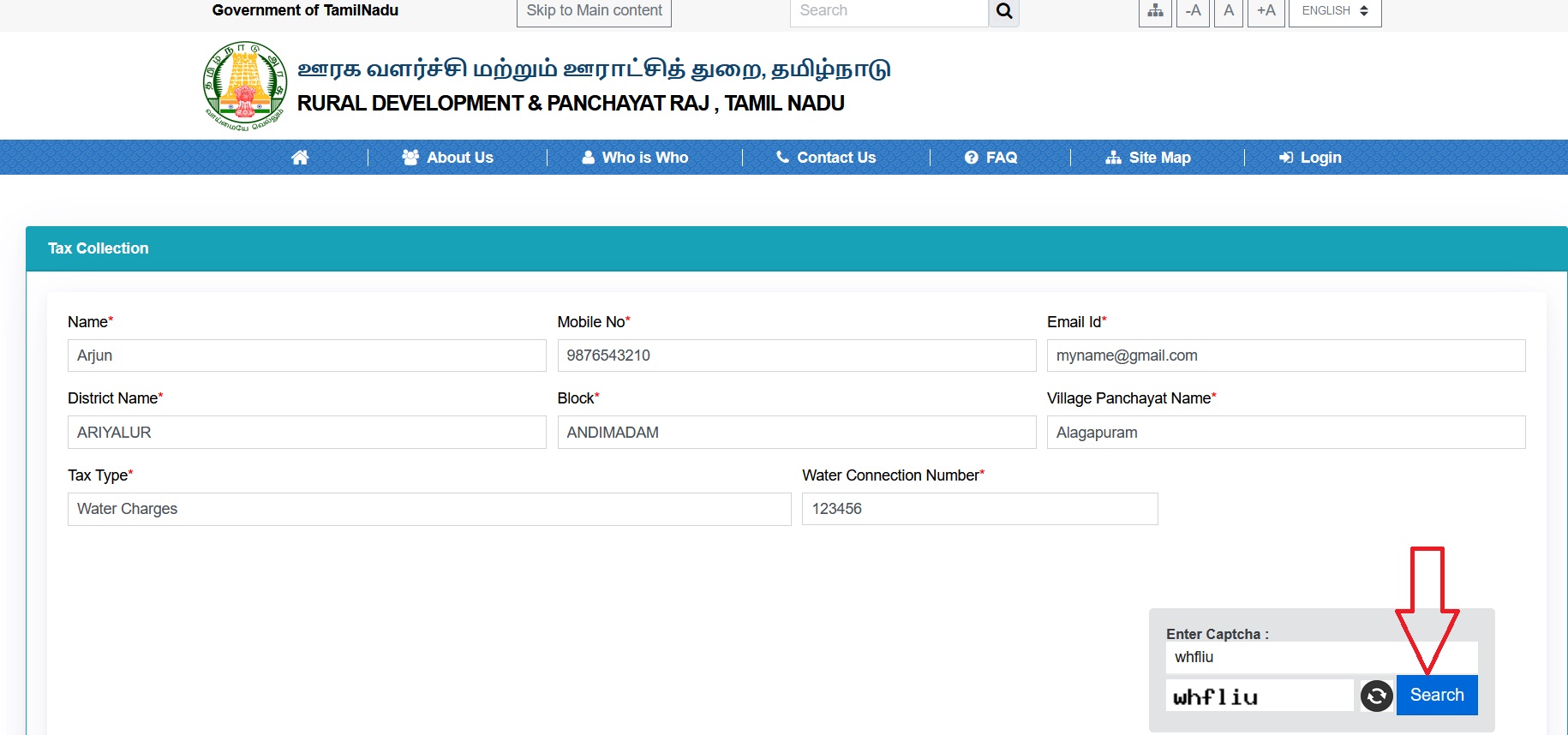

Step-1 : Go to the link https://vptax.tnrd.tn.gov.in/project/forms/VillagePanchayatMaster/TaxDemandCollection_group_public.php

Step-2 : Enter the Name, Mobile Number and Email Id

Step-3 : Choose District Name, Block, Village Panchayat Name and Tax Type

Step-4 : Enter the Assessment Number

Step-5 : Enter the Captcha and

Step-6 : Click On Search Button

FAQ On House Tax

Frequently Asked Questions FAQ On House Tax

1. What is House Tax?

Tax is a tax levied by the Village panchayats for the buildings located in their jurisdictions. The term building includes all Buildings located in the Village Panchayats.

2. Who has to pay House Tax?

The owner/occupier of the buildings has to pay property tax to the concerned Village Panchayat.

3. How House tax is calculated for the property?

Property Tax is calculated based on the flat rate/ based on the build-up area of the property. The Tax calculator is enabled in the website for the further reference.

4. When Property should be assessed for House tax?

Property tax should be levied for the properties after the completion or occupation whichever is earlier, as per Section 172 of Tamil Nadu Panchayats Act 1994 and Tamil Nadu Village Panchayat (Assessment and Collection of taxes) Rules, 1999.

5. When property Tax should be paid?

The house tax shall and by the owner of the house within thirty days after the commencement of the half year or sixty days after the commencement of the year according to the period of levy.

6. If the assessee has not paid the property tax within the stipulated period ?

Every Village Panchayat may collect an interest for the belated payment of tax due to it at Rupees one and fifty paise or two rupees as may be decided by the Village Panchayat concerned for every hundred rupees of the tax for every month of belated payment.

The interest shall be levied after thirty days of the commencement of the year if the tax is levied on half – yearly basis or sixty days of the commencement of the year if the tax is levied on yearly basis.

7. Who is the bill collector for property tax and other Tax Revenues in rural areas ?

Village Panchayat Secretary is the responsible person for collection of Taxes.

Contact

Any grievances in the payment of Tax may be contacted in the following toll-free number.

Whatsapp number:9176109822, 8072579719, 9003594939,7305421384

Email id: vptax-tn [AT] panchayat.gov.in

how can I pay again if my transaction was failed once?

not open in login option