Raigarh Municipal Property Tax Online Payment : ptsraigarh.in

Organisation : Raigarh Municipal Corporation

Facility Name : Property Tax Online Payment

Website : https://ptsraigarh.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Raigarh Property Tax Online?

To Pay Raigarh Property Tax Online, Follow the below steps

Steps:

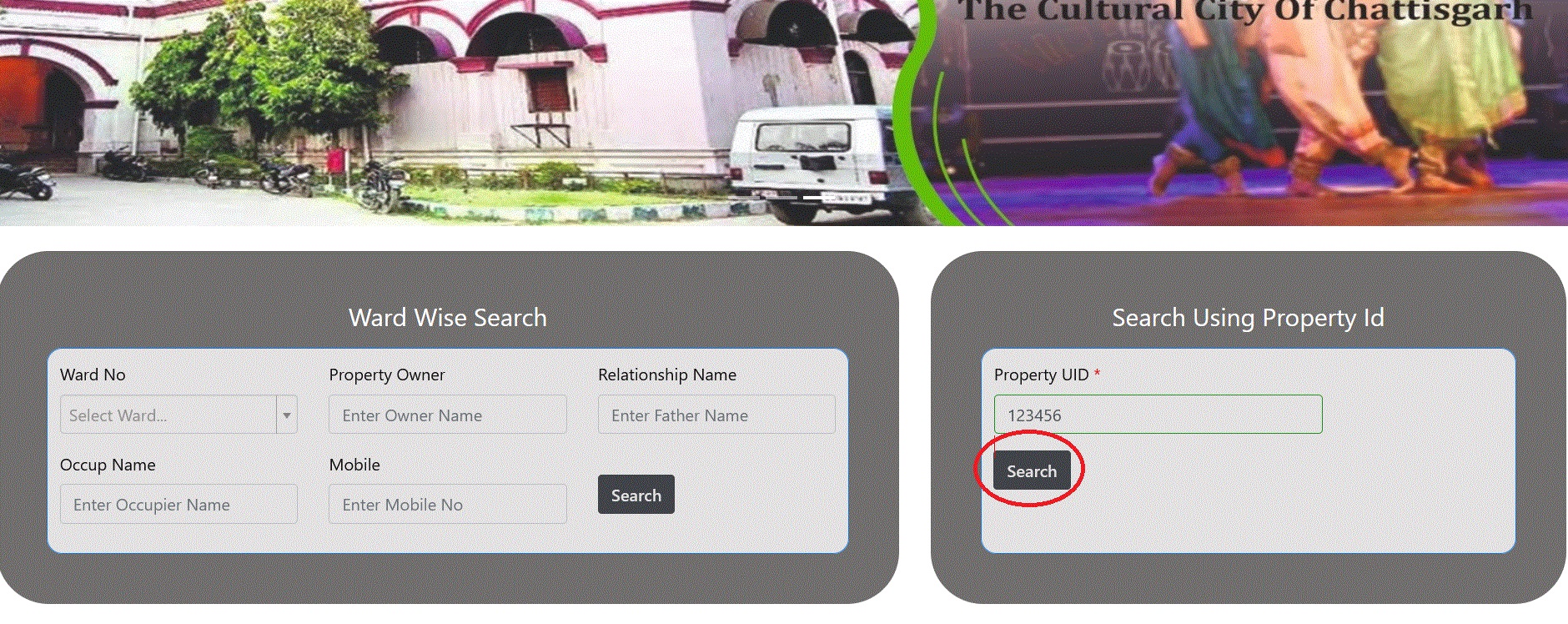

Step-1 : Go to the above link

Step-2 : Enter the Property UID

Step-3 : Click On Search Button

Step-4 : Pay Tax Online

Raigarh Municipal Refund Policy

Refund are made by follow below steps:

Step 1 : Customer need to submit application to their corresponding zone.

Step 2 : Zone officer can ask for refund the amount to the bank.

Note : Bank will not give direct money to the customer’s account.

FAQ On Raigarh Property Tax

Frequently Asked Questions FAQ On Raigarh Property Tax

Q: Who is responsible for paying property tax in Raigarh?

A: All owners of immovable property in Raigarh are responsible for paying property tax. This includes residential, commercial, and industrial properties.

Q: What is the rate of property tax in Raigarh?

A: The rate of property tax in Raigarh varies depending on the type of property and its location. For residential properties, the rate is between 5% and 10% of the annual rental value. For commercial properties, the rate is between 10% and 15% of the annual rental value. For industrial properties, the rate is between 15% and 20% of the annual rental value.

Q: When is property tax due in Raigarh?

A: Property tax is due in Raigarh on or before April 1st of each year.

Q: How can I pay my property tax in Raigarh?

A:You can pay your property tax in Raigarh in a variety of ways, including:

** Online through the Raigarh Municipal Corporation website

** In person at the Raigarh Municipal Corporation office

** Through the Raigarh Municipal Corporation mobile app

Q: What are the penalties for not paying property tax in Raigarh?

A: If you do not pay your property tax by the due date, you will be charged a late fee of 2% of the outstanding amount per month. The maximum late fee that can be charged is 20% of the outstanding amount.

Q: Where can I find more information about property tax in Raigarh?

A: You can find more information about property tax in Raigarh on the Raigarh Municipal Corporation website

Here are some additional tips for paying Raigarh property tax online:

** Make sure you have your property ID or assessment number handy before you start the process.

** You can also pay your property tax through the Raigarh Municipal Corporation mobile app.

** If you have any questions, you can contact the Raigarh Municipal Corporation customer care.