dtp.tn.gov.in : Pay Town Panchayat Property Tax Online Tamil Nadu

Organisation : Directorate of Town Panchayats, Tamil Nadu

Facility Name : Pay Town Panchayat Property Tax Online

Applicable State/UT : Tamil Nadu

Website : https://dtp.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Apply For Town Panchayat Property Tax Online?

To Apply For Town Panchayat Property Tax Online, Follow the below steps

Related / Similar Facility : Pay Town Panchayat Profession Tax Online Tamil Nadu

Steps:

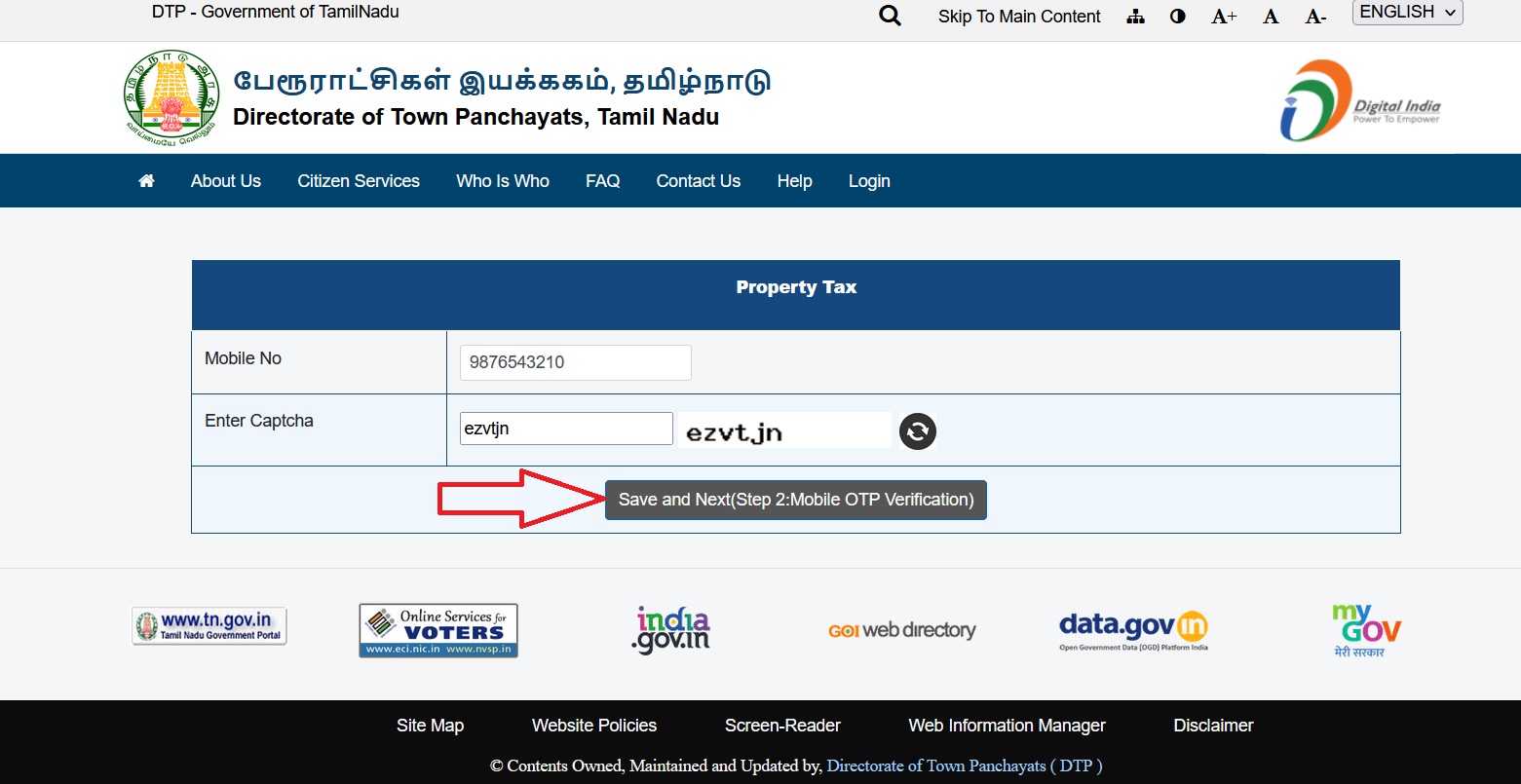

Step-1 : Go to the link https://dtp.tn.gov.in/project/forms/TownPanchayatMaster/quick_pay.php

Step-2 : Click on the button “Pay Tax”

Step-3 : Fill the Online Tax Form

Step-4 : Click On “View” Button.

A citizen applying for Property Tax should submit :

a) duly filled in Self-Assessment Form.

b) Documents of title such as sale deed / patta.

c) Agreement of Sale / Agreement of construction in case of Apartments.

d) Approved Building Plan obtained from the Concerned Town Panchayat.

e) Photograph showing the Rain Water Harvesting Structure in the building.

FAQ On Town Panchayat Property Tax

Frequently Asked Questions FAQ On Town Panchayat Property Tax

What is Property tax?

Property tax is a tax levied on every building in a Municipal / Town Panchayat limit together with its site and other adjacent premises occupied as appurtenance.

Who is empowered to levy a Property Tax?

The concerned Municipal Council is empowered to levy Property tax on directions from the Government by order published in the Official Gazette (Refer Sec 78(1) of TNDM Act, 1920)

What are the components of Property Tax?

a) a tax on general purpose

b) a drainage tax

c) a lighting tax

d) a Scavenging tax

e) a railway tax. But in town panchayats, only the tax on general purpose is levied.

What is the period of levy of the Property tax?

The Property tax is levied every half year (Ref Sec 86 of TNDM Act, 1920)

What is the mode of Assessment of Property Tax?

Self Assessment Mode

What are the buildings exempted from Property Tax?

The following buildings and lands shall be exempt from property tax:- a) Places set apart for public worship.

b) Choultries for the occupation of which no rent is charged.

c) buildings used for educational purpose including hostels attached there to, public buildings and places used for charitable purpose.

d) Such Ancient moments prescribe under Ancient moments preservation Act, 1904

e) Charitable hospitals and dispensaries

f) Such hospitals and dispensaries maintained by railway administrations.

g) Burial and burning grounds included in the book kept at the municipal Office.

h) Buildings or land belonging to municipal Council. (Ref Sec 83 of TNDM Act, 1920)

What is the procedure for Name Transfer of Property?

i) On application by the person to whom the property is transferred the Registered Sale Deed of the property.

ii) Copy of receipt of the property tax paid up to the previous half year.

iii) Payment of Name Transfer Fees as prescribed by the concerned Town Panchayat.