vms.cbic.gov.in Vendor Management System : Central Board of Indirect Taxes & Customs

Organisation : Central Board of Indirect Taxes & Customs (CBIC)

Facility Name : Vendor Management System (VMS)

Applicable State/UT : India

Website : https://vms.cbic.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is CBIC Vendor Management System?

The Central Board of Indirect Taxes and Customs (CBIC) Vendor Management System (VMS) is a central platform that helps businesses, particularly those involved in customs and excise, manage their vendors and streamline related processes. It’s a web-based application that facilitates communication, data exchange, and management of vendor-related activities.

Related / Similar Facility : NITI Aayog Internship Management System

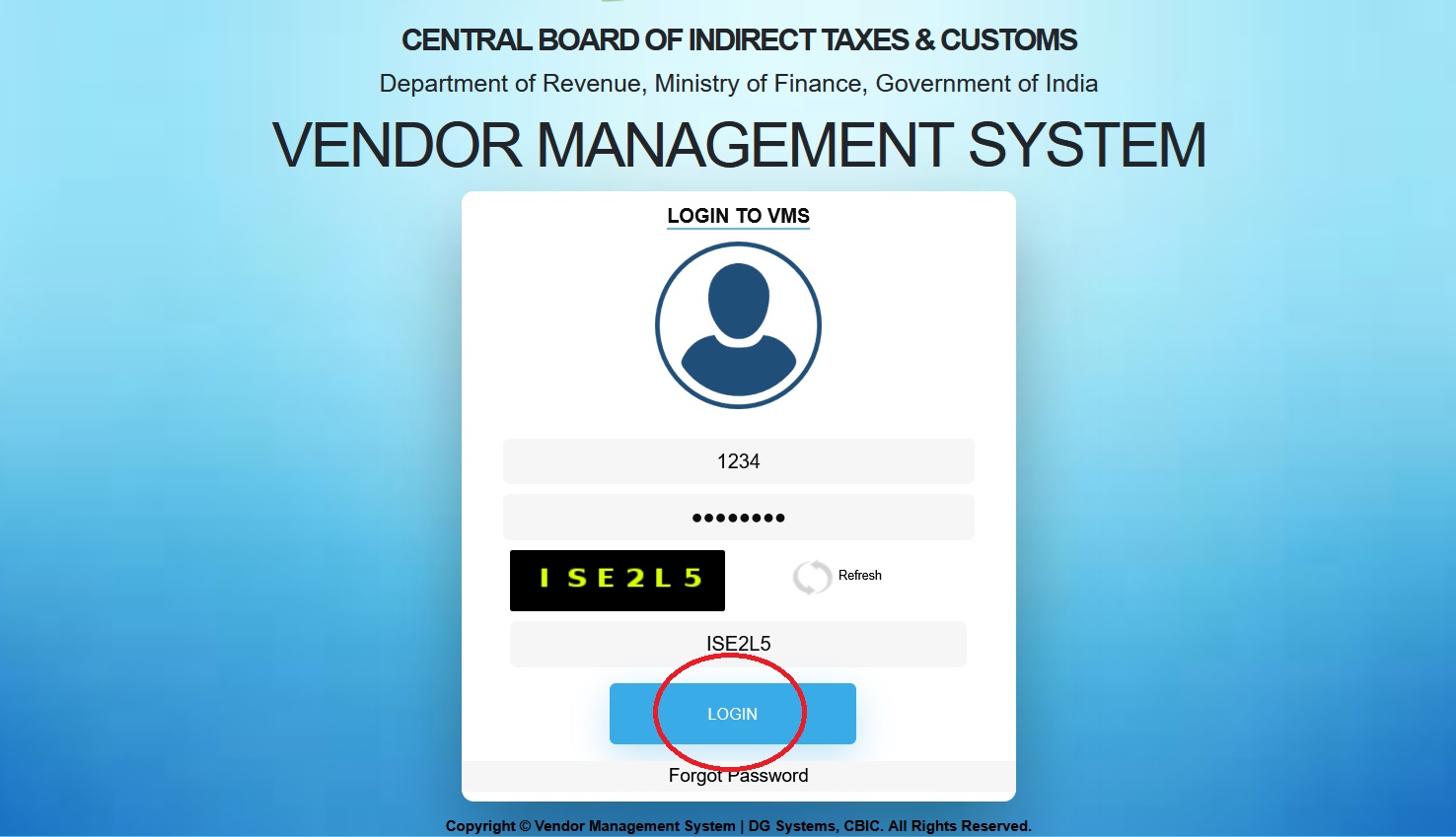

How To Login To CBIC Vendor Management System?

To login to CBIC Vendor Management System, Follow the below steps

Steps:

Step-1 : Go to the link given above

Step-2 : Enter the User SSO ID and Password

Step-3 : Enter the Captcha code and

Step-4 : Click On Login Button.

Benefits of CBIC Vendor Management System

** Increased Efficiency: Automating tasks like registration, invoicing, and performance evaluations saves time and reduces errors.

** Better Organization: Centralizing all vendor information in one place makes it easier to manage and access.

** Improved Compliance: Ensuring vendors meet regulatory requirements and internal policies becomes more manageable.

** Cost Savings: Optimizing vendor selection, negotiating better terms, and preventing overpayments can lead to cost reductions.

** Enhanced Visibility: Having a clear overview of all vendors, their performance, and contracts allows for better decision-making.

** Stronger Relationships: Streamlined communication and transparent processes can foster better collaboration with vendors.

** Risk Mitigation: Identifying and managing potential risks associated with vendors becomes easier.

About CBIC:

** Central Board of Indirect Taxes and Customs (erstwhile Central Board of Excise & Customs) is a part of the Department of Revenue under the Ministry of Finance, Government of India.

** It deals with the tasks of formulation of policy concerning levy and collection of Customs, Central Excise duties, Central Goods & Services Tax and IGST, prevention of smuggling and administration of matters relating to Customs, Central Excise, Central Goods & Services Tax, IGST and Narcotics to the extent under CBIC’s purview.

** The Board is the administrative authority for its subordinate organizations, including Custom Houses, Central Excise and Central GST Commissionerates and the Central Revenues Control Laboratory.

Functions and structure of the Department of Revenue:

The Department of Revenue is mainly responsible for the following functions: –

** All matters relating to levy and collection of Direct Taxes.

** All matters relating to levy and collection of Indirect Taxes.

** Investigation into economic offences and enforcement of economic laws.

** Framing of policy for cultivation, export and fixation of price of Opium etc.

** Prevention and combating abuse of Narcotic drugs and psychotropic substances and illicit traffic therein.

** Enforcement of FEMA and recommendation of detention under COFEPOSA.

** Work relating to forfeiture of property under Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976 and Narcotics Drugs and Psychotropic Substances Act, 1985.

** Levy of taxes on sales in the course of inter-state trade or commerce.

** Matters relating to consolidation/reduction/exemption from payment of Stamp duty under Indian Stamp Act, 1899.

** Residual work of Gold Control

** Matters relating to CESTAT.

** Cadre Control of IRS (Group-A) and IRS (C&CE) (Group-A).