pt.kar.nic.in : Pay Professional Tax Online Karnataka

Organization : Karnataka Commercial Taxes Department

Facility : How to Pay Professional Tax Online in Karnataka?

Home Page :https://pt.kar.nic.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay Karnataka Professional Tax?

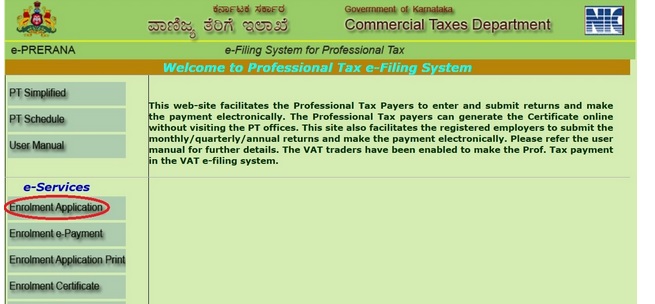

This facility for Professional Tax Payers to enter and submit returns and make the payment electronically. The Professional Tax payers can generate the Certificate online without visiting the PT offices in Karnataka.

Related / Similar Service :

e-PRERANA Professional Tax Enrolment & e-Filing Karnataka

This site also facilitates the registered employers to submit the monthly/quarterly/annual returns and make the payment electronically. Please refer the user manual for further details. The VAT traders have been enabled to make the Prof. Tax payment in the VAT e-filing system.

Important :

** The New EC and RC numbers are being provided for all the existing PT payers. New EC Number is displayed while entering the enrolment application and new RC Number is displayed once logged in to the system.

** If the e-payment is made, one need not have to visit the PT office and can download the Enrolment Certificate online.

** The already registered employer needs to collect the username and password from the concerned PT Office to open the PT login page.

** The already enrolled professionals can directly submit the return and make payment without any logging in process and download the certificate online

** The new enrolment application can be submitted online and payment can be made accordingly and download the certificate online.

** New registration application, under employer category, can be submitted electronically.

** The status of the registration application can be tracked through web-site and certificate can be downloaded once it is approved by concerned PT Office.

Enrolment Application & Certification

Enrolment and filing of e-return in Form 4-A under Profession Tax Act :

Every person (whether natural or juridical) who is engaged in any profession, trade, calling or employment in the State of Karnataka, specified in the second column of the schedule is liable to pay tax at the rate mentioned in the corresponding entry in the third column of the said schedule. Schedule is hosted on the website http ://ctax.kar.nic.in. Further, every person liable to pay tax shall obtain a certificate of enrolment.

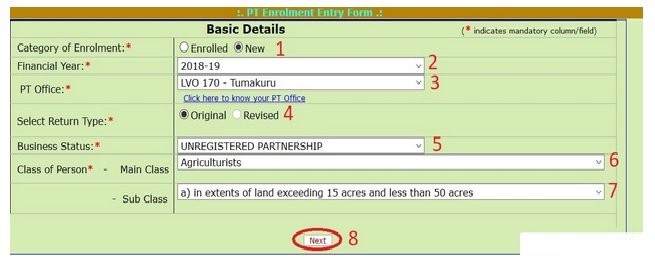

If you are applying for enrolment certificate or for revised enrolment certificate or filing an annual return in all these three cases, then click Enrolment Application on the main page.

You will find the option as new or enrolled one.

First lets see about new enrollment.

Step 1 : Select the category as New by clicking the appropriate Readio Button

Step 2 : Enter the required financial year for which the tax is due (Eg : 2018-19)

Step 3 : Select the PT office on the basis of PIN code of your place of profession /business from the drop down menu.(Eg : VSO-171 – Tiptur)

Step 4 : Select Return Type as Original or Revised

Step 5 : Select Business Status From Drop Down List (Eg : Trust)

Step 6 : Select the appropriate class of person to which you belong from the drop down menu (Eg : Bankers)

Step 7 : After selecting the appropriate class of persons, the person has to select the sub – class applicable to him.

Step 8 : Click Next Button

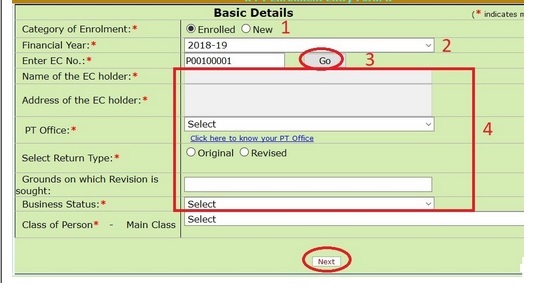

If you are a enrolled person, then follow the below procedure.

Step 1 : Select the category as Enrolled by clicking the appropriate Readio Button

Step 2 : Enter the relevant year for which you are filing an application for revised enrolment certificate or filing a return and making payment of tax. (Eg : 2018-19)

Step 3 : Enter the enrolment certificate number which is a alpha numeric of 9 characters (Eg : P00100001)

Step 4 : The system will validate the certificate number from the data base and if the number is correct then the name of the certificate holder, address, office in which he is enrolled and business status will be populated.

Step 5 : Click Next Button

Filing of monthly statement in Form 5-A

Filing of monthly statement in Form 5-A and the annual return in Form 5 by an Employer under the Profession Tax Act :

Every employer registered under the Profession Tax Act is required to furnish a statement in Form 5-A every month showing the salary and wages paid by him to his employees and the amount of tax deducted by him. Such statement shall be furnished on or before 20th of succeeding month along with payment of the full amount of tax according to the statement.

Such employer is also required to furnish an annual return in Form 5 within 60 days of the expiry of a year. Further, he shall pay the full amount of tax payable by him on the basis of such return as reduced by any tax already paid along with monthly statement in Form 5-A.

If the amount of tax deducted in a month is not more than rupees five thousand, such employer shall furnish Form 5-A within 20 days of expiry of a quarter along with payment of tax (“Quarter” means period of three months ending on 31st day of May, 31st day of August, 30th day of November, and 28th day or 29th day of February).

“ Salary” or “Wages” includes pay or wages, dearness allowance, arrears of salary, bonus, perquisites and profits in lieu of salary etc. . If arrears of salary or bonus is paid in kind, value of such kinds shall also include in the “ Salary” or “Wages”.

Exemptions :

i. No tax is deductible and payable by an employer from his employee who has attained the age of 65 years.

ii. No tax is deductible and payable by an employer in respect of an employee in any year if he is employed for a period which does not exceed 120 days. Filing of monthly statement in Form 5-A and the annual return in Form 5 by an Employer under the Profession Tax Act

iii. Certain categories of employees like persons having single child, physically handicapped person, combatant member of armed forces etc. are also exempted by virtue of notification issued by the Government subject to terms and conditions laid down in the relevant notifications.

Contact Us :

For Queries, Please Contact the Control Room-(24×7 Service) 080-25706187/080-25706190/080-25706191

FAQ On Karnataka Professional Tax

Karnataka Professional Tax is a tax levied by the State Government of Karnataka on the income earned by individuals from their profession, trade or employment. Here are some frequently asked questions (FAQ) about Karnataka Professional Tax:

Q: Who is liable to pay Karnataka Professional Tax?

A: Individuals who are engaged in a profession, trade, or employment in the State of Karnataka are liable to pay professional tax.

Q: What is the rate of Karnataka Professional Tax?

A: The rate of Karnataka Professional Tax varies based on the monthly income of the individual. It can range from Rs. 200 per month to Rs. 2,500 per month.

Q: When is the due date for paying Karnataka Professional Tax?

A: The due date for paying Karnataka Professional Tax is the 30th of April for the first half of the financial year (April to September) and the 31st of October for the second half of the financial year (October to March).

NOT UPDATING PROFESSIONAL TAX MODULE , RAIL WHEEL FACTORY , YELAHANKA

how to get forgot userID

I want to know that, how can I get the CGD number.

I want to know, How to cancel the registration of Professional Tax?

How do I edit file? I submitted returns of professional tax in karnataka.

Please make easy method for online payment ( site is not opened in Internet explorer)

List of banks in Karnataka for paying Professional tax?

How to cancel filed and submitted returns of professional tax in Karnataka?

Not possible to cancel because once number is generated it is over. Better ti file a revised return.