apct.gov.in Transporter Registration Andhra Pradesh : Commercial Taxes

Organization : Commercial Taxes Department

Service Name : Transporter Registration

State : Andhra Pradesh

Website : https://apct.gov.in/GSTPortal/Ap_index.aspx

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

APCT Transporter Registration

Registration Help for Transporters:

This facility is registered the transporter for the Commercial Taxes Department. Go to the official website,click on the registration option, form will be displayed on the screen.

Related / Similar Service :

APCT Check Registration Status

Registration

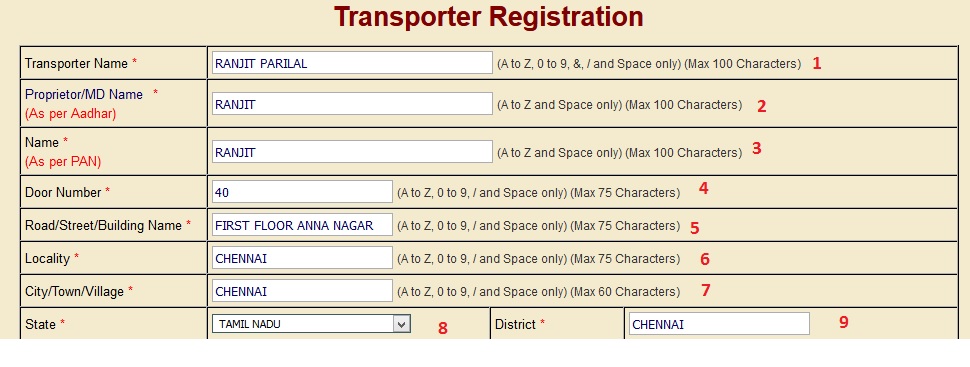

1. Visit www.apct.gov.in Click on “Transporter Registration” link. System will open new window for Transporter Registration.

Steps :

1. Enter Name of Transporter

2. Enter Name as per given Aadhar Number.

3. Enter Name as per given PAN Number.

4. Enter Door No

5. Enter Road/Street/Building Name

6. Enter Locality Name

7. Enter City/Town/Village Name

8. Select from List only

9. If State are AP Select from List only ., Other than Enter Name of District manually.

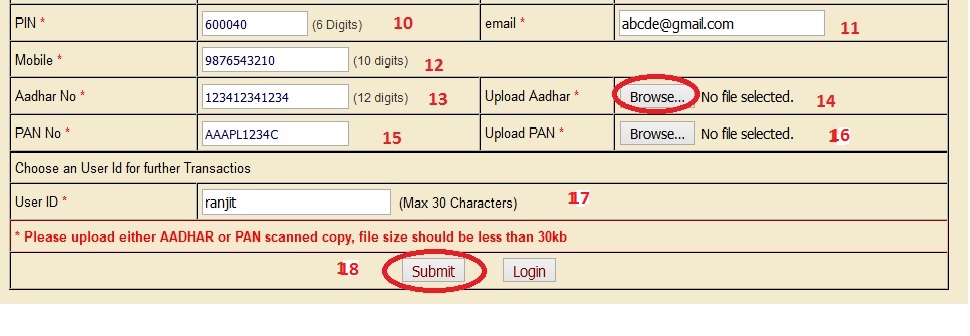

10. Enter Pincode

11. Enter email Id

12. Enter Mobile no(10 digits).

13. Enter Adhaar Number already given by Government.

14. Upload Aadhar – Click “Browse” to upload Aadhar document for the corresponding Aadhar No.

15. Enter Pan Number

16. Upload Pan

17. Please choose an User Id for further Transactions.

18. Click Submit Button. System will send password to your registered email Id. In case you don’t get the password please forward a request to ctd_helpdesk@apct.gov.in through your registered email only.

After completion of the registration procedure you will get a Acknowledgement for the registrations with your details.

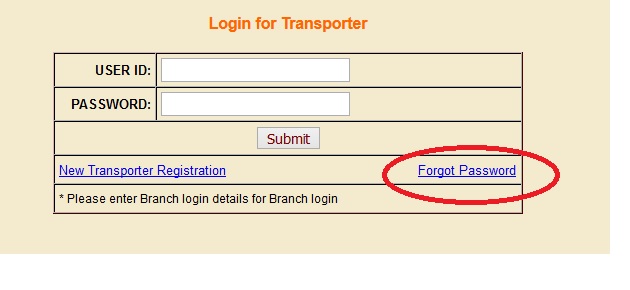

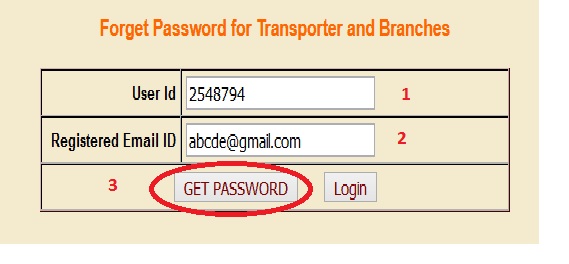

Forget Password

Click the above link,then Click on the link Transporter Login,select on the link Forget Password

1. Enter User Id

2. Enter your Registered mail id.

3. Click on Get Password. An Automated email with Password will be sent to your registered email id.

Create User ID’s for Branches

1. Open the url : https://www.apct.gov.in/gstportal/Ap_index.aspx

2. Click on the link Transporter Login

3. Enter your user ID and password to login

4. After login, in home page you will find a link “Branch Registration”

5. Enter Branch Name

6. Enter Branch Address

7. Choose one user ID for that particular branch

8. Select a password on your own.

9. Click on save button.

Help desk:

Call us on: 040-24602171 – Ext:123

FAQ On VAT & CST

1. When Do I Start To Charge Vat?

You should start keeping VAT records and charging VAT to your customers from the date notified to you by the Commercial Taxes Department. This will be the date shown as the effective date of your registration on your Certificate of Registration. You will have to account for VAT from that date.

2. How Do I Register For Cst?

For getting registered under CST ACT prior registration under VAT is mandatory. The dealers who are registered under VAT can apply for CST registration in form CST A (“Application for CST registration”), which is obtainable from your Tax Office.

The form to apply for Registration CST A is also available on the wesite of the CTD. You must fill in this form and submit it to the Tax Office.

3. What Is A Start-Up Business?

This is a new business enterprise which requires a period of time to create an infrastructure before being in a position to commence business operations.

4. How Do I Take Advantage Of These Provisions?

You must apply for VAT registration on Form VAT 100 and for special registration as a Start-up business on Form VAT 104. The Commercial Taxes Department will need to be satisfied that you are setting-up a new business which will eventually make sales of goods on which VAT will be charged.

You will have to furnish full details regarding the location of your business premises and a summary of your business plans.

5. How I Will Know That My ( Transportation) Registration Has Been Done?? Will You Send A Copy Of this Mail Or Some Registration No.

You should contact your local Tax Office.

Benefits of APCT Transporter Registration

The Andhra Pradesh Commercial Tax (APCT) department is responsible for administering the commercial tax laws in Andhra Pradesh. APCT Transporter Registration is a mandatory requirement for all transporters who operate in Andhra Pradesh.

There are a number of benefits to registering with APCT. These benefits include:

** Legal protection: Registration with APCT provides legal protection to transporters. This protection is important because it helps to ensure that transporters are not subject to unfair competition from transporters that do not register with APCT.

** Reduced risk of penalties: Transporters that register with APCT are less likely to be penalized by the government. This is because registration shows that the transporter is complying with the law.

** Increased compliance: Registration with APCT helps to increase compliance with the law. This is because it makes it more difficult for transporters to avoid paying commercial tax.

** Improved customer service: Registration with APCT can help transporters to improve their customer service. This is because it can help transporters to provide customers with accurate information about the commercial tax that is applicable to their goods and services.

** Access to government tenders: Transporters that are registered with APCT are eligible to bid on government tenders. This can be a great way to get new business.

How can I register my transport name in Andhra pradesh for getting transport declarations form?

REGISTRATION WEB NOT OPENING. HOW CAN I REG MY TRANSPORT NAME?

PLEASE HELP US AND SEND THE WEB NAME.

How can I register my transport name in Andra Pradesh for getting transport declarations form?

How does the transport declaration look like?

Can you send a copy to this mail when I entered?

I got only unique no

372822329428

How to transit the goods without TIN buyer for own use goods?